Oljepriser stiger efter amerikanska sanktioner och EU-förbud: En djupdykning i förra veckans marknadsvolatilitet

Förra veckan tog oljepriserna ett kraftigt hopp, och det dröjde inte länge innan alla började fråga sig varför. Svaret ligger i en kombination av nya amerikanska sanktioner mot Ryssland, tillsammans med ett EU-förbud mot rysk flytande naturgas (LNG) och växande oro över stabiliteten på den globala oljemarknaden.

Varför steg oljepriset som det gjorde?

Torsdagen den 23 oktober steg oljepriset med över 5 %, vilket var den största enskilda uppgången på en dag sedan juni. Denna rörelse kom efter att USA införde nya sanktioner mot de två största ryska oljeproducenterna, Rosneft och Lukoil. Sanktionerna syftar till att stänga av de ryska oljeproducenterna från viktiga internationella marknader, vilket kraftigt begränsar Rysslands förmåga att exportera olja och gas. Nyheten väckte farhågor om en potentiell brist på utbud och skickade priserna i höjden. Utöver de amerikanska sanktionerna meddelade EU också ett förbud mot rysk flytande naturgas (LNG), vilket ytterligare ökade pressen på den globala energimarknaden. Ryssland har spelat en stor roll på den globala energimarknaden, och att ta bort en stor del av deras export från marknaden har gjort oljan ännu dyrare.

De sanktioner som beordrats av USA:s president Donald Trump och genomförts av finansdepartementet är mycket tydliga. Alla amerikanska tillgångar som tillhör Rosneft och Lukoil är frysta. Amerikanska företag och individer är också förbjudna att göra affärer med dem. Ytterligare sanktioner kan införas mot utländska finansiella institutioner som samarbetar med de ryska oljejättarna, vilket skulle stänga av deras tillgång till internationella marknader.

It all comes down to a stalemate in the recent negotiations with Putin to end the ongoing was in Ukraine. Trump announced last week that the talks did not “go anywhere”, and that Kremlin stuck to hard demands, including Ukraine giving up large chunks for territory. The new sanctions are meant to weaken Russia’s ability to fund the invasion by targeting its primary revenue source: taxes from the oil and gas industry, which makes up around a quarter of the total state budget.

Oil importers in India, which takes in between 1.6 and 1.8 million barrels of Russian crude oil per day, or more than a third of its oil shipments, are preparing for massive cuts of its oil shipments in order to comply with US sanctions. China’s state oil majors are also suspending their Russian oil purchases. China procured about 17% of its crude oil imports throughout August from Russia, and is Kremlins biggest customer, India coming in at second place.

The road ahead

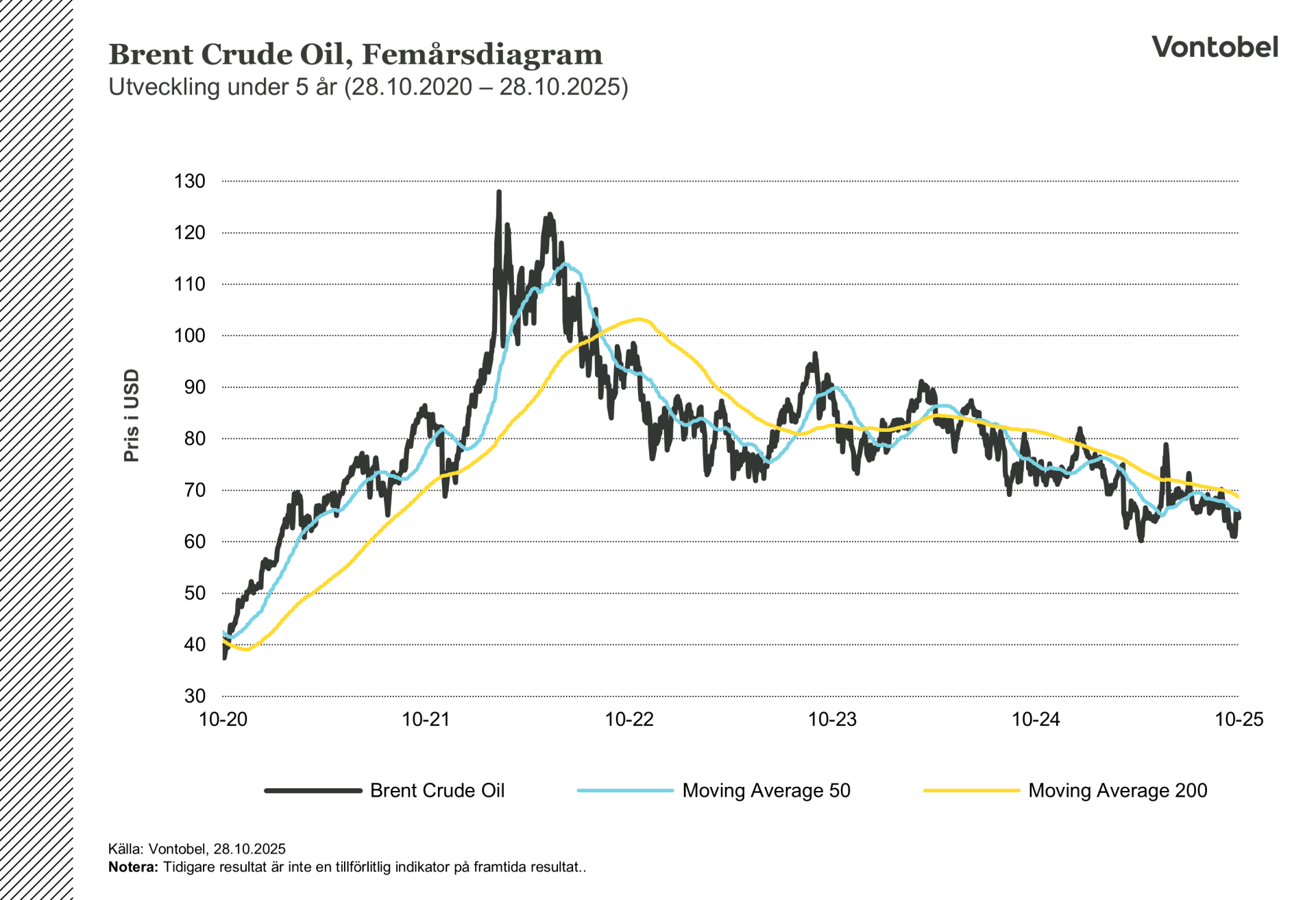

Oil prices have been all over the place in recent times, and it is hard to say exactly where things will go from here. The combination of US sanctions, the EU LNG ban and continuous geopolitical tensions in Russia means the global oil market remains very uncertain. If these issues continue to disrupt the supply, we could potentially see more price hikes and volatility in the months ahead. Vontobel offers a wide range of leveraged products with oil as underlying. No matter which way you expect the price to move, you can gain long or short exposure through our offerings.

Risker

Credit risk of the issuer:

Investors in the products are exposed to the risk that the Issuer or the Guarantor may not be able to meet its obligations under the products. A total loss of the invested capital is possible. The products are not subject to any deposit protection.

Currency risk:

If the product currency differs from the currency of the underlying asset, the value of a product will also depend on the exchange rate between the respective currencies. As a result, the value of a product can fluctuate significantly.

Market risk:

The value of the products can fall significantly below the purchase price due to changes in market factors, especially if the value of the underlying asset falls. The products are not capital-protected

Product costs:

Product and possible financing costs reduce the value of the products.

Risk with leverage products:

Due to the leverage effect, there is an increased risk of loss (risk of total loss) with leverage products, e.g. Bull & Bear Certificates, Warrants and Mini Futures.

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.

© Bank Vontobel Europe AG and/or its affiliates. All rights reserved.