Crypto – What is the surge all about?

Many markets have reacted to the newly elected president, Donald Trump; where crypto clearly emerges as one of the winners. The basic rationale for these movements lies in the fears that, had a Democratic victory occurred, regulations on decentralized currencies would have been on the table. With Donald Trump, who has taken a more liberal approach to the popular currency, the crypto world has therefore favored him. But to understand why Donald Trump is favorable for the price of cryptocurrencies, it’s important to understand the effects of various regulations.

Why Would People Want Regulations?

Firstly, why would anyone want to regulate cryptocurrencies? A big difference between a regular stock exchange and the exchange for crypto is that cryptocurrencies are not regulated to the same extent. Regulation brings safety for investors and provides authorities with insight into exchanges complying with the laws in place. The lack of regulations and enforceable laws makes it a target for market manipulation, scams, or rug pulls. Rug pulls are a type of exit scam in which the developers of a currency attract investors, only to shut it down later and take the investors' money with them. These types of scams alone are estimated to have cost investors a total of 750 million USD in 2023 alone, and a total of 14 billion USD worth of crypto in all types of scams. Hence, it is understandable why some argue for a more regulated market. But if the aim of regulations is to make it safer, why is the price expected to decrease? One reason is that by limiting the possibility of illicit transactions, part of the market will leave, decreasing short-term demand.

However, some experts believe that it will still be a net positive for cryptocurrencies in the long run due to the inflow of institutional money, which could outweigh the short-term decrease in demand.

Cryptocurrencies, at their core, appeal to investors due to their deregulated and decentralized properties. They offer people an alternative currency that is not controlled by governments. Therefore, when policies are suggested that threaten these unique properties, it should not come as a surprise that opposition arises. But why would you not want the government involved? For example, Bitcoin has a capped supply of 21 million coins, which means that it is impossible for the central bank to print more money and devalue the currency.

Why Trump Drives Prices

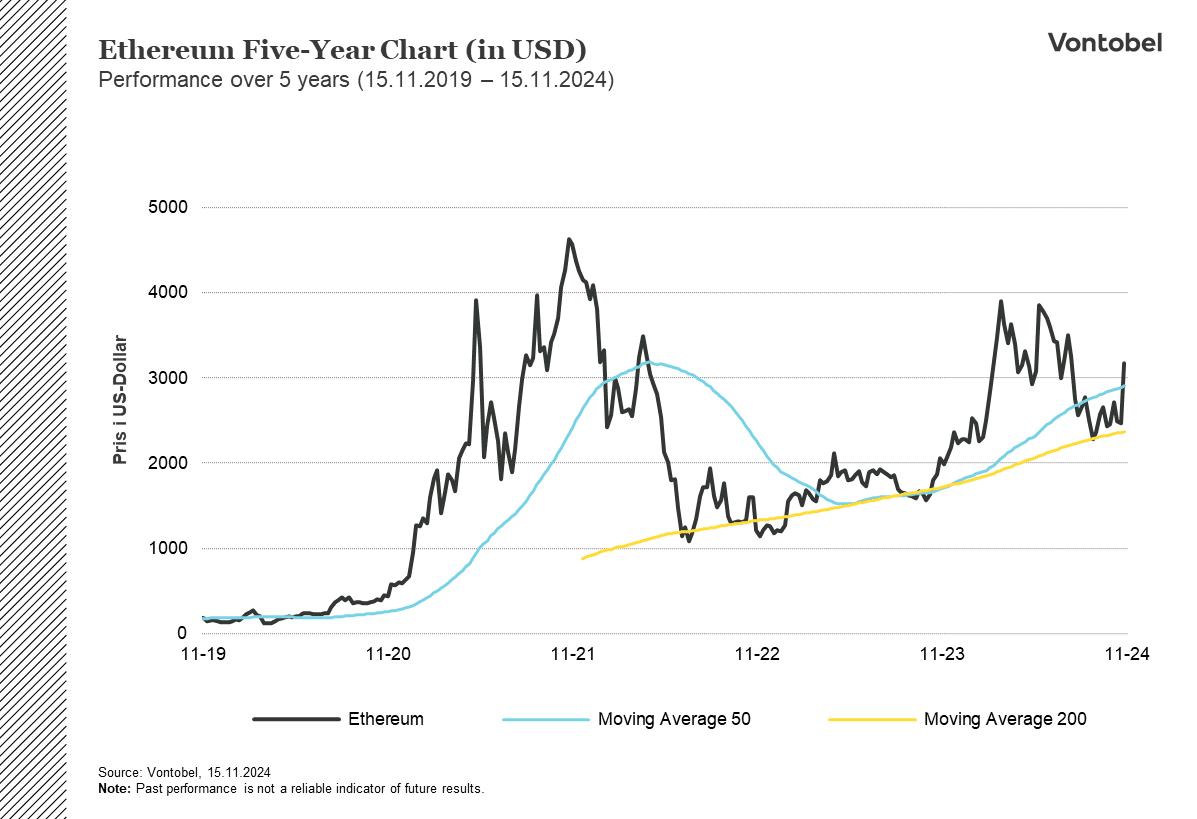

Moreover, during Donald Trump’s campaign, he promised to take a friendly stance towards crypto, even exploring the option of keeping it as a reserve currency, which would most likely make other countries more inclined to follow suit. The market is reacting positively to this news, as it legitimizes Bitcoin as stable enough, which has been one of its main battles in the past. Stability would open the door for more institutional investors to enter the market on a larger scale, further legitimizing the currency. Currently, Bitcoin and Ethereum have shown strong performance after Trump’s victory, and both are trading at high levels. However, only bitcoin trades at its highest levels when both a one- and five-year time span in considered.

A Bet on Better Demand

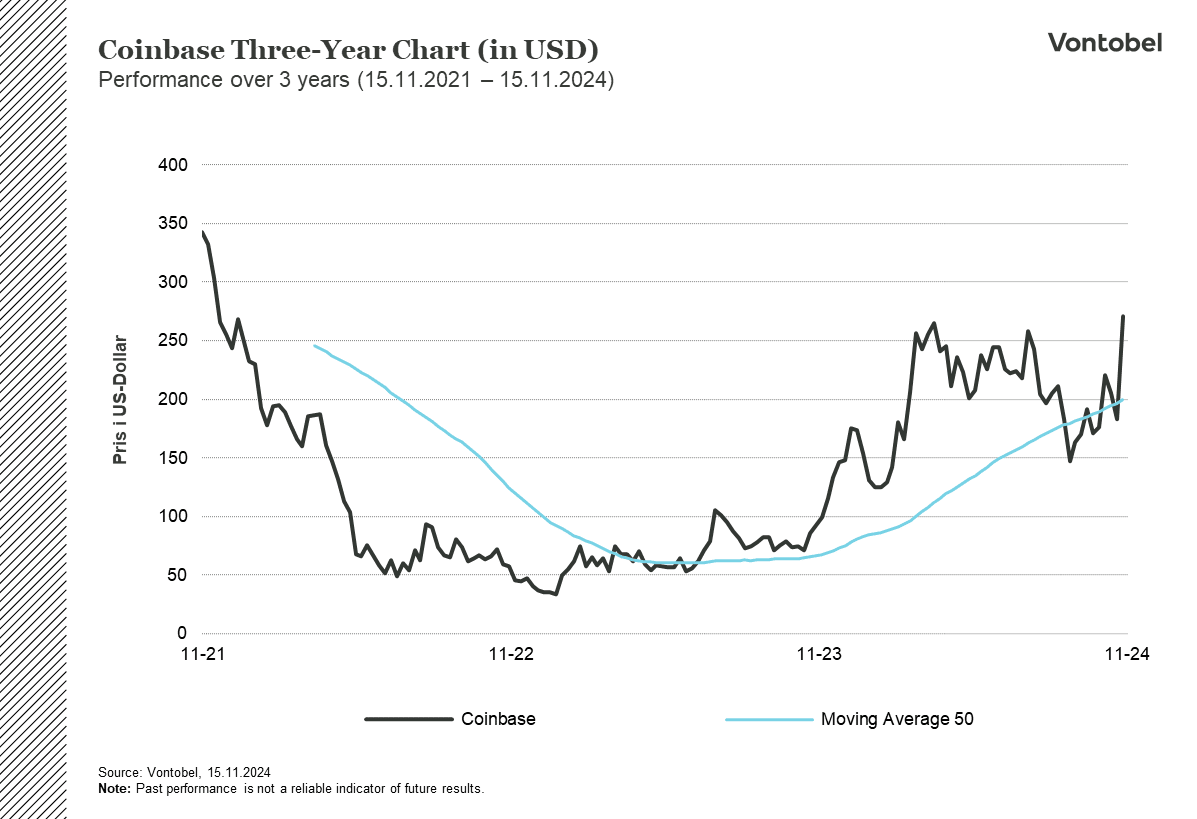

Furthermore, another way to invest into crypto is to invest in brokers who facilitate the trade, and who benefit from the general increase in demand. Coinbase is one of the largest brokers out there and is often regarded as the leader in the segment. Much of its appeal comes from the user-friendly interface, which is targeted at a more beginner audience. With cryptocurrency increasing in popularity, it could be that this audience will enter the market and thus benefit Coinbase more than its competitors, who focus on more advanced traders.

Additionally, Coinbase is currently trading at a yearly high, with a performance of around 100%. Brokers benefit from operational leverage, as their fixed costs remain relatively constant and do not increase proportionally with demand. This makes them a potentially attractive investment opportunity, especially if the increase in demand for crypto is here to stay.

While it's clear that crypto has attracted more investors in recent weeks, this trend is largely driven by expectations. Trump, a president with many promises, will face significant challenges upon entering the Oval Office. However, with control of the House of Representatives, it becomes increasingly likely that he will be able to fulfill the promises made during his campaign. This, in turn, could pave the way for a more sustained bull run for crypto.

Risks

Credit risk of the issuer:

Investors in the products are exposed to the risk that the Issuer or the Guarantor may not be able to meet its obligations under the products. A total loss of the invested capital is possible. The products are not subject to any deposit protection.

Currency risk:

If the product currency differs from the currency of the underlying asset, the value of a product will also depend on the exchange rate between the respective currencies. As a result, the value of a product can fluctuate significantly.

Market risk:

The value of the products can fall significantly below the purchase price due to changes in market factors, especially if the value of the underlying asset falls. The products are not capital-protected

Product costs:

Product and possible financing costs reduce the value of the products.

Risk with leverage products:

Due to the leverage effect, there is an increased risk of loss (risk of total loss) with leverage products, e.g. Bull & Bear Certificates, Warrants and Mini Futures.

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.

© Bank Vontobel Europe AG and/or its affiliates. All rights reserved.