Warrants: How they work

Warrants enable investors to participate disproportionally in the performance of the underlying with less invested capital than a direct investment. If investors expect prices to rise, they can position themselves with a Call warrant. Put warrants are available if prices are expected to decline. Additionally, warrants have a fixed maturity and a strike price. Investors can choose from a wide range of different asset classes such as stocks, indices, commodities, precious metals and currency pairs.

How do Warrants work?

Warrants are part of the leverage products category and are popular instrument for many investors. Because less capital is required compared to a direct investment in the underlying, warrants enable a disproportionate (“leveraged”) participation in the performance of the underlying. Conceptually, warrants represent the securitized form of an option. This has the advantage that the resulting warrant is easily tradable on an exchange.

Valuation of Warrants

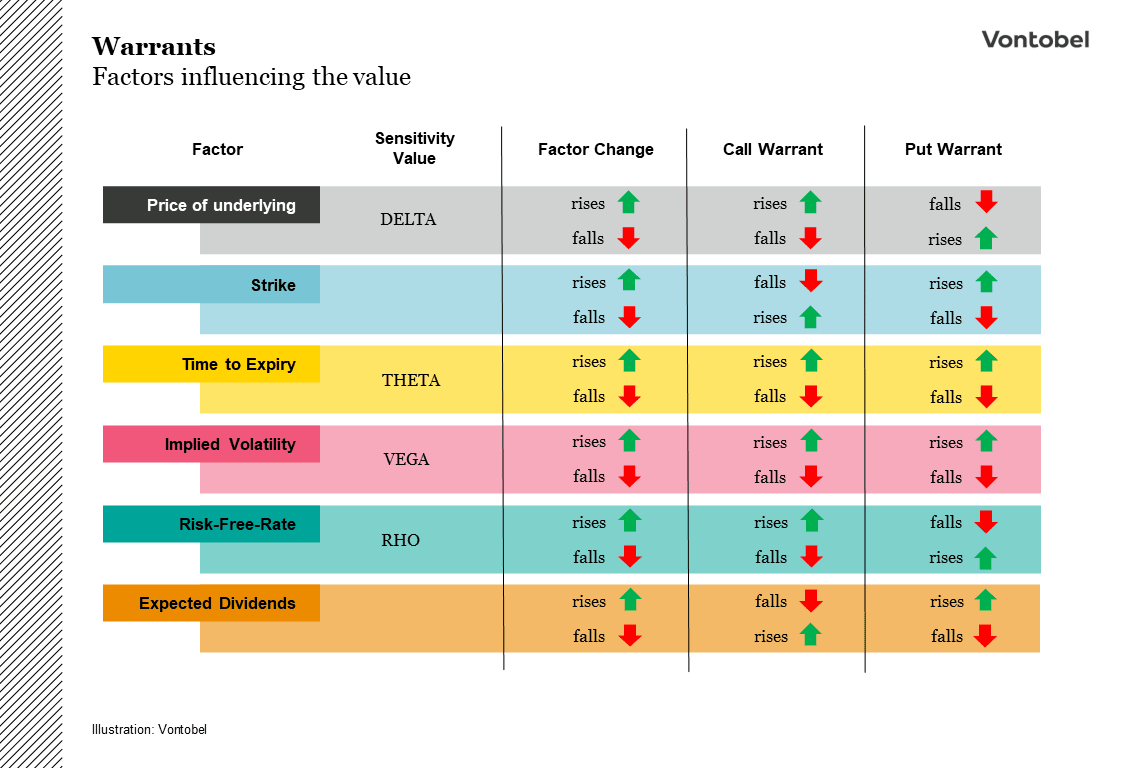

Due to the similarity to options, the value of warrants is influenced by the same factors. The relevant factors are: price of the underlying, strike price, remaining time to expiry, implied volatility, risk-free rate and the expected dividend. Changes in these factors can have different effects on the valuation of warrants. Therefore, the valuation of warrants is complex.

Investing with leverage

Compared to a direct investment, a warrant requires less capital. The resulting leverage-effect enables a disproportionate participation in the performance of the underlying. Leverage, indicates the percentage change of the warrant in the event that the underlying’s value changes by one percent. The leverage value can change over time and is product specific.

While the theoretical profit with call warrants for a rising underlying is unlimited, the theoretical profit for put warrants is limited, because the underlying cannot go below zero. If the underlying moves in the opposite direction of the warrant, losses can materialize. The warrant can expire worthless which subsequently leads to a total loss. Margin calls are not applicable to these leverage products.

Warrant characteristics

The value of a warrant consists of two components: the intrinsic and time value.

Intrinsic value of a Warrant

The intrinsic value equals the amount an investor would receive, if he exercises the warrant early, in this case immediately in the case of a cash settlement. The intrinsic can be calculated easily.

For call warrants, the intrinsic value equals the difference between the current value of the underlying and the strike price. For put warrants it is the difference between the strike price and the value of the underlying. It is important to note that for both call and put warrants, the intrinsic value must be divided by the specific product ratio to arrive at the correct intrinsic value for a warrant.

When discussing intrinsic value, it is important to mention the terms “in the money”, “at the money” and “out of the money”.

A warrant is in the money if the underlying is trading above (call warrant) or below (put warrant) the strike price.

A warrant is at the money if the underlying equals the strike price.

A warrant is out of the money if the underlying is trading below (call warrant) or above (put warrant) the strike price.

Time value of a warrant

The time value corresponds to the difference between the current value of the warrant and the intrinsic value. Without intrinsic value, i.e. out of the money, the value of a warrant corresponds to the time value. The time value declines (time decay) over time. At the beginning time decay is small but accelerates as the expiration date moves closer. At expiration, the time value is zero.

Factors influencing the value of Warrants

A warrant’s value depends on many different factors. These factors are subject to change until maturity. To better understand how a warrant behaves to changes of these factors, investors can look at these factors through their sensitivities, also known as “Greeks”.

Sensitivities show how the value of a warrant changes if one specific factor changes by one unit whilst other variables remain unchanged.

Delta

The Delta is one of the most important sensitivity values. It shows the change in value of the warrant (adjusted for the ratio) given an up or down move by one unit in the underlying. Delta takes values between 0 and 1 for Call and 0 and -1 for Put Warrants.

The Delta for warrants is lower the further out-of-the-money they are. On the other hand, the Delta is higher the more in-the-money the warrant is.

A delta of 0.5 means that a (call) warrant increases by 0.5 CHF when the underlying rises by 1 CHF, if all other factors remain unchanged.

Theta

Theta expresses the decline in value over time (time decay). Assuming all other variables remain unchanged, a warrant loses value as the expiry date moves closer. The Theta value shows the daily decline in value of the warrant until maturity.

Vega

A very important factor is volatility. Volatility describes the price fluctuation of an underlying asset over a specific period. The influence of (implied) volatility on the value of a warrant is described by the sensitivity Vega. The Vega value shows by how much the value of a warrant changes (adjusted for the ratio) when volatility increases or falls by one percentage point.

Rho

The sensitivity value Rho shows the change in the value of the warrant if the risk-free interest rate changes. If the risk-free interest rate rises by one percentage point, the warrant price increases by the value of Rho for call warrants, while it falls for put warrants (adjusted for the ratio).

Hedging with Warrants

Apart from speculation on specific price movements, Warrants can also be used to hedge existing positions or entire portfolios.

Consider a scenario where investors hold a portfolio consisting of long positions in multiple individual stocks of the SMI® and fear that there might be a price correction in the near future. If they anticipate a decline in the SMI®, investors can protect themselves from losses in their existing equity positions, either partially or entirely, by using Put Warrants. This is possible because Put Warrants increase in value when the price of the underlying asset falls, allowing investors to offset losses in their long positions. This hedge is essentially a form of insurance.

Due to their function and limited maturity, Put Warrants are particularly suitable for temporary hedging. The hedging mechanism only takes effect from the exercise price and is valid upon expiration of the warrant. Once the expiration date is reached, new Put Warrants need to be purchased if the investor wishes to continue the hedge.

The cost of hedging

The duration of the hedge influences the associated costs. Generally, the longer the hedge period, the more expensive it becomes. Additionally, the exercise price has an impact on the cost of the hedge. The lower the exercise price, the cheaper the price of a Put Warrant. However, it is essential not to choose the exercise price too low because if the price of the underlying asset is above the exercise price at expiration, the Put Warrant expires worthless.

Static vs. Dynamic Hedging with Put Warrants

When using Put Warrants for hedging, there are two approaches: static and dynamic hedging. For static hedging, the number of required Put Warrants is determined at the beginning. On the other hand, dynamic hedging requires continuous adjustments to the number of Put Warrants. Since dynamic hedging involves buying and selling Put Warrants continuously, it causes higher transaction costs. Therefore, dynamic hedging is more suitable for professional or institutional market participants rather than individual investors.

Pro and Cons of Warrants

Advantages of Warrants

- Lower capital investment compared to direct investment in the underlying asset

- Amplified participation in both rising and falling prices due to leverage

- Available instruments: Rising underlying: Call Warrants, Falling underlying : Put Warrants

- Broad selection of asset classes can contribute to portfolio diversification

- Cost-effectiveness of Put Warrant hedging during periods of low volatility

Disadvantages of Warrants

- Market risk of underlying asset

- Leverage works in both directions, leading to potential disproportionate losses, up to total loss

- Issuer risk

- Currency risk for underlying assets denominated in foreign currencies

- Volatility plays a significant role in warrant pricing

- Complex valuation due to numerous influencing factors