SMCI an interesting but risky AI case

This week's case is Super Micro Computer, where we have seen a recent surge in the share price due to its exposure to increased demand for storage and server solutions to secure big data for AI. We believe this will increase volatility in the share price ahead of its Q3 2024 report, due on 29 April 2024. The S&P500 Q1 2024 earnings season kicks off this week with some of the major US banks reporting on Friday 12th April

Case of the week: Super Micro Computer

Volatility expected after spike in Q1 2024

Super Micro Computer, Inc. (SMCI) specialises in developing and manufacturing high-performance server and storage solutions based on modular and open architecture. SMCI plays an important role in the AI sector by offering high-performance server and storage solutions that are critical to AI applications and enterprises. As the demand for high-performance computing increases amidst the trends of AI, big data, and cloud computing, SMCI's rapid adoption of new chip technologies gives it a competitive edge. This enables SMCI's customers to quickly adopt new technologies and enhance their market competitiveness. SMCI's competitive advantage was evident in the second quarter of fiscal 2024 (corresponding to the fourth quarter of 2023), when the company reported revenues of $3.66 billion, double that of the same quarter a year earlier, with net income also increasing from $176 million to $296 million.

The AI server market is forecast to grow dramatically from $12.34 billion in 2023 to $50.65 billion in 2029. With its established leadership position, SMCI is well positioned to capitalise on this exponential growth. Analyst consensus revenues for fiscal 2024 are approximately $14.4 billion and $19.9 billion in 2025.

Given its significant presence in high-growth technology sectors and its strong growth, it's no surprise that SMCI's share price soared in 2023 and is already up 255.3% in 2024. This surge led to its inclusion in the S&P 500 earlier this year, positioning it as one of the top performers in 2024.

Although SMCI has a competitive advantage in servers and storage, its Price-to-Earnings ratio (P/E) of around 79x is only slightly lower than its peak of around 90x. This is significantly higher than the S&P 500's average P/E of around 23x. Historically, SMCI's P/E ratio has been in the 20x-30x range prior to the recent run-up in its share price. From Q3 2023 to Q4 2024, both gross margin and net margin declined. This shows that SMCI could be under competitive pressure in the long run if (and when) competitors catch up with SMCI's current advantage. For example, DELL is currently putting a lot of emphasis on developing AI servers and AI storage solutions and should be seen as a fierce competitor in the long run.

SMCI reports its Q3 2024 (fiscal year from 1 July 2023 to 30 June 2024) results on Monday 29 April. After the surge in the share price and the high expectations for the future, the share price may experience an increase in volatility until the report. The potential for large price movements following the reports is very high, regardless of the outcome. A positive result is likely to push the share price higher, while a negative result could push the price in the opposite direction.

SMCI (in USD), one-year daily chart

SMCI (in USD), weekly chart since August 2018

Macro comments

The US non-farm payrolls report for March was released on Friday 5th April and showed a surprisingly strong 303,000 new jobs versus an expected 212,000. The figure reduced market expectations for a first Fed rate cut in June to just over 46%, down from 59.5% before the jobs report. Fed member. The interest rate market reacted by pushing up both long and short market rates, with the 10-year US Treasury bond trading at 4.43% and the 2-year bond at 4.75% (both up 8bp) on Monday morning 8th April. At the time of writing (Tuesday 9th April), the 10-year Treasury yield has fallen to 4.38%, while the 2-year Treasury yield is trading at 4.72%.

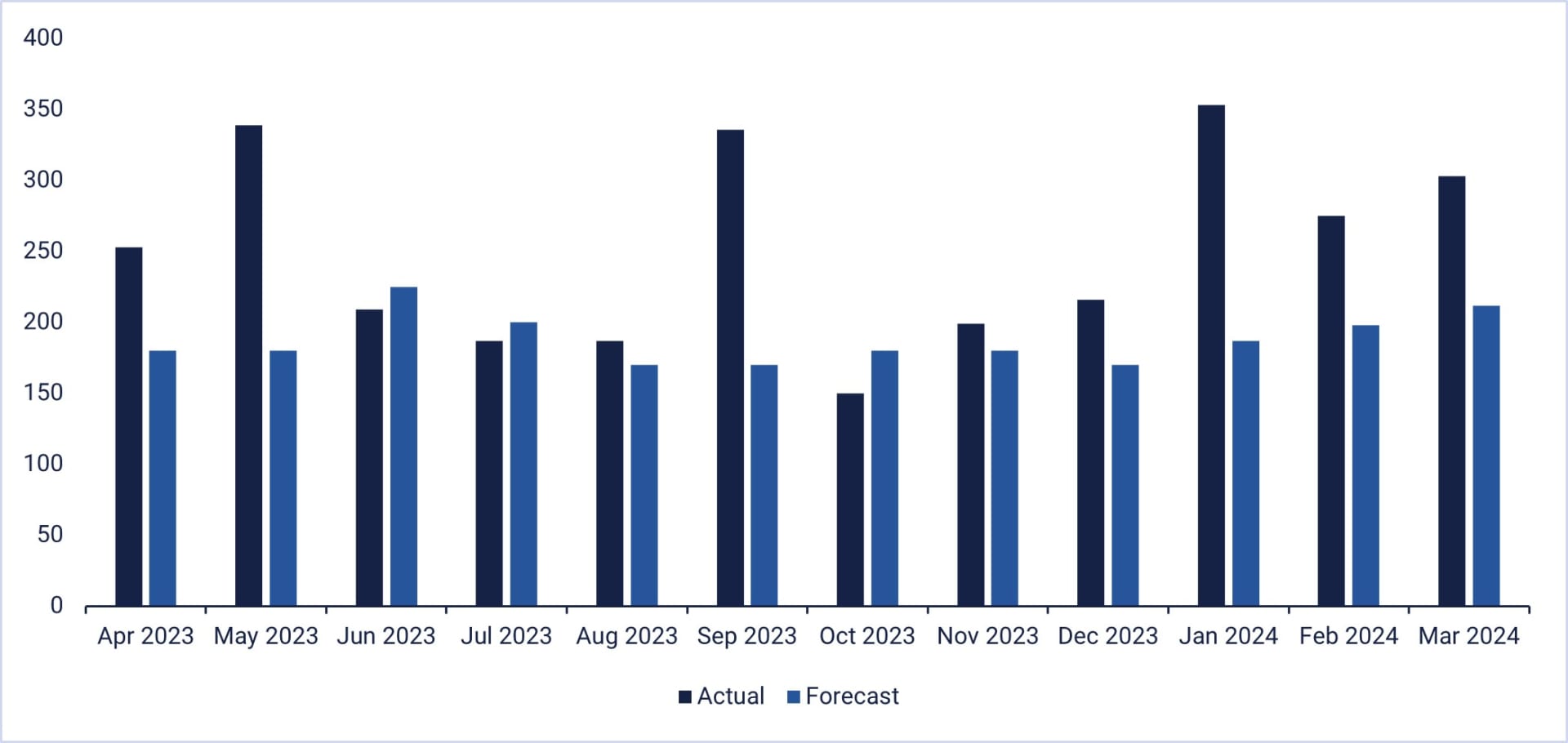

US Nonfarm payrolls April 2023-March 2024

The S&P500 Q1 2024 earnings season kicks off this week with some of the major US banks reporting on Friday 12th April (JP Morgan Chase, Citigroup, and Wells Fargo). This is followed by Goldman Sachs and Charles Schwab on Monday 15th April and Bank of America and Morgan Stanley on Tuesday 16th April.

The average expected earnings growth for the S&P500 financials sector is 0.7% for Q1 2024. However, it varies widely from 37% expected earnings growth for insurance companies to negative 18% earnings growth for S&P500 banks. In between these two extremes, we find Consumer Financials, Financial Services and Capital Markets with 13%, 11% and 0% expected earnings growth in Q1 2024, respectively.

For the first quarter of 2024, the estimated annual earnings growth rate for S&P500 companies is currently 3.2%. This is significantly lower than the corresponding estimated earnings growth rate of 5.7% on 31 December 2023.

As of Friday 5 April 2024, 20 S&P 500 companies (4% of all companies) have reported their Q1 2024 results. 90% have reported positive earnings surprises and 45% have reported positive revenue surprises.

Risk still tilted to the downside

After a false break below the MA20 on Thursday last week, the S&P 500 managed to regain both the MA20 and the EMA9. However, the momentum is positive but falling as the index dances along the two moving averages. The risk is therefore still to the downside. In the event of a break, MA50, currently just above 5,100, could be next.

S&P 500 (in USD), one-year daily chart

S&P 500 (in USD), weekly five-year chart

The Nasdaq has bounced nicely off the MA50 and is currently trading above both the MA20 and the EMA9. Momentum has been waning for some time, but the risk has shifted to the downside in the last week. A break below the MA50 could take us to the MA100, currently just above 17,200. Also note the soft sell signal generated by the MACD on the weekly chart.

Nasdaq 100 (in USD), one-year daily chart

Nasdaq 100 (in USD), weekly five-year chart

Meanwhile, the Swedish OMXS30 has regained its EMA9 but is currently trading just below the MA20 with positive but declining momentum. Support has been established just south of 2,500.

OMXS30 (in SEK), one-year daily chart

OMXS30 (in SEK), weekly five-year chart

The German DAX is currently under pressure and testing a rising MA20. A break to the downside and support should be found around 17,950.

DAX (in EUR), one-year daily chart

DAX (in EUR), weekly five-year chart

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risks

External author:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.

Credit risk of the issuer:

Investors in the products are exposed to the risk that the Issuer or the Guarantor may not be able to meet its obligations under the products. A total loss of the invested capital is possible. The products are not subject to any deposit protection.

Market risk:

The value of the products can fall significantly below the purchase price due to changes in market factors, especially if the value of the underlying asset falls. The products are not capital-protected

Risk with leverage products:

Due to the leverage effect, there is an increased risk of loss (risk of total loss) with leverage products, e.g. Bull & Bear Certificates, Warrants and Mini Futures.

Product costs:

Product and possible financing costs reduce the value of the products.

Currency risk:

If the product currency differs from the currency of the underlying asset, the value of a product will also depend on the exchange rate between the respective currencies. As a result, the value of a product can fluctuate significantly.