Will inflation data continue to propel USD upwards?

US inflation (CPI) once again surprised on the upside in April. Core CPI rose 6.2 per cent year-on-year, higher than the expected 6.0 per cent. The numbers fuel concerns that the Federal Reserve is behind the curve, and there is still some probability of a 75 bp hike in July implied by market prices, despite chairman Powell’s soothing comments last week. There is some silver lining, however, since inflation fell from the March numbers, even if a lower inflation rate was widely expected.

Consequently, the dollar-index is in a strong trend and challenges multi-year highs. In the short term, the dollar strength puts pressure on both risk assets as well as commodities. The question is if the dollar will continue to rise or is over-bought and will top out at current levels.

On balance, we believe the odds seem to favour the dollar for now. EUR/USD has been consolidating during the last two weeks. Perhaps there is more downside to be realised for the currency pair.

EUR/USD, May 10, 2021, to May 11, 2022

Source: Infront and Carlsquare. Note: Past performance is not a reliable indicator of future results.

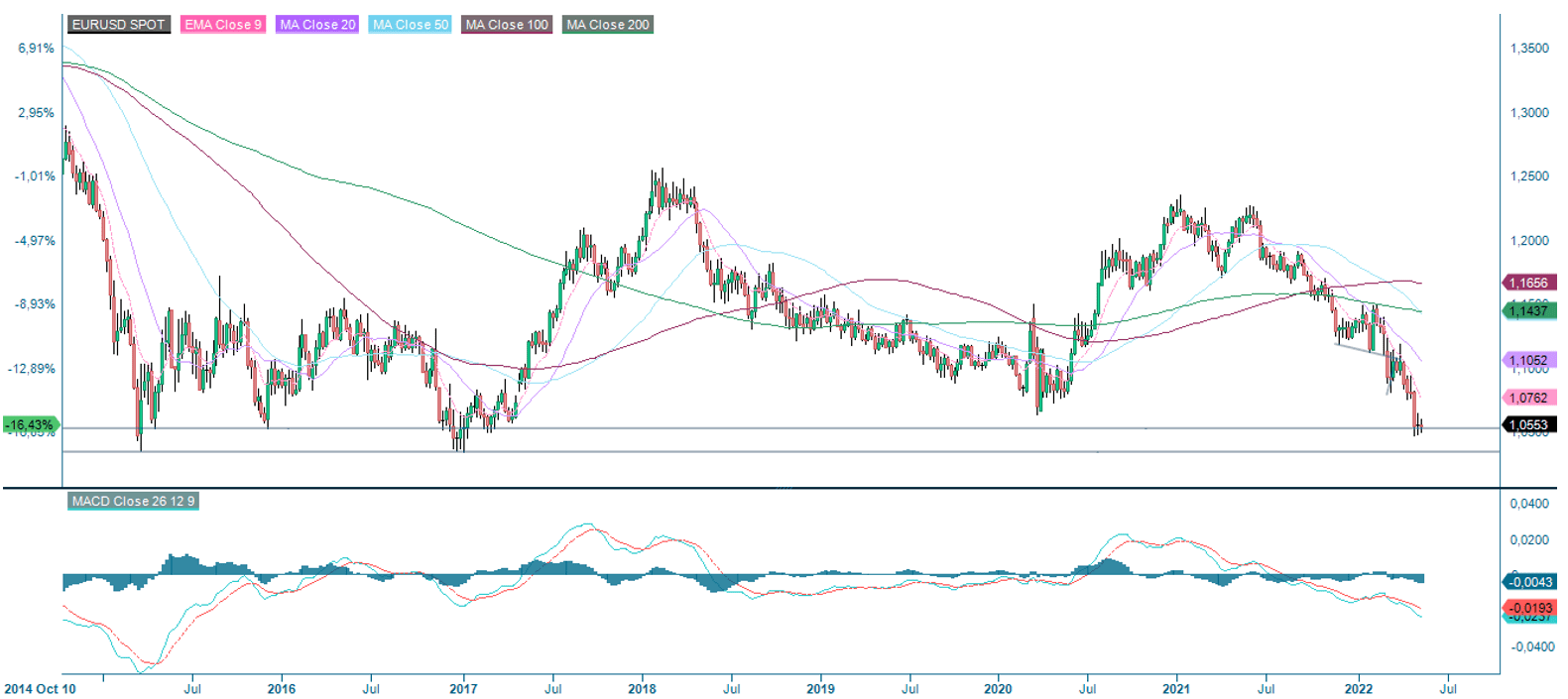

In the weekly chart below, one can see how EUR/USD is trading at support. A break and lows around 1.035, last seen in 2016 may be next.

EUR/USD, October 14 2014 to May 11 2022

Source: Infront and Carlsquare. Note: Past performance is not a reliable indicator of future results.

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence of numbers in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risks

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.

External author:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.