The market needs a canary

We continue to stare at the famous canary in the coal mine, to see if it is about to faint or not. But it still looks lively. Assets at the far end of the risk curve such as SPAC, IPO index and micro companies even test upwards. The statistics also clearly show that the Fed continues to build up its balance sheet when it buys up bonds that the US government sells. So far, this looks to trump the otherwise weak stock market season.

We continue to stare at the famous canary in the coal mine, to see if it is about to faint or not. But it still looks lively. Assets at the far end of the risk curve such as SPAC, IPO index and micro companies even test upwards. The statistics also clearly show that the Fed continues to build up its balance sheet when it buys up bonds that the US government sells. So far, this looks to trump the otherwise weak stock market season.

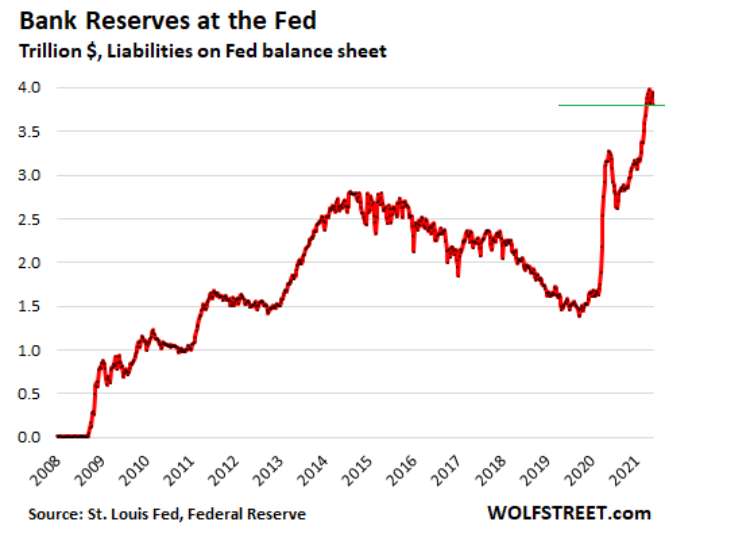

The Fed continues with its support purchases, which can clearly be seen in the graph above. It is historically the best signal to stay long in equities, ever since 2008.

But there are clear signals of stress in the system. The graph below shows that banks are depositing an increasing amount of capital with the Fed. This indicates that the banks have nowhere else to invest their money.

The money that the banks do not want to lie on themselves is lent to the Fed. The graph below shows that the peaks in these usually occur at the turn of the quarter, but right now a mega-peak is being built that we do not have seen since 2016-2017. It will be interesting to see how Fed handles this. As the Fed actively seeks to control the market, it also falls to their responsibility to actively deal with any deviation from normalcy.

The S&P500 index continues to advance in its rising trading channel. Note however how the index is having difficulties to reach new highs that is important for the trend.

Nevertheless, Nasdaq is attracting continued interest and is developing well according to the cup- and handle-formation we have shown in recent weeks. In case of a break of the handle (just below 13 800), the formation calls for a fast upwards movement.

Google acts as the driving locomotive. But as with S&P 500, Google has yet to break its previous top:

But it is important to be alert on trend changes.

The picture below is from a museum in England. It shows a canary that is caught in a cage to be carried down in the coal mines. Canaries are more sensitive to carbon monoxide than humans, which is why they faint faster if the toxic gas is spread in the mine. If the bird fainted or died, it was a warning that the miners must quickly get out of the mine.

https://museumcrush.org/this-device-was-used-to-resuscitate-canaries-in-coal-mines/

This specific cage has the cute feature of a tube of oxygen at the top. There was thus an opportunity to close the mine and open the oxygen tap so the miner could save the canary from dying. For many miners, the canaries were a dear companion, so it is easy to understand why this feature had been added.

We use disparate tools to measure risk appetite in the market. For a long time, we looked at, for example, the Stibor interest rates, which shows the interest rates used between the banks in Sweden. But they became increasingly strange. Finally, a big scandal revealed that they were completely manipulated in the market.

So, each time has its indicators, and it is important to be careful with which tools you choose.

We have long used the ETF HYG or JNK since they reflect the market for junk bonds, i.e., high-yielding junk bonds issued by companies that do not always have a positive cash flows. This market is now also affected by the Fed, which, when they want to, can let oxygen into the market and make it look better than it is. However, HYG still works well in the short term.

As shown in the graph below, HYG is consolidating in a neutral wedge formation. A break can be a trigger for the stock market.

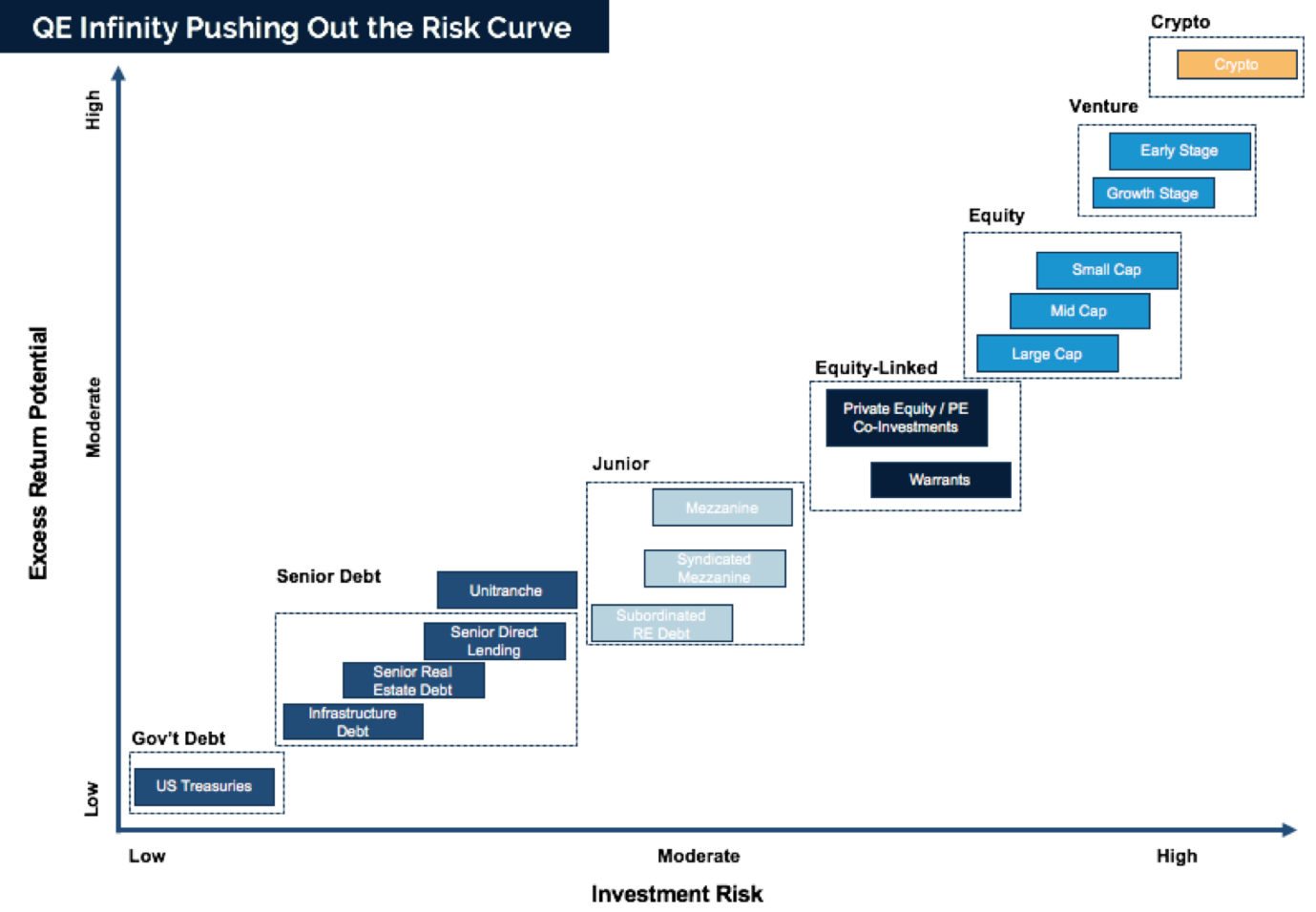

One concept we often use is to hike further and further out on the risk curve. This means that the investor must take an ever-increasing risk to get a return on their money. The picture below shows a risk curve. On the far left are government bonds and on the far-right crypto, such as Bitcoin.

Bitcoin has not yet created a bottom from the almost free fall. It has the chance to create a stud bottom now following the test of MA200. It then applies that 29,900 hold!

When Covid-19 hit the market, Zoom became the most hyped share in the stock market. It certainly is not anymore after falling 50 percent since the top.

There is a genuine interest in finding interesting small micro companies. This is reflected in the ETF IWC, which tries to reflect the development of the US microcap companies.

The IPO market is also starting to recover. This means that the investors are starting to look back to the IPO market again- seriously.

The SPAC companies are also starting to recover:

All these indicators (IWC, IPO, SPAC) have collapsed and are about to recover. If they can continue this journey, it is a clear signal that the market is about to reach a new hysterical period. The stock market season speaks against this so keep an eye on these!

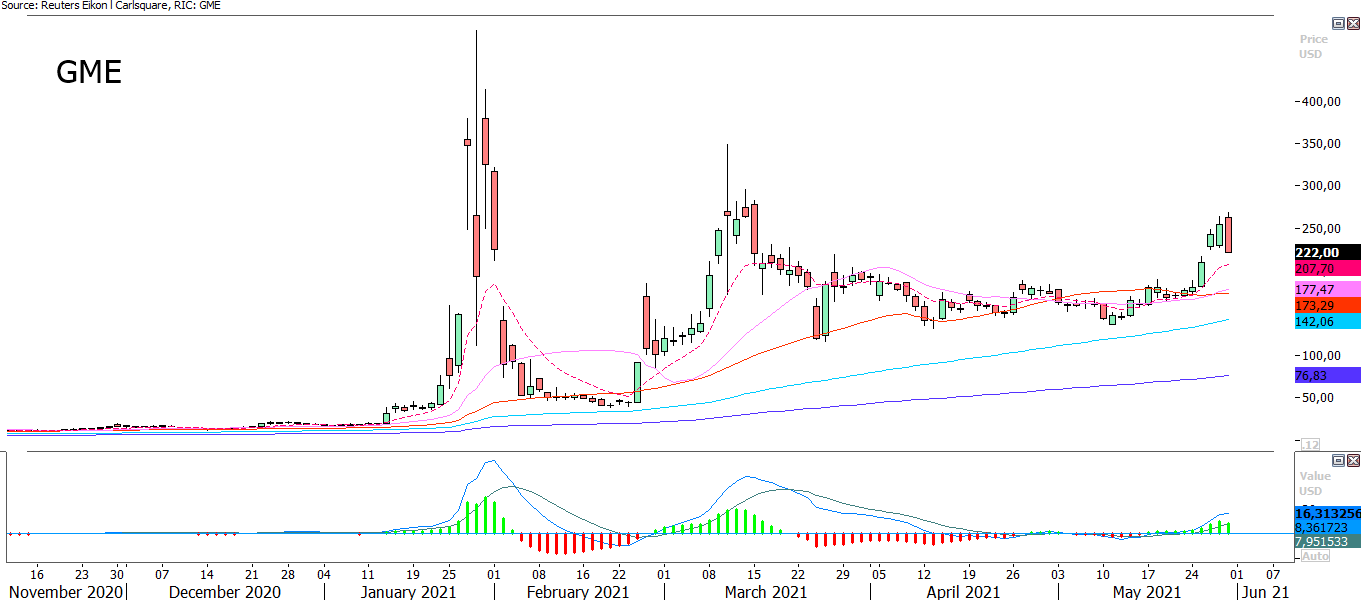

Reddit continues with its runs. The Gamestop share has once again been in the spotlight.

However, the AMC bio chain is the big draw. AMC is a mediocre company that, among other things, owns cinema chains such as the Swedish Filmstaden. Following Reddit´s runs, the AMC share now tops the list of the most traded shares in the United States.

AMC shows no profit. But check out the P/S-ratio above that exploded when Reddit pushed the share price to a price/sale of eight times. We fundamentally interested choose to stay away. Reddit is no more than a pack of wolves that moves from prey to prey and only seems to leave cadavers behind…

In Sweden, OMXS30 is testing the ceiling of the short falling trend channel. MA50 is giving support:

German DAX index is faced with selling pressure close to a previous top and is in need of a trigger to continue to rise:

The EUR/USD is consolidating after a good run since the end of March:

Gold may be an attractive asset when inflation comes back as a topic, which it has on a frequent basis during the recent months. Gold is also rising quickly but can it test previous top without the support even when the EUR/USD is consolidating?

Riskit

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.