Oil prices at a crossroads after a downturn

After a somewhat volatile stock market session yesterday (Wednesday, March 16), the Fed's interest rate announcement was made. The rate hikes increased to one per meeting and seven policy rate hikes in total. It caused long-term U.S. treasury rates to rise while the short-term rates declined, indicating that the fixed-income market began to discount a recession.

After a somewhat volatile stock market session yesterday (Wednesday, March 16), the Fed's interest rate announcement was made. The rate hikes increased to one per meeting and seven policy rate hikes in total. It caused long-term U.S. treasury rates to rise while the short-term rates declined, indicating that the fixed-income market began to discount a recession.

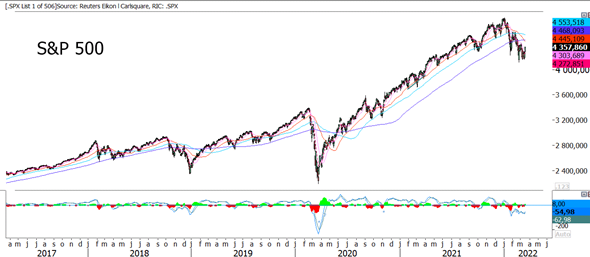

The Fed faces a challenge to curb inflation with higher interest rates. For three weeks, war is also going on in eastern Europe. On top of that, the Fed has committed itself to shrink its balance sheet. This equation is not going to add up. During the press conference, stock market investors took note of Fed chief Powell saying that the risk of a recession is low. But Powell also admitted that Fed is behind the curb and chasing. Fixed-income investors have historically been better in their forecasts of changes in the economic cycle than both the Fed and the stock market.

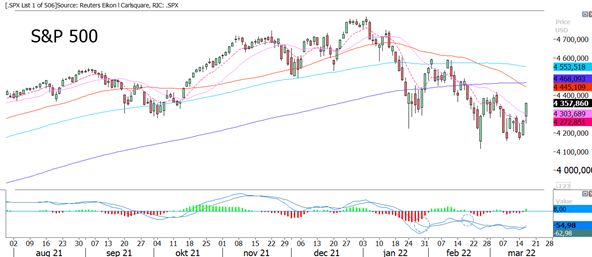

S&P500 Index (in USD) from August 2, 2021, to March 17, 2022

The S&P500 index closed at daily highs on Wednesday evening. According to indications, there is a wall of put options expiring on Friday on the New York Stock Exchange. Therefore, the big banks are interested in keeping the market up until then. So, the U.S. stock market could fall back again early next week.

S&P500 Index (in USD), five-year-chart

The Russian offensive in Ukraine seems to have stalled. It is due to stiff Ukrainian resistance and Russian maintenance problems. Military analysts believe that Russia will not be able to mount a full-scale offensive for more than another ten days. Then it will have to slow down or withdraw. An alternative could be a low-scale war along the current front lines. For the stock market, this is positive news. Both the oil and gold prices have plummeted.

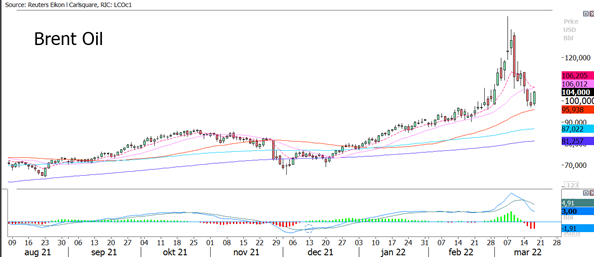

Brent oil price (in USD) from August 9, 2021, to March 17, 2022

Oil prices are falling, despite the disappearance of Russia's share of the world market. However, we expect China to buy discounted oil in Russia right now, with the quid pro quo of supplying Russia with weapons, although it is susceptible on China's part.

We better understand the rebound in the gold price than in oil. After all, Russia is the world's second-largest oil producer, with 13% of world production by 2020. Large volumes need to come from other countries to achieve the same balance as before.

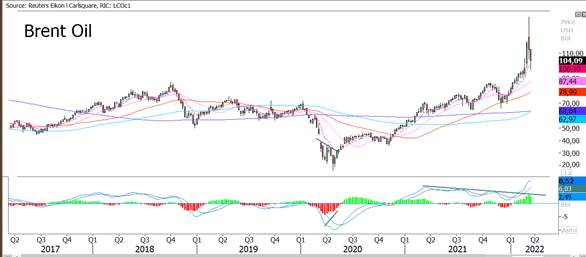

There also appears to be some form of technical support at current lower oil prices. Although this support is still somewhat vague, there is a possible rising secondary line from where the recent price rise began.

Brent oil price (in USD), weekly-five-year-chart

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence of numbers in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Riskit

Important notice:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future result.