Copper in a balancing act

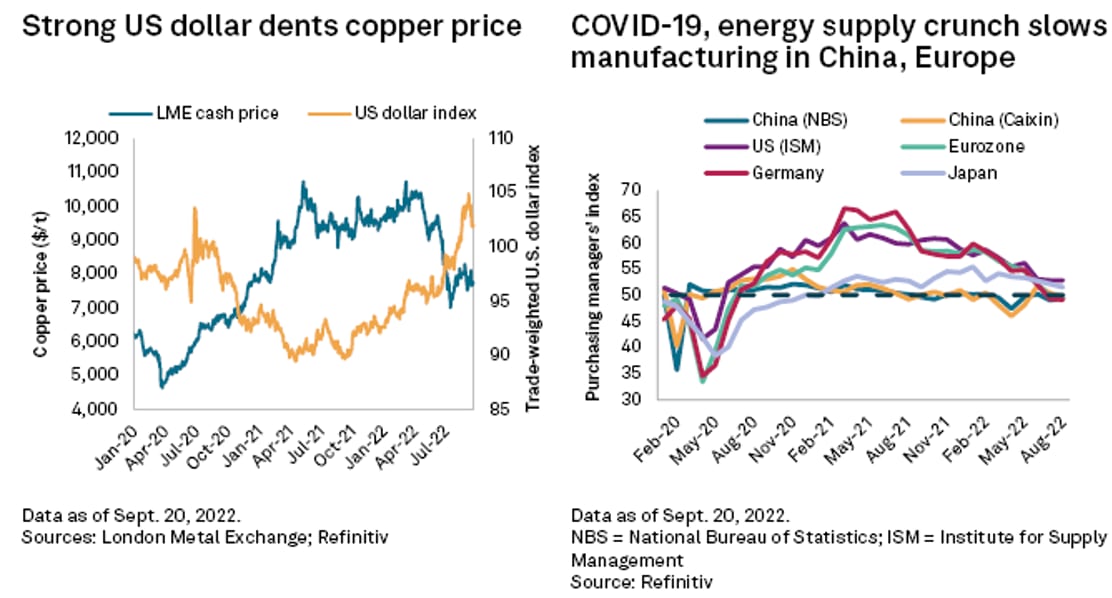

Early this year the copper price climbed to an all-time high. It has dropped some 30 percent since and has entered a bear market. The sentiment is dampened by an uncertain outlook for the Chinese economy. Aggressive tightening by the Federal Reserve and the ensuing rally in the US dollar has also weighed on the price. The inverse relation between the copper price and the US dollar is illustrated below:

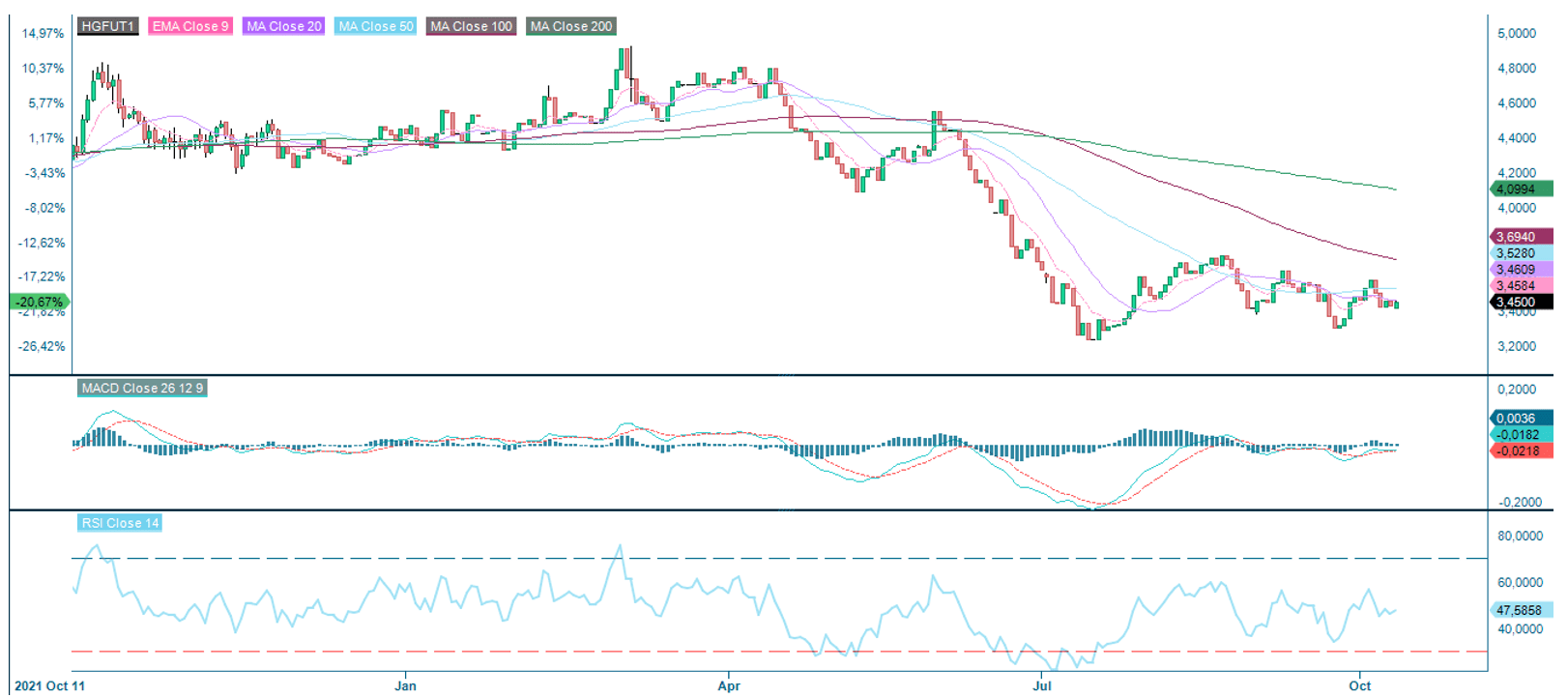

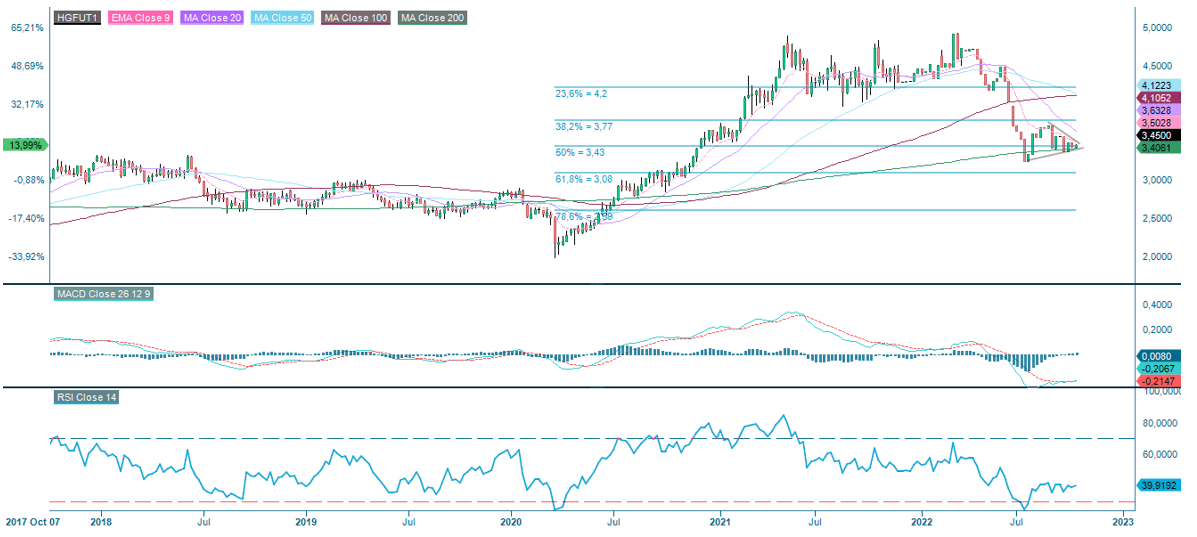

From a technical perspective, copper has reached an important target of the Fib 50 retracement at around USD 3.45 (as calculated from the covid low of 2020). It is also balancing close to the weekly MA200 level of some USD 3.4. This level is a significant support to watch. From the charts, we interpret that copper is in a possible bearish pennant pattern. Normally, when the price breaks out, it should continue the prevailing trend – in this case, downwards.

If so, we believe the first natural target is the year low of around USD 3.24 per pound, with the Fib 61.8 level at USD 3.08 as the next stop.

Copper (USD per pound), daily 12-month price chart

Bull & Bear-Certificates

Copper price (USD per pound), October 2017 to October 2022

The full name for abbreviations used in the

previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis.

Fibonacci numbers are a sequence of numbers in which each successive number is

the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risks

Important notice:

This information is neither an investment advice

nor an investment or investment strategy recommendation, but advertisement. The

complete information on the trading products (securities) mentioned herein, in

particular the structure and risks associated with an investment, are described

in the base prospectus, together with any supplements, as well as the final

terms. The base prospectus and final terms constitute the solely binding sales

documents for the securities and are available under the product links. It is

recommended that potential investors read these documents before making any

investment decision. The documents and the key information document are

published on the website of the issuer, Vontobel Financial Products GmbH,

Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on

prospectus.vontobel.com and are available from the issuer free of charge. The

approval of the prospectus should not be understood as an endorsement of the

securities. The securities are products that are not simple and may be

difficult to understand. This information includes or relates to figures

of past performance. Past performance is not a reliable indicator of future results.