The bears are in charge in Sweden and sneaking up on the US

This week we look at the Brazilian coffee market, where the prices of two different types of coffee beans, Arabica and Robusta, have recently diverged. The price charts for OMX Stockholm have been looking weak for some time. Similar patterns, reminiscent of a so-called bear market, are now beginning to be seen in the US stock indices.

Case of the week: A different blend of coffee

As Brazil, the largest coffee producer in the world, has enjoyed near-perfect weather for harvesting coffee, prices have been pressed downward. Coming off the high plateaus reached in 2022, the price has more or less reverted to the mean, albeit a bit higher than the five-year average. Although recent developments could point to a long-term decline in price, there is potential for a rebound as the season draws to a close.

Arabica coffee Sep ’23 future price chart (in USD), contract average comparison daily chart (against average price for the five prior September futures)

ICE contracts for coffee have historically been reserved for premium, washed coffee beans of arabica coffee. But recently, unwashed beans from Brazil have entered the ICE warehouse. The unwashed beans have caused unrest in other arabica-producing countries, where small-scale farms fear that the premium status of the contract is being compromised. Coffee from Brazil is usually sold in physical markets where sellers can fetch a higher price. Still, recently ICE has started increasing its stock of Brazilian coffee, with about 30 % of the approved stock in ICE warehouses coming from Brazil. Likely to include unwashed beans, this represents a significant shift for the commodity. Smaller players, more likely to grow coffee on hillsides where it can not be harvested as efficiently as on plane surfaces, are now under more pressure than ever to increase yields and efficiency.

On the other side of the coffee spectrum, the more bitter robusta coffee has been struggling to meet production quotas and timelines. While Brazil only has a quarter of the harvest left to go, countries like Indonesia have been dealing with El Niño. After heavy downpours during the summer, the forecast is now shifted toward dryness for the remainder of the year, entirely at odds with the crop cycle of the coffee beans. Together, robusta is again nearing the All-time high reached in June of this year.

In the short term, a meteorological surprise and a pendulum effect could entail a rush for the relatively cheaper arabica. Brazil outpaced the harvesting speeds of 2022 more considerably at the beginning of the season than currently in the last stretch. Considering that demand is looking as solid as ever, there is a significant possibility for a rally in arabica prices as traders start to divest their long positions in robusta.

Robusta coffee Sep ’23 future price chart (in USD), contract average comparison daily chart (against average price for the five prior September futures)

Arabica coffee price chart (in USD/Lbs), one-year daily chart

Arabica coffee price chart (in USD/Lbs), five-year weekly chart

Minor rate hike after US inflation data

The US Consumer Price Index for July was released on Thursday, 10th August. Inflation rose by 0.2% in July and by 3.2% annually. The US Producer Price Index, released on Friday, 11th August, was slightly higher than analysts' expectations (0.8% vs. 0.7% forecast for July). The two-year US Treasury note yield rose by eleven bps (from 4.78% to 4.89%) between Thursday 10th and Monday 14th August.

US 2-year Treasury yield (in %), one-year daily chart

US 2-year Treasury yield (in %), five-year weekly chart

Eurozone Consumer Price Index for July are due on Friday, 18th August. It is expected to have fallen by 0.1% in July, putting the annual inflation rate at 5.3%. Looking ahead into August, oil and natural gas prices have risen recently. There is also a risk that food prices will rise this autumn, where for example, rice prices in Asia have increased lately.

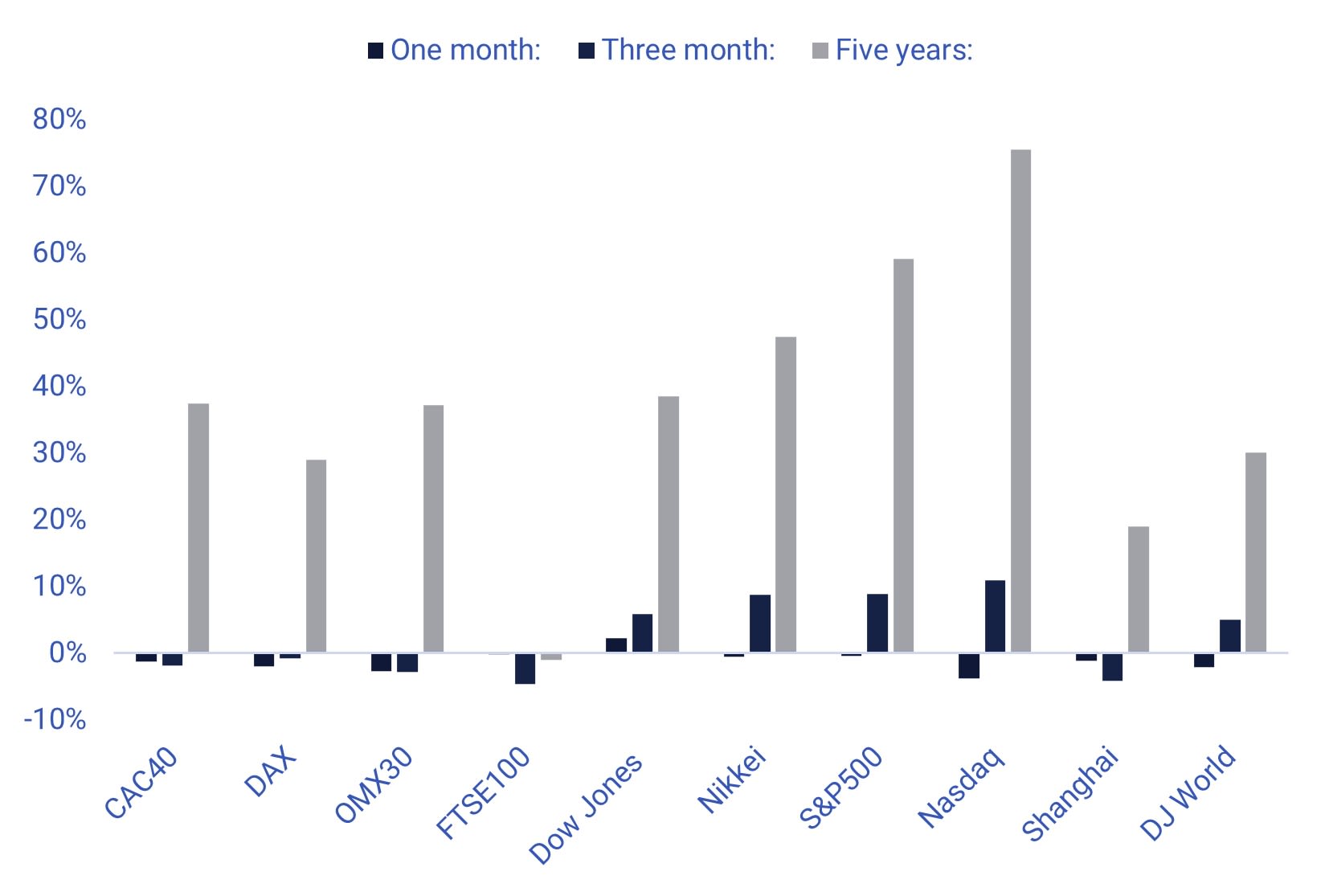

As can be seen from the chart below, the US equity indices and the Nikkei have outperformed the European equity indices over the last three months. Meanwhile, worrying news from China's commercial property sector has weighed down the Shanghai stock index. We also saw weak Chinese trade data last week.

Significant stock indices performance in one month, three months and five years

The UK Consumer Price Index and Producer Price Index for July and June industrial production and Q2 GDP and employment from the eurozone will be presented on Wednesday, 16 August. We also get July housing and industrial production from the US, weekly oil inventories (DOE), and the Fed's July 26th meeting minutes on Wednesday, 16 August.

On Thursday, 17 August, we get Japan's July trade balance and June machinery orders. From the US, there will be the Philadelphia Fed index for August, weekly unemployment data and leading indicators for July.

Friday, 18 August’s news agenda consists of Japan’s July Consumer Price Index, the Q2 employment and Q3 industrial capacity utilisation from Sweden and UK retail sales for July. We also get Eurozone statistics of the June trade balance and construction output, July Consumer Price Index and Q2 job vacancies.

The bears are in charge in Sweden and sneaking up on the US

S&P 500 is now trading at support made up by MA50, currently at 4,452. Meanwhile, MACD is approaching a sell signal. In case of a break to the downside, the next level is found around 4,330, followed by MA100. Selling short a stop-loss around MA20, currently at 4,523, may look attractive from a risk/reward perspective.

S&P 500 (in USD), one-year daily chart

S&P 500 (in USD), weekly five-year chart

Nasdaq 100 is also trading close to support. If more bears come to the market, the next level is found between 14,230 to 14,300. Again a short bet may look attractive from a risk/reward perspective, given a stop loss around MA20, currently at 15,408.

Nasdaq 100 (in USD), one-year daily chart

MACD has generated a soft sell signal in the weekly chart below.

Nasdaq 100 (in USD), weekly five-year chart

The bears have established themselves in Sweden as OMXS30 closed yesterday’s trading below MA200. The next downside level is around 2,120, where Fibonacci 38.2 meets up.

OMXS30 (in SEK), one-year daily chart

OMXS30 (in SEK), weekly five-year chart

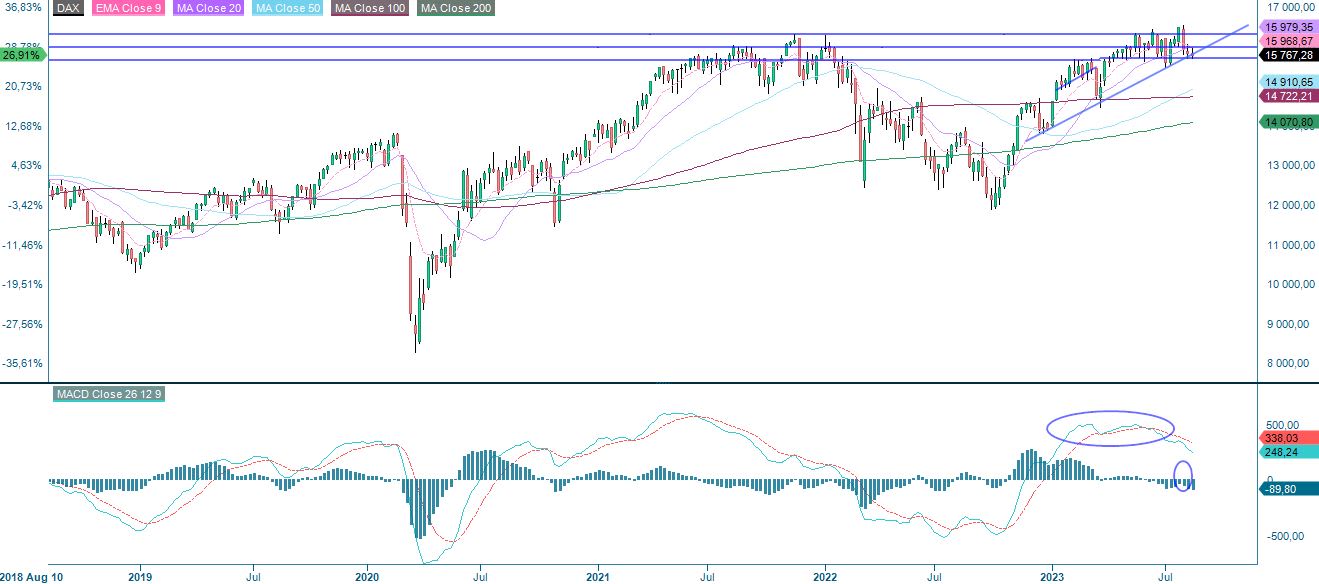

The German DAX is trading around support of around 15,700. The next level on the downside is pretty close, around 15,445. Next after that is MA200, currently at 15,335. Thus, DAX looks the least attractive for a short trade from a risk/reward perspective.

DAX (in EUR), one-year daily chart

DAX (in EUR), weekly five-year chart

Time to take profits in oil

As mentioned last week, Brent oil has performed strongly but is currently at levels where it has bounced back down from several times this year. Maybe history will repeat itself, and it is time to take profits. This case is still alive as MACD recently generated a soft sell signal.

Brent oil (in USD per barrel), one-year daily chart

Brent oil (in USD per barrel), weekly five-year chart

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risiko

Ekstern forfatter:

Denne informasjonen er utelukkende på gjesteforfatterens ansvar og representerer ikke nødvendigvis oppfatningen til Bank Vontobel Europe AG eller noe annet selskap i Vontobel Group. Den videre utviklingen av indeksen eller et selskap samt aksjekursen avhenger av en lang rekke selskaps-, gruppe- og sektorspesifikke samt økonomiske faktorer. Hver investor må ta hensyn til risikoen for kurstap i investeringsbeslutningen. Vær oppmerksom på at investering i disse produktene ikke vil generere løpende inntekter.

Produktene er ikke kapitalbeskyttet, i verste fall er et totalt tap av investert kapital mulig. Ved insolvens av utstederen og garantisten, bærer investoren risikoen for totaltap av sin investering. I alle fall bør investorer merke seg at tidligere resultater og/eller analytikeres meninger ikke er en tilstrekkelig indikator på fremtidig ytelse. Ytelsen til de underliggende elementene avhenger av en rekke økonomiske, entreprenørielle og politiske faktorer som bør tas i betraktning i dannelsen av en markedsforventning.

Disclaimer:

Denne informasjonen er verken et investeringsråd eller en investerings- eller investeringsstrategianbefaling, men en annonse. Den fullstendige informasjonen om handelsproduktene (verdipapirene) nevnt her, spesielt strukturen og risikoene knyttet til en investering, er beskrevet i basisprospektet, sammen med eventuelle tillegg, samt de endelige vilkårene. Grunnprospektet og de endelige vilkårene utgjør de eneste bindende salgsdokumentene for verdipapirene og er tilgjengelige under produktlenkene. Det anbefales at potensielle investorer leser disse dokumentene før de tar noen investeringsbeslutning. Dokumentene og nøkkelinformasjonsdokumentet er publisert på nettsiden til utstederen, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Tyskland, på prospectus.vontobel.com og er gratis tilgjengelig fra utstederen. Godkjenningen av prospektet skal ikke forstås som en godkjenning av verdipapirene. Verdipapirene er produkter som ikke er enkle og kan være vanskelige å forstå. Denne informasjonen inkluderer eller er relatert til tall for tidligere resultater. Tidligere resultater er ikke en pålitelig indikator på fremtidig ytelse.