Falling VIX indicates lower investor concerns

Fed chief Powell did not calm the markets on Wednesday, January 26. Powell’s message appeared more hawkish at the subsequent press conference. The super-strong labor market and high inflation make it “easier” for Fed to communicate like this. However, there is a distinction between the number of rate hikes expected to be implemented by the Fed this year (the market discounts five) and the more significant issue of starting to shrink the Fed’s balance sheet.

In this weekly trading note from Carlsquare, we elaborate on the following topics, indices, and stocks:

- Falling VIX indicates lower investor concerns

- Mixed signals from company guidance in the US

- More reports to come this week

- Can Friday’s strong momentum in S&P 500 continue

- Nasdaq is lagging behind

- Apple at critical level after strong report

- The quest for stable and secure returns is challenging

- Oil price contributes to inflation, though exposed to geopolitical uncertainty

- Stronger EUR/USD is not helping oil

- DAX is in a wide trading range with risk still on the downside

- Will support hold for OMXS30?

- H&M gapped on report. Is it a break away gap?

Falling VIX indicates lower investor concerns

Fed chief Powell did not calm the markets on Wednesday, January 26. Powell’s message appeared more hawkish at the subsequent press conference. The super-strong labor market and high inflation make it “easier” for Fed to communicate like this. However, there is a distinction between the number of rate hikes expected to be implemented by the Fed this year (the market discounts five) and the more significant issue of starting to shrink the Fed’s balance sheet.

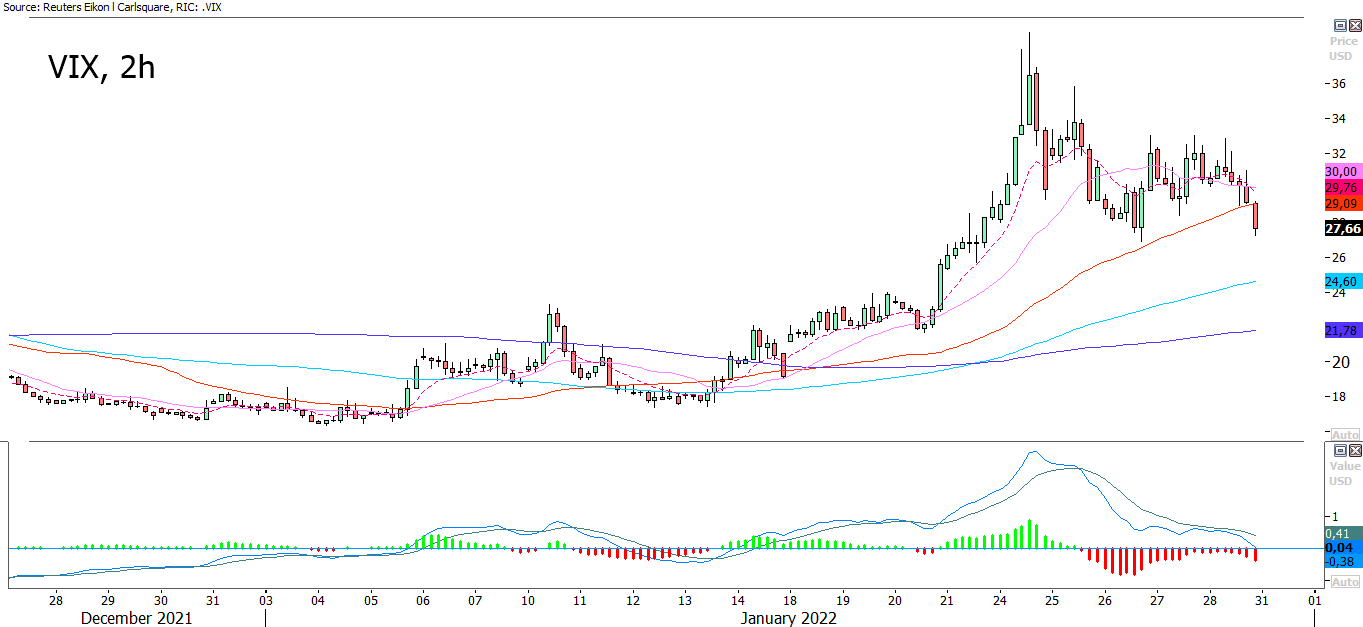

Historically, the correlation between an increase in the Fed’s balance sheet and a rising stock market is high. The opposite might also be true. But market jitters, as measured by the VIX index, have come down from their peak since Monday, January 24. Combined with Apple’s quarterly solid report, this could explain the strong performance on the US stock exchanges on Friday, January 28.

VIX, 2h-graph from December 27, 2021, to January 28, 2022

Only the FTSE (London Stock Exchange) has resisted the recent price fall of the major stock market indices in the last month. While European stock markets fell back across the board on Friday, the US stock market, especially the Nasdaq, rose. However, over the last month, Nasdaq has been the worst performer. We may be now seeing the beginning of a positive rebound phase.

Significant stock indices performance on Friday, January 28, in one week and one month

Mixed signals from company guidance in the US

As of Friday, January 28, about a third of S&P500 companies (168 out of 503) had reported their Q4 results. 78% of these have been better than forecast earnings, while 77% had higher than expected revenues. The best sectors in terms of earnings performance have been technology and engineering, with 93 and 90 percent better-than-expected results, respectively. On average, earnings revision for Q1 2022 for the S&P500 companies reported has improved to plus 0.6 percent.

Only 20 S&P500 companies have provided earnings guidance for Q1 2022 to date; of these, seven have been positive, while 13 have provided negative earnings guidance. The technology sector dominates with six positive earnings guidance and eight negative ones.

At the same time, the rolling P/E of the S&P500 index has declined to 19.2 times, only slightly higher than the historical average of 18.5 times due to lower share prices. The graph below illustrates the value gap between the market value and earnings. This gap has decreased to between 10 and 15 percent.

Trailing P/E-ratio from January 2012 to January 2022 for the S&P500 companies

More reports to come this week

This week, Alphabet will release its quarterly report on Tuesday, Meta Platforms on Wednesday, and Amazon on Thursday.

Can Friday’s strong momentum in S&P 500 continue

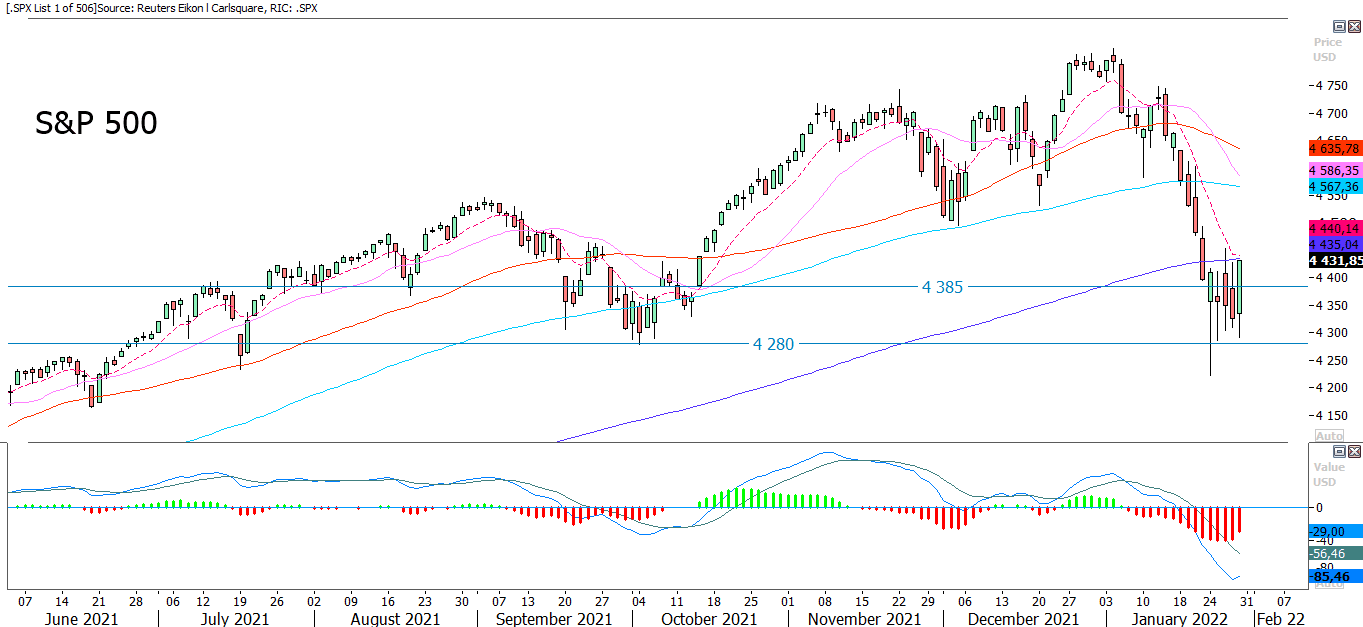

With help from the strong report from Apple, the market sentiment improved on Friday. As shown in the chart below, S&P 500 closed near its intraday high, just below MA200 and EMA9 serving as resistance. A break above is a positive signal, and in such a scenario, the index may quickly approach MA100 currently at 4 567:

S&P 500: June 3, 2021, to January 28, 2022

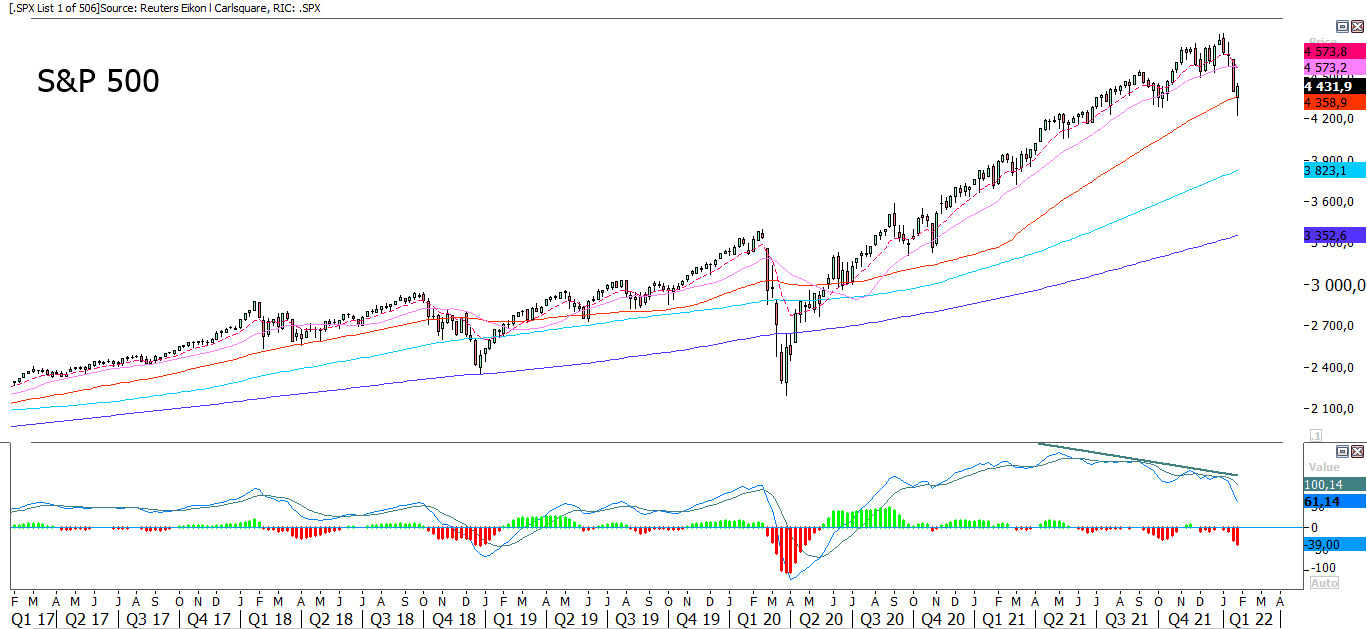

The weekly chart shows how the index closed above MA200, which is positive.

S&P 500, weekly five-year price graph

Source: Refinitiv Eikon and Carlsquare. Note: Past performance is not a reliable indicator of future results.

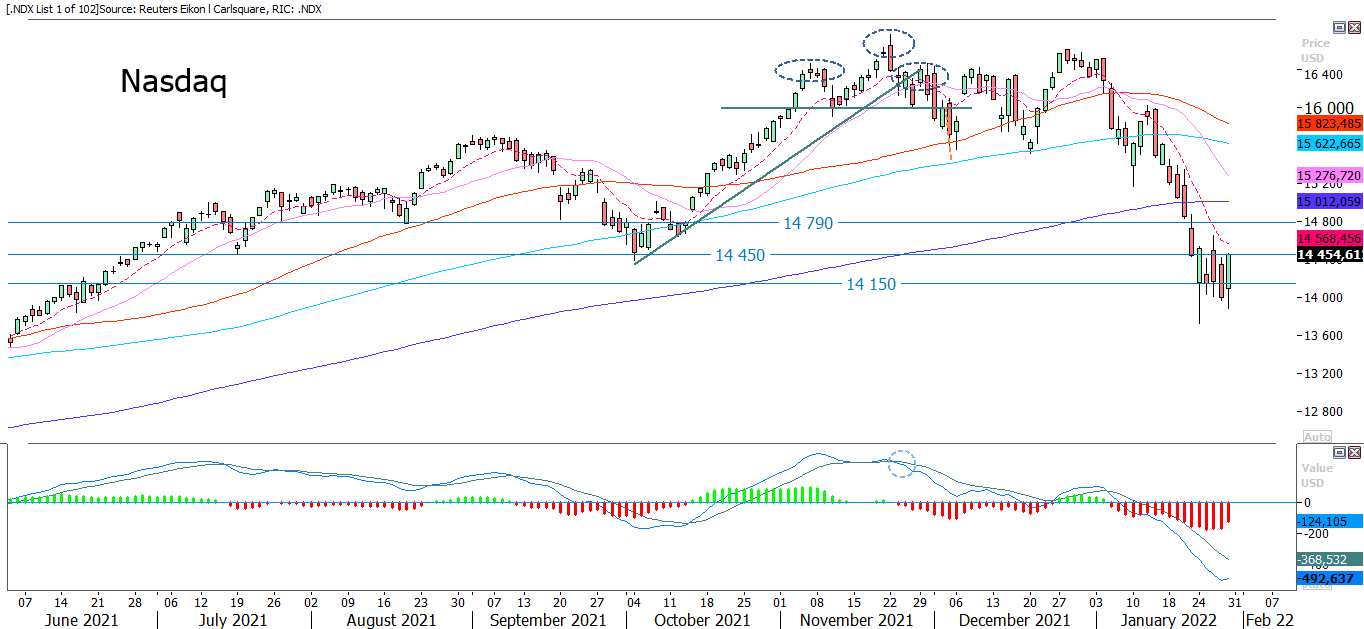

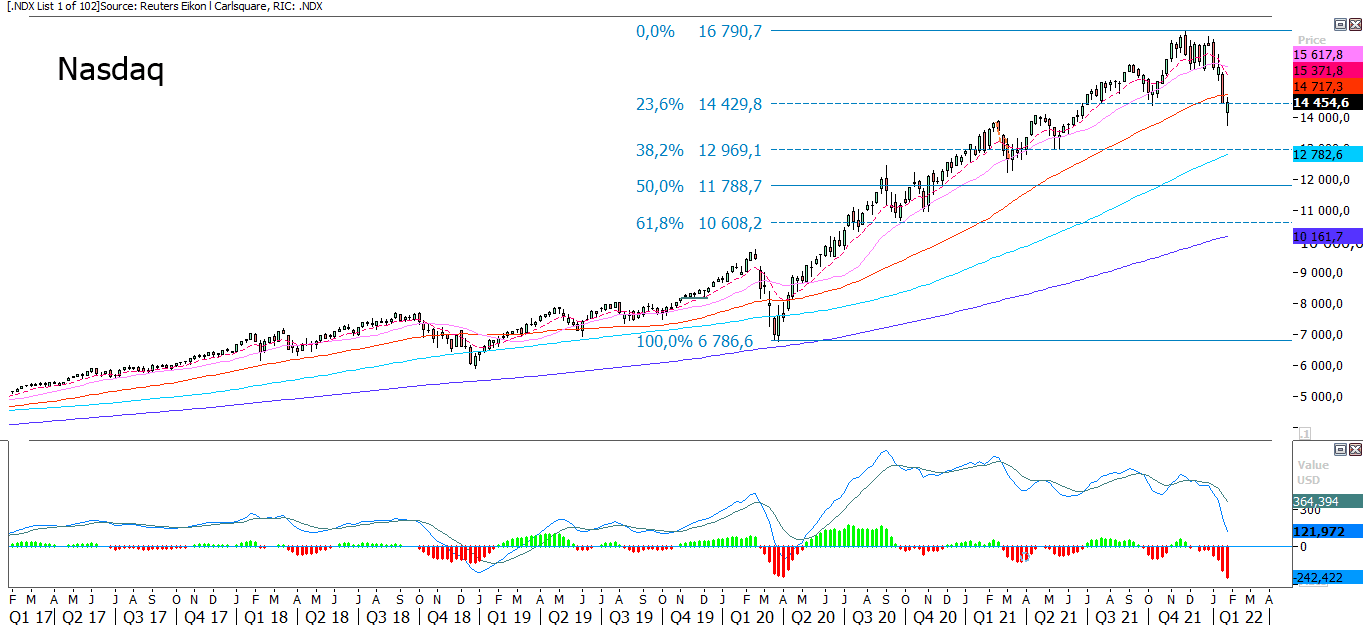

Nasdaq is lagging behind

Last week was a time of consolidation with relatively large moves for the S&P 500 and Nasdaq. However, as shown in the chart below, Nasdaq is trading well below its MA200. It closed Friday, January 28 at 14 450, serving as resistance. The next level on the upside is EMA9 followed by 14 790:

Nasdaq 100 price graph: June 3, 2021, to January 28, 2022

In the weekly chart below, it is visible how the index closed just above Fibonacci 23.6 but did not manage to retake MA200

Nasdaq 100, weekly five-year price graph

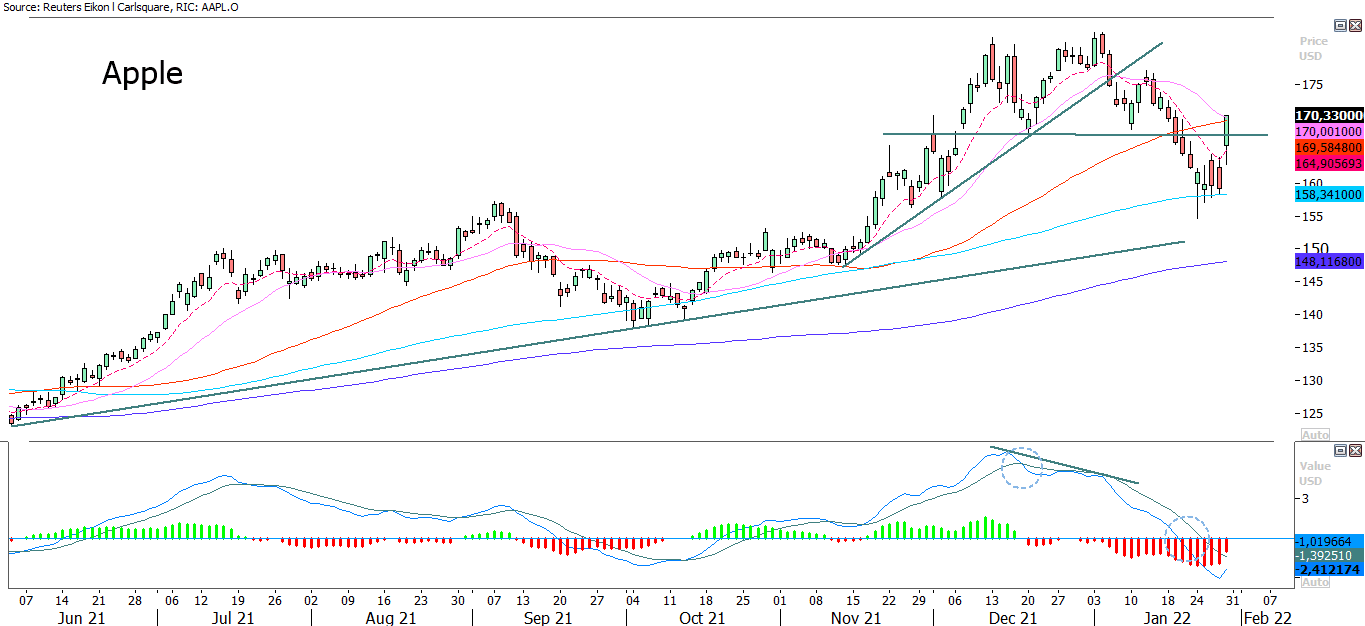

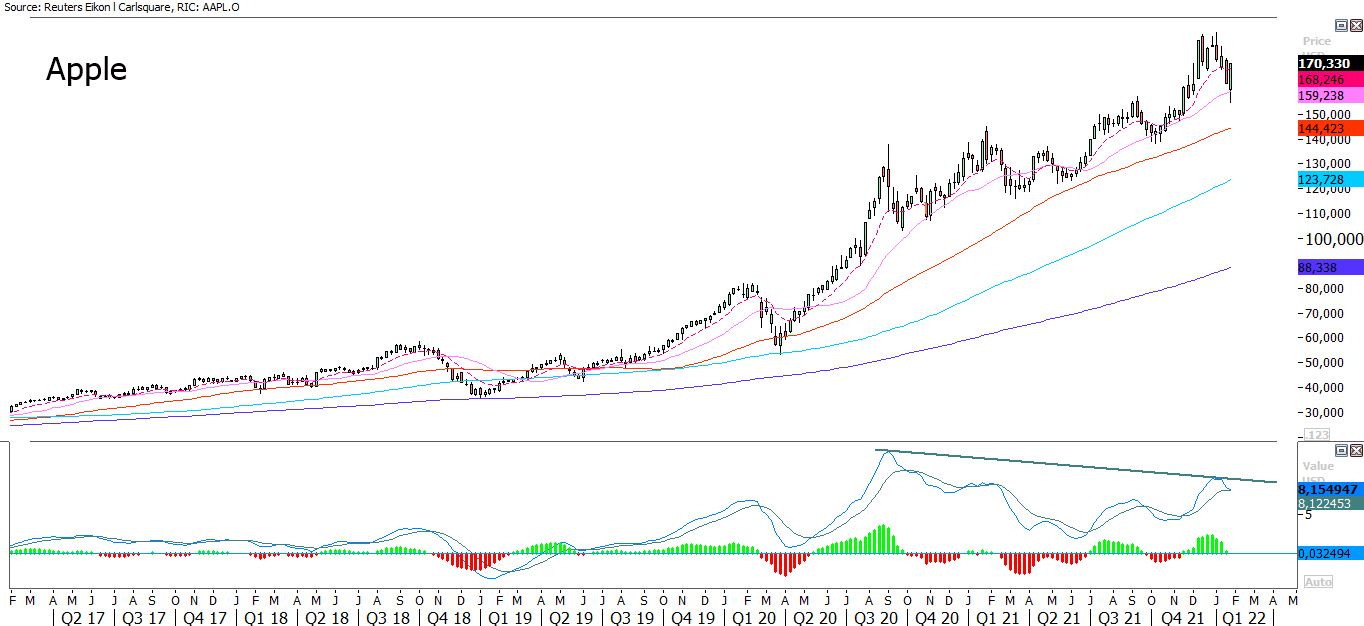

Apple at critical level after a strong report

Apple reported a record revenue above expectations. Profit was also above expectations. However, its management has flagged for continued uncertainty around its supply chain. Nevertheless, the share rose by 7.0% on Friday, closing its intraday high. Around this level, resistance in the percentage of MA20 and MA50 meet up. Today’s trading will hint if Apple continues to its previous top.

Apple share price graph: June 3, 2021, to January 28, 2022

In the weekly chart below, one can see how the share rebounded nicely from levels below MA20:

Apple, weekly five-year price graph

The quest for stable and secure returns is challenging

There are several strategies for investors to choose from in today’s market. One is to assume that a rebound has now begun, starting with the US stock markets on Friday. In that case, technology stocks and the Nasdaq are the ones that have taken the biggest beating and therefore should recover the most. But more likely, the threat of higher interest rates will remain as a cloud over equity markets. If that is the case, the challenge is to find stocks or other instruments that can provide a safe return. Value stocks have significantly outperformed growth stocks over the past month, seen in the graph below.

US Growth versus Value stocks from April 28, 2021, to January 28, 2022

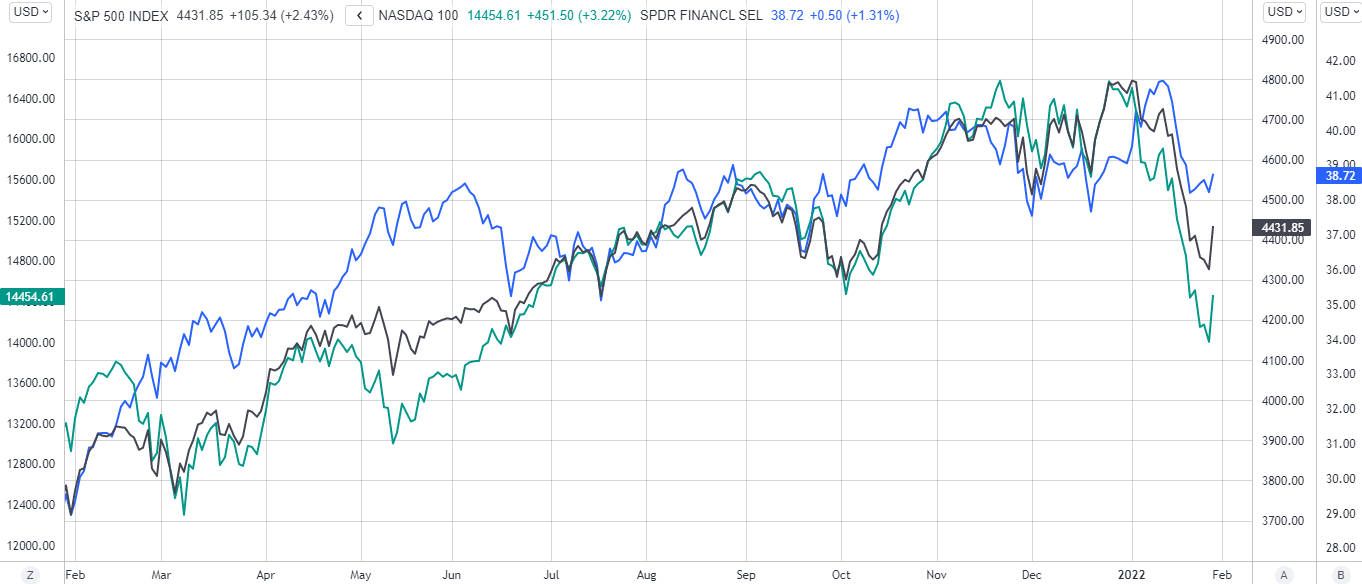

Those looking for exposure to companies that benefit from rising interest rates can choose the Financial Sector Select SPDR Fund ETF. The fund’s holdings are in investment companies such as Berkshire Hathaway and banks such as JP Morgan Chase. Nevertheless, the price-performance has not been that impressive in absolute terms recently. On the other hand, investors in this ETF have seen a more stable performance with less volatility than the overall market.

S&P 500, Nasdaq 100, and SPDR Finance: 1-year development

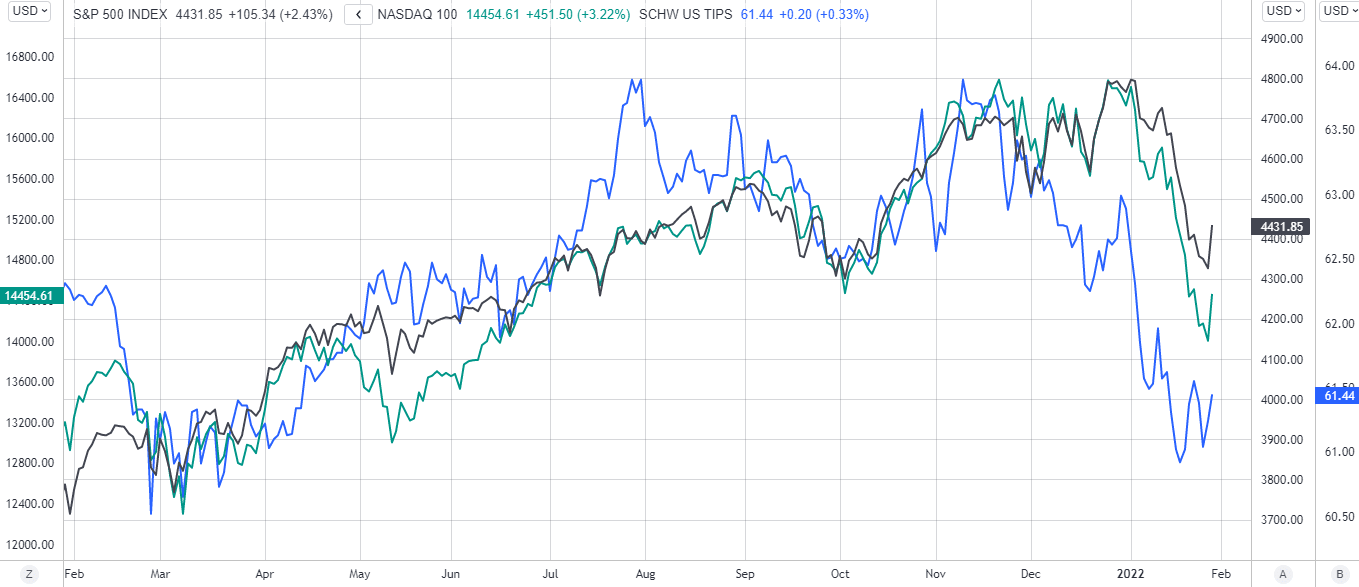

If the investor is looking for protection against rising inflation (CPI), the Schwab U.S TIPS ETF may be an instrument to evaluate. However, here too, the performance has been negative recently.

Schwab U.S TIPS ETF price graph from June 7, 2021, to January 28, 2022

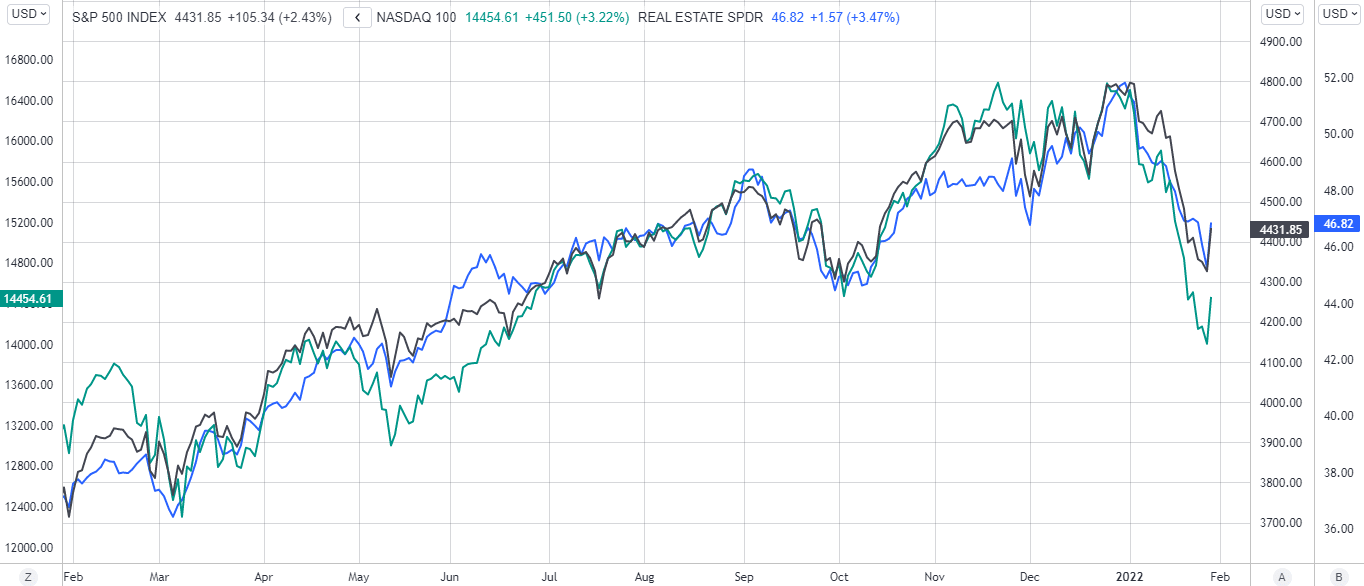

Real estate stocks are perceived to be disadvantaged by rising interest rates. The main argument is that rising yields translate into lower property values and thus lower net asset value in the company. On the other hand, the rental income of real estate companies increases typically with rising inflation due to indexation clauses with tenants. Real estate shares are nowadays not valued solely based on net asset value. The company’s earning power and its growth also affect the share price.

S&P 500, Nasdaq 100, and SPDR Real Estate: 1-year development

When we turn to corporate bonds and investment-grade (i.e., low risk of credit default), their performance has also followed the stock market downturn. High-interest rates reduce their current value.

iShares Broad USD Investment Grade Corporate Bond ETF from June 7, 2021, to January 28, 2022

To sum up, it isn’t easy to find fixed income instruments or derivates that have a positive return in times like these. As interest rates rise, so do the yield requirement and the value of most assets. In this case, gold and commodities may be an attractive hedge, not least because they drive inflation, so the interest rate rises. However, over a more extended period and relative to the entire market, value stocks, in particular, may prove to remain attractive. That is if we will continue to be in a period of rising interest rates.

Oil price contributes to inflation, though exposed to geopolitical uncertainty

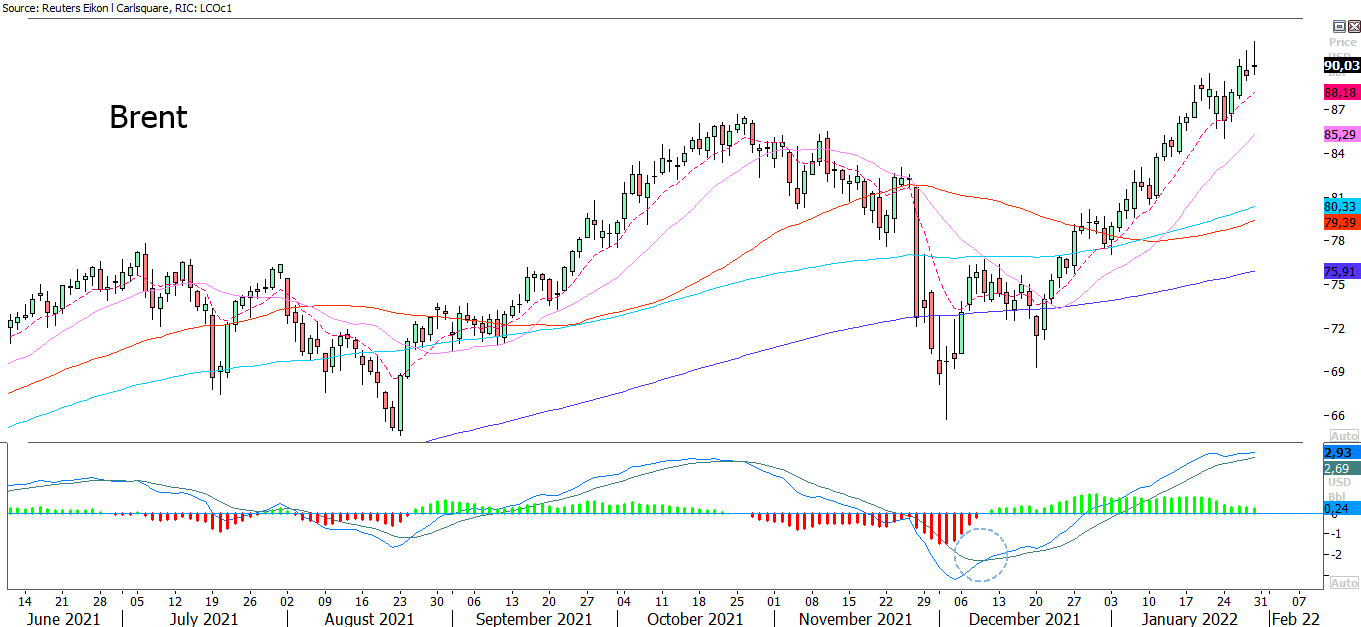

Due to supply disturbances and geopolitical uncertainty, the oil price rises strongly. Brent oil in the chart below is having difficulties breaking above the 90 USD per barrel level. RSI is on oversold levels. Is it time for profit-taking and a downwards rebound?

Brent oil price graph: June 3, 2021, to January 28, 2022

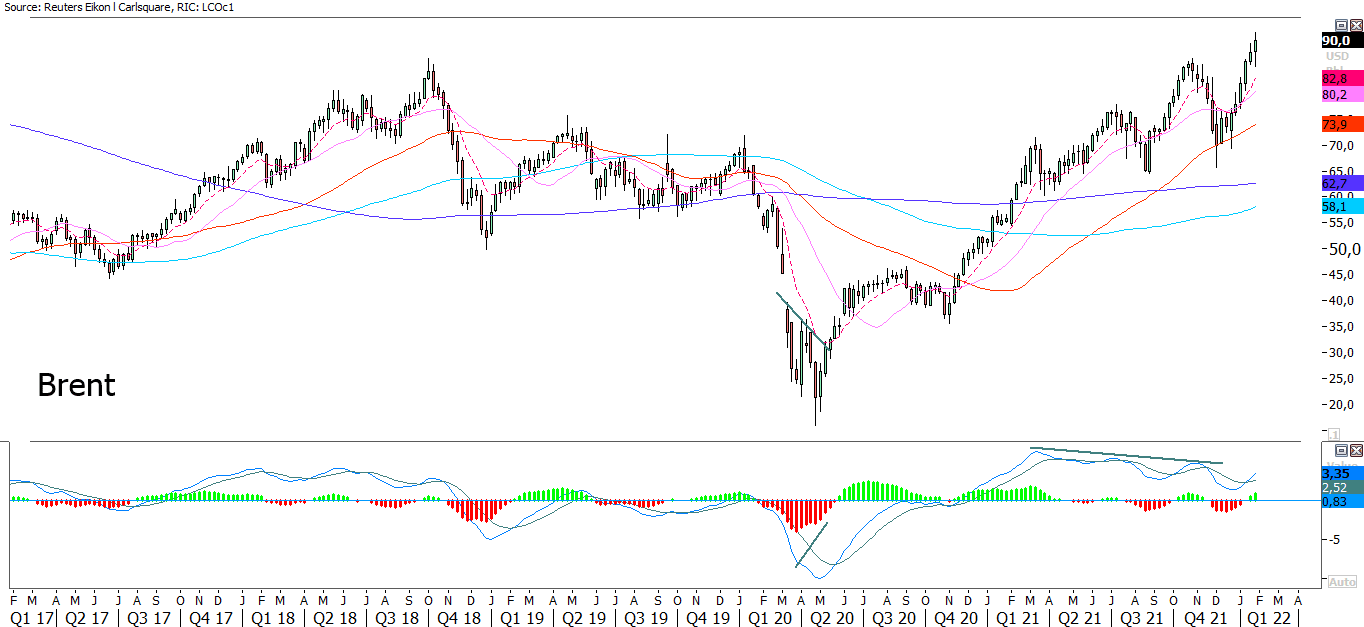

In the weekly chart below, one should note the negative divergence between oil and MACD

Brent oil, weekly five-year price graph

Stronger EUR/USD is not helping oil

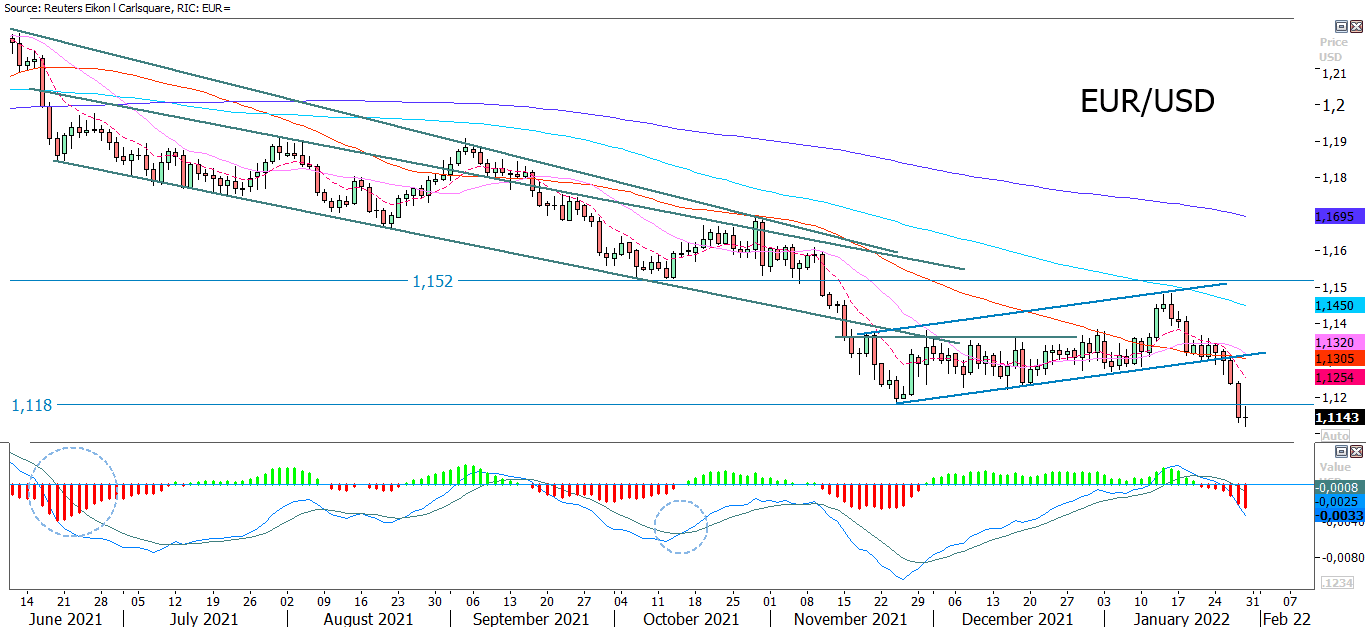

After Feds Powell’s speech last week, the USD has strengthened against the euro. The chart below shows that the currency pair has broken down from a slight rising trend and closed Friday below the 1.118-level. Interestingly, a Doji was created on Friday, implying uncertainty on the next move.

EUR/USD graph: June 3, 2021, to January 28, 2022

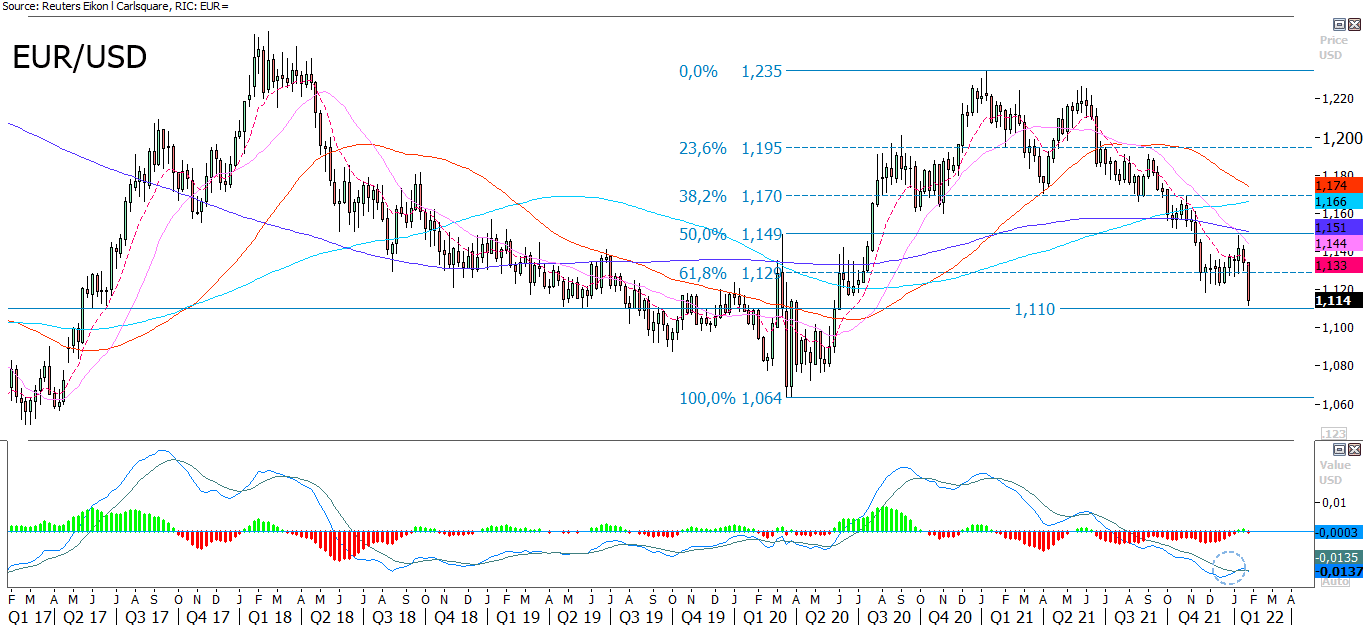

The weekly chart below shows how the 1.11-level may be able to serve as support in case of continued strength in the USD:

EUR/USD, weekly five-year price graph

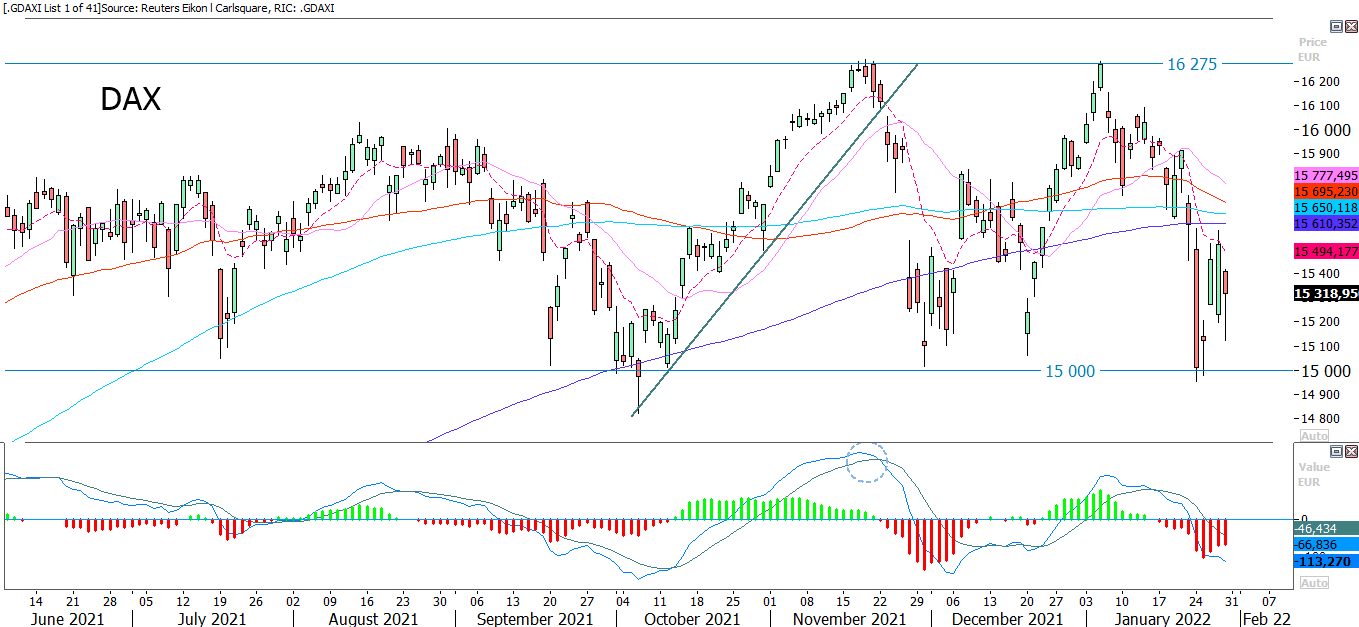

DAX is in a broad trading range with risk still on the downside

Below is DAX, trading in a wide range between 15 000 and 16 275. The index is still below its moving averages, and the risk can thus be on the downside. Given the nice finish on Friday in the US, initial rising stock markets are expected. However, 15 000 is vital as the index has managed to bounce from this level five times since July 2021.

DAX price graph: June 3, 2021, to January 28, 2022

In the weekly chart below, the index closed last week just below MA200. MACD is still falling, implying weaker momentum:

DAX, weekly five-year price graph

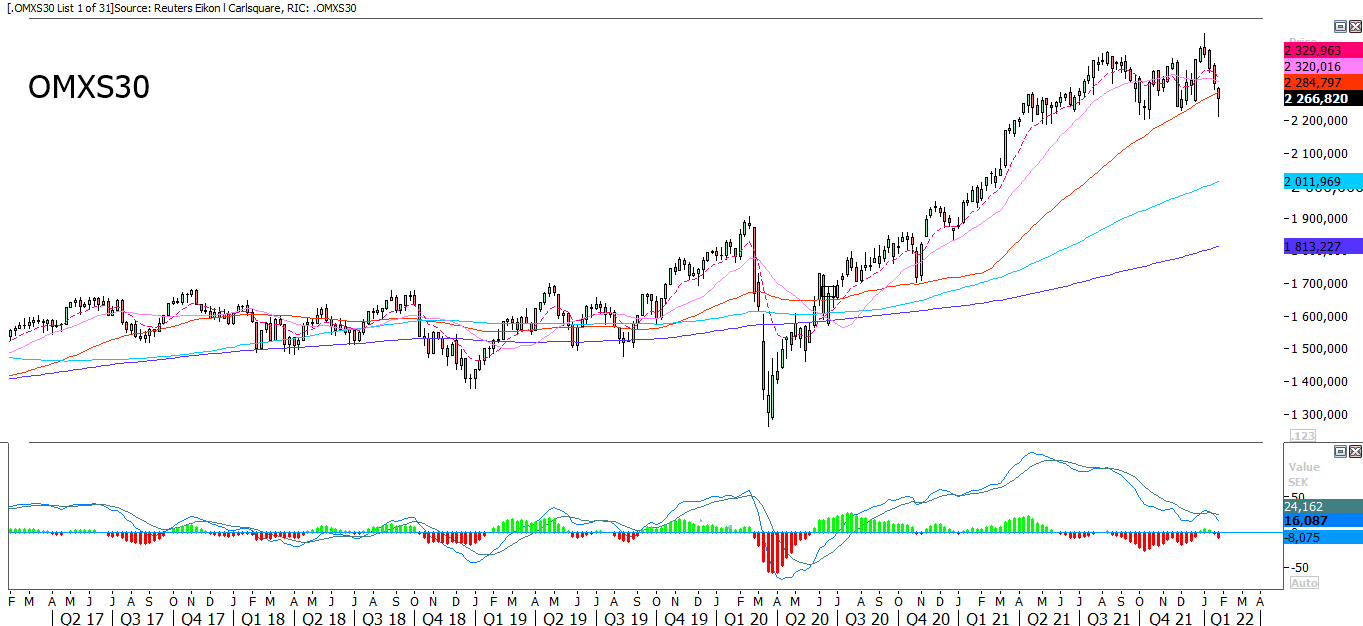

Will support hold for OMXS30?

OMXS30 is trading close to support around 2 230, where the index has bounced three times since June 2021. Momentum is negative and still falling. The index is still below its moving averages, and the risk on the downside is thus still highly present.

OMXS30: June 3, 2021, to January 28, 2022

In the weekly chart below, it can be seen the OMXS30 closed below MA200. Again, MACD is still falling, implying weaker momentum:

OMXS30, weekly five-year price graph

H&M gapped on the report. Is it a breakaway gap?

On Friday, January 28, H&M reported figures exceeding the market’s expectations on several points. The H&M share rose 5 percent on an otherwise slightly falling Stockholm stock market. Above all, a new growth target to double H&Ms revenue in nine years (from 2021 to 2030) lifted the share price.

Measured at Friday’s closing price, the H&M share is trading at P/E 28x last year’s earnings and at a yield of 3.5 percent. Add to this a buyback program equivalent to a further almost 1% of the market value.

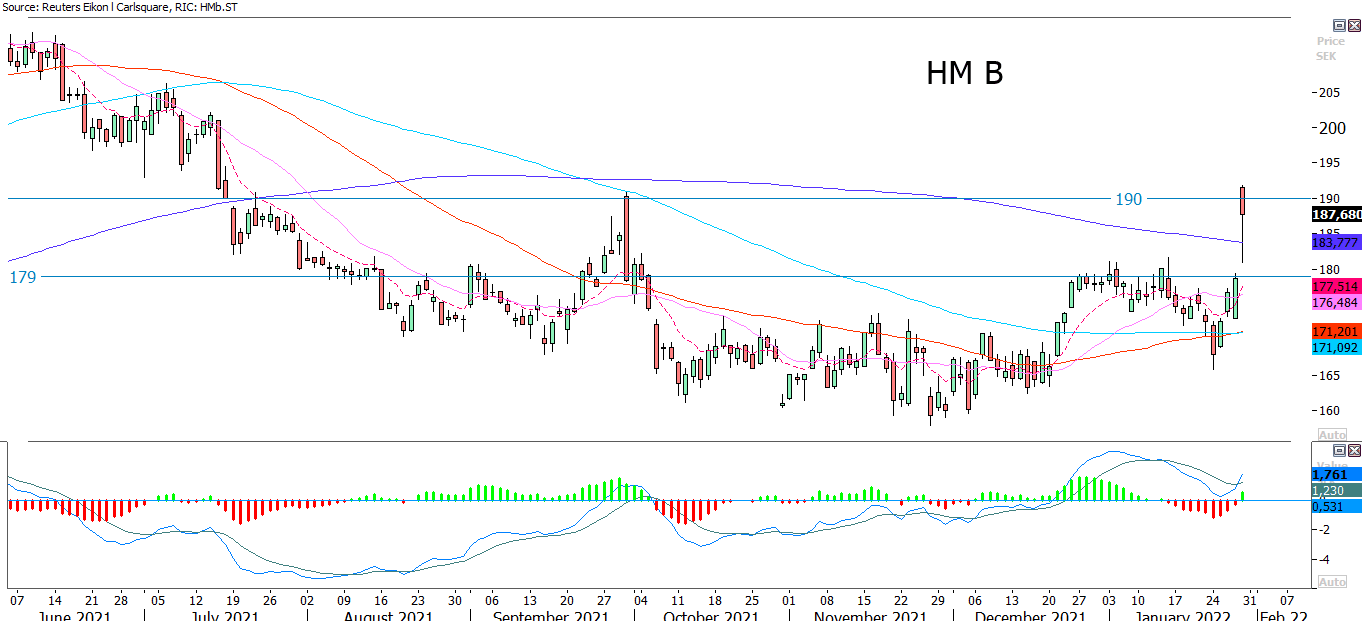

From a technical perspective, the share gaped up but did not manage to close above the 190-level. Today’s trading will give further info on whether the gap gets completed or a if it is a breakaway gap.

H&M B share price graph: June 3, 2021, to January 28, 2022

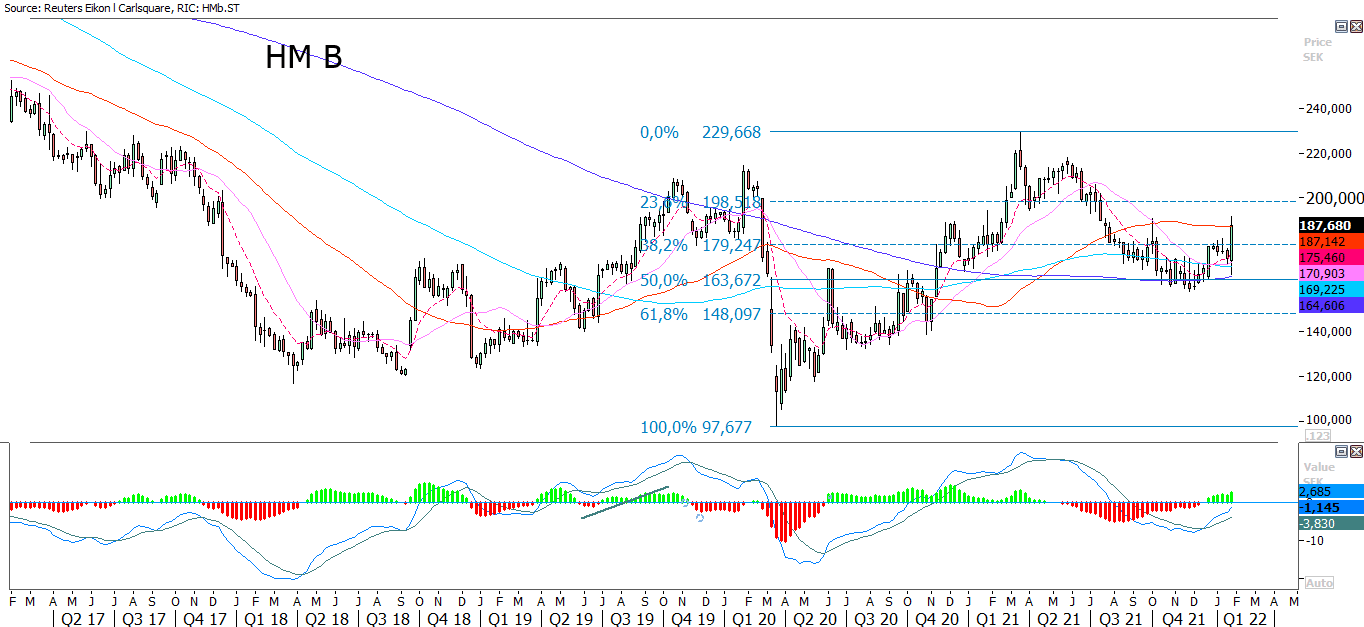

In the weekly chart below, one can see how H&M closed at MA200, serving as resistance.

H&M B, weekly five-year price graph

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence of numbers in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving ema9average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risker

Important notice:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.