Lower US interest rates provide soft buy signals

This week we focus on the potential for a rise in the price of platinum linked to increased demand from the automotive industry. The war between Israel and Hamas has led to increased market risk awareness, but also lower interest rates in the US. Technically, soft buy signals have emerged on most indices.

Case of the week: Platinum, a bright light in the fall darkness

The platinum price has fallen by around 20% so far in 2023. However, there is pent-up demand for platinum due to a shift from palladium in automotive catalytic converters, giving the platinum price upside potential from current low levels.

Since the beginning of 2023, the platinum price has experienced a notable decline, dropping from around 1,100 USD/ounce at the beginning of the year to approximately 870 USD/ounce as of October 9, 2023.

The primary demand for platinum is found in the automotive sector accounting for some 31 to 46% of total platinum demand in recent years. Platinum's usage in various industrial applications places it as the second-largest demand sector, making up nearly 26-36% of the total demand in recent years. Additionally, annual jewelry demand has consistently been around 23-30% of the total demand, with investment demand ranging between 10 and 20% over several years.

In 2022, the mined platinum supply was only 5 million ounces. The supply deficit has continued through 2023 following low production levels from primary producer South-Africa. According to a recent report by the World Platinum Investment Council (WPIC), the demand for platinum in the automotive sector in current year is projected to reach its highest levels since 2017, leading to a platinum deficit of over one million ounces (which is one-fifth of its total mined supply in 2022) for 2023. In the automotive sector, palladium and platinum serve as catalytic converters, Hence, platinum can serve as an alternative to palladium in numerous applications within the sector. Given the fact that palladium is far rarer than platinum, the palladium price (approximately 1 170 USD/ounce) exceeds the platinum price.

The report further indicates that automotive demand for platinum is expected to reach 3.3 million ounces in 2023, a 13% increase over 2017 levels. This surge in automotive demand is primarily fueled by the shift from palladium to platinum, initiated in the past year. It is projected to increase by 615,000 ounces in 2023, along with higher loadings. Additionally, a boost in vehicle production during the second quarter of 2023 contributed to this growth. The impact of semiconductor shortages and other supply chain challenges that affected the industry due to the pandemic and the Ukraine conflict appeared to have diminished significantly.

WPIC notably pointed out a 14% enhancement in light vehicle production and an 18% surge in heavy-duty vehicle production in the second quarter of 2023. Moreover, both China and Japan experienced remarkable growth in vehicle production during this timeframe. Japan witnessed a 20% upswing in the production of gasoline and diesel cars in the second quarter of 2023 compared with the corresponding period in 2022.

To summarize: following a shift from palladium to platinum in catalytic converters in the automotive industry, an increase in demand for platinum is anticipated in the automotive industry. This shift is likely motivated by factors including cost considerations and availability, whereas platinum is more available and less pricy than palladium. Furthermore, the platinum supply is limited given low production levels in 2022 and through 2023, fueling further potential upside to the platinum price in the foreseeable future.

Platinum (USD/Ounce), one-year daily chart

Platinum (USD/Ounce), five-year weekly chart

Macro comments

The military clashes between Hamas and Israel, which began on Saturday morning 7th October, threaten to draw more countries into the conflict, including oil-rich Iran. This led to a risk-off mood on the global stock markets on Monday 9 October. At the time of writing, the US two-year Treasury yield has fallen 23 basis points to 4.97% and the ten-year US Treasury yield has fallen 13 basis points to 4.68%. This can be explained by investors "running to safety" by buying US government bonds. At the same time, the market is anticipating that the war between Israel and Hamas could have an impact on the Fed's future interest rate policy. If this will be the case remains to be seen.

US non-farm payrolls rose by 336,000 in September, compared with the average forecast of 170,000. At the same time, the number of jobs created in August was revised down by 8,000 to an increase of 179,000. Average hourly earnings rose by 4.2% year on year, compared to an estimate of 4.3%.

The strong US employment figures give the Fed an argument to continue to communicate that high interest rates should be "higher for longer". This has led to less inverted yield curves (10-year rates have risen more than 2-year rates). The market is pricing in a 30% probability of a rate hike on 1 November and a 45% probability of a hike at the December FOMC meeting.

US 5-year Treasury yield (in %), one-year daily chart

US 5-year Treasury yield (in %), five-year weekly chart

German Consumer Price Index (CPI) for September and US Producer Price Index (PPI) for September will be released on Wednesday 11th of October. In the evening, the minutes of the 20th of September FOMC meeting are due.

Japanese machinery orders for August, UK GDP and industrial production for August and US CPI in September and weekly initial jobless claims are due on Thursday 12th of October. On Thursday there will also be Q3 2023 results posted by Delta Airlines, Fastenal, Infosys, and Walgreen Boots Alliance.

On Friday morning 13th October, China will release its CPI, PPI, and trade balance for September. In Europe, September CPI are due from Sweden, France, and Spain and August Industrial production from the eurozone After lunch, the US will release import prices for September and the Michigan index for October. On Friday 13 October, JP Morgan Chase, Blackrock, Citigroup, PNC Financial, The Progressive, United Health Group and Wells Fargo report their Q3 results. Within the S&P500 financial sector, the best results are expected from insurance companies and somewhat weaker, but still quite good, from banks. Meanwhile, investment banks are on average expected to post negative earnings growth in Q3 2023.

Soft buy signals all over the place. Is Nasdaq 100 set for 16,000?

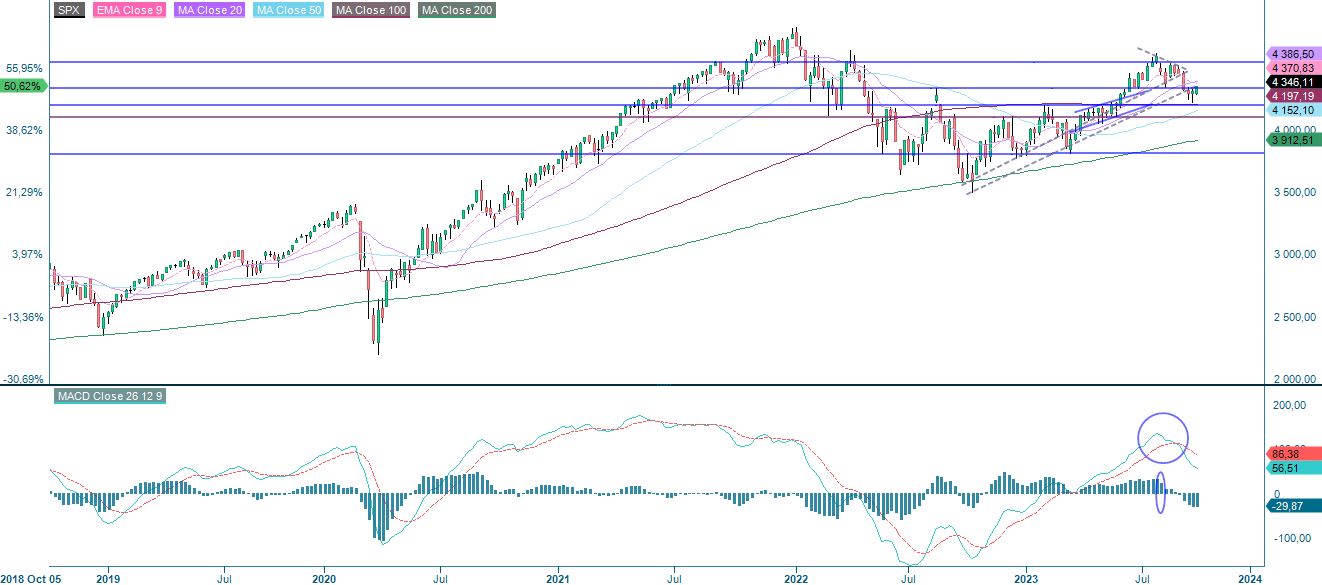

Stocks in the US bounced nicely of the support made up by MA200. S&P 500 is currently trying to retake MA20. A break is good news for the short-term trend as it would go from negative to positive. Note how MACD has generated a soft buy signal. In case of a break on the upside, the next level is just above 4,400 where MA100 and MA50 converge.

S&P 500 (in USD), one-year daily chart

S&P 500 (in USD), weekly five-year chart

Nasdaq is currently trading above MA20 and MA50. MACD has recently generated a soft buy signal. A breakout from the descending wedge-formation is bullish with a target level around 16,000.

Nasdaq 100 (in USD), one-year daily chart

Nasdaq 100 (in USD), weekly five-year chart

MACD for OMXS30 has also generated a soft buy-signal as the index is trading above its MA50. MA200 just above 2,210 is the next level. A break above MA200 and levels around 2,300 may be tested.

OMXS30 (in SEK), one-year daily chart

OMXS30 (in SEK), weekly five-year chart

DAX also managed to bounce of the support and is currently testing MA20. A break on the upside and levels around 15,620-15,660 may be next. MACD is close to be generating a soft buy-signal.

DAX (in EUR), one-year daily chart

DAX (in EUR), weekly five-year chart

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risiko

Ekstern forfatter:

Denne informasjonen er utelukkende på gjesteforfatterens ansvar og representerer ikke nødvendigvis oppfatningen til Bank Vontobel Europe AG eller noe annet selskap i Vontobel Group. Den videre utviklingen av indeksen eller et selskap samt aksjekursen avhenger av en lang rekke selskaps-, gruppe- og sektorspesifikke samt økonomiske faktorer. Hver investor må ta hensyn til risikoen for kurstap i investeringsbeslutningen. Vær oppmerksom på at investering i disse produktene ikke vil generere løpende inntekter.

Produktene er ikke kapitalbeskyttet, i verste fall er et totalt tap av investert kapital mulig. Ved insolvens av utstederen og garantisten, bærer investoren risikoen for totaltap av sin investering. I alle fall bør investorer merke seg at tidligere resultater og/eller analytikeres meninger ikke er en tilstrekkelig indikator på fremtidig ytelse. Ytelsen til de underliggende elementene avhenger av en rekke økonomiske, entreprenørielle og politiske faktorer som bør tas i betraktning i dannelsen av en markedsforventning.

Disclaimer:

Denne informasjonen er verken et investeringsråd eller en investerings- eller investeringsstrategianbefaling, men en annonse. Den fullstendige informasjonen om handelsproduktene (verdipapirene) nevnt her, spesielt strukturen og risikoene knyttet til en investering, er beskrevet i basisprospektet, sammen med eventuelle tillegg, samt de endelige vilkårene. Grunnprospektet og de endelige vilkårene utgjør de eneste bindende salgsdokumentene for verdipapirene og er tilgjengelige under produktlenkene. Det anbefales at potensielle investorer leser disse dokumentene før de tar noen investeringsbeslutning. Dokumentene og nøkkelinformasjonsdokumentet er publisert på nettsiden til utstederen, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Tyskland, på prospectus.vontobel.com og er gratis tilgjengelig fra utstederen. Godkjenningen av prospektet skal ikke forstås som en godkjenning av verdipapirene. Verdipapirene er produkter som ikke er enkle og kan være vanskelige å forstå. Denne informasjonen inkluderer eller er relatert til tall for tidligere resultater. Tidligere resultater er ikke en pålitelig indikator på fremtidig ytelse.