USD and interest rates in focus

This week's US presidential election could have an impact on the Swedish Krona (SEK) against the US Dollar (USD). In our view, a Trump victory would trigger a short SEK/USD position, while the opposite, a Harris victory, would call for a long SEK/USD position. This week will also be influenced by interest rate announcements from the Federal Reserve (Fed), the Bank of England and Sweden's Riksbanken.

Case of the week: SEK vs USD, Trump vs Harris

The week beginning 4 November 2024 is an intense one, with the US election on Tuesday and the Fed's interest rate decision on Thursday. On the European side, both the United Kingdom (UK) and Sweden will also decide on their respective interest rates on Thursday. All three central banks are expected to cut rates, with the US Federal Reserve cutting from 5% to 4.75%, the Bank of England doing the same and the Swedish Riksbank cutting from 3.25% to 2.75%. As for the euro area, the three key interest rates, the deposit facility rate, the main refinancing operations rate and the marginal facility rate, were all cut by 25 basis points in October. They now stand at 3.25%, 3.40% and 3.65% respectively. At the time of writing, US presidential polls and betting sites are showing a neck-and-neck race between Trump and Harris. The outcome will either push the USD down or up against the SEK.

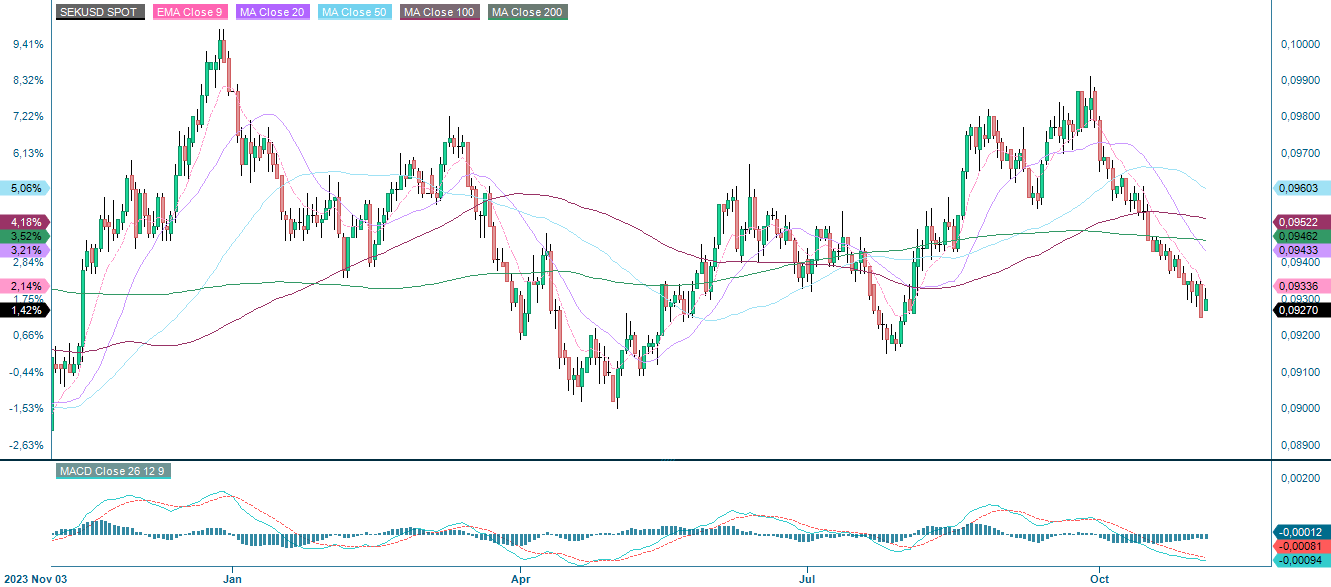

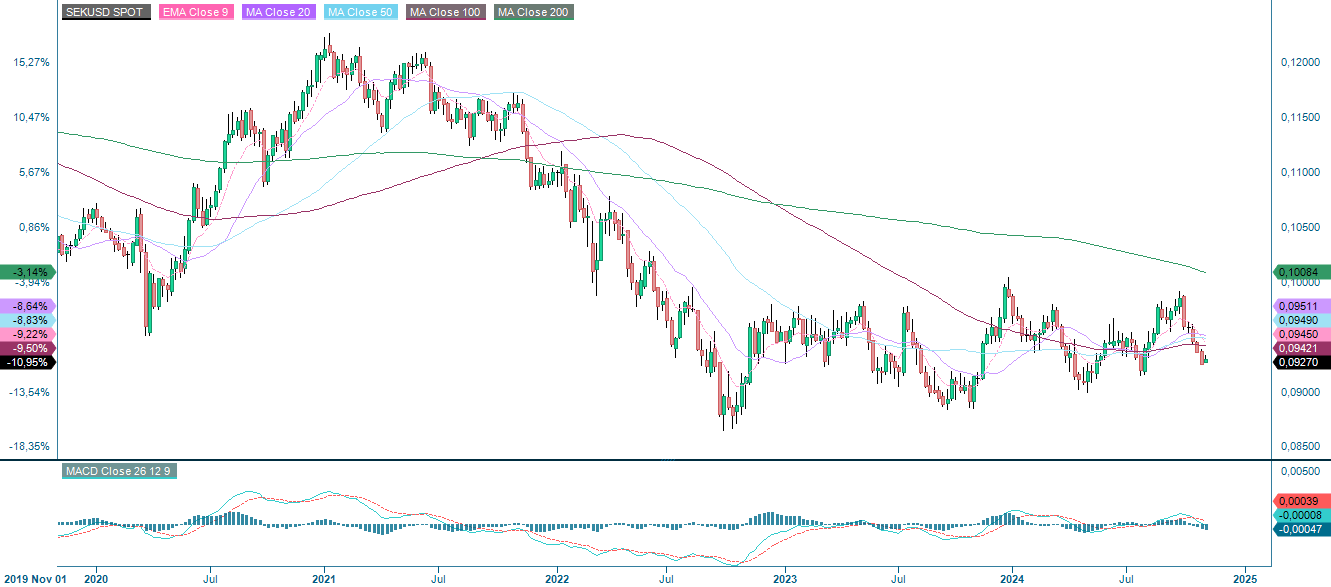

US interest rates have risen and the US dollar has strengthened in October ahead of the presidential election. The market has thus partially priced in a Trump victory, which is expected to lead to inflationary policies and higher budget deficits.The general view is that if Trump wins, the USD would become more attractive, leading to a sell-off in other smaller currencies such as the SEK. If Harris wins, the opposite would be true, with traders likely to jump into smaller currencies such as the SEK. The same is true for the US Senate and House of Representatives, with Republican victories expected to correlate with increased pressure on the SEK. In parallel, the direction of the Fed's interest rates is less clear after the expected cut in November. Again, the outcome of the US election is likely to play a role in determining the Fed's path forward, as a Trump presidency promising tariff hikes and tax cuts could lead to a resurgence in inflationary pressures. This in turn would push the needle towards higher for longer interest rates, making it more attractive to short SEK and jump on the greenback.

With regard to Sweden, the economic data releases seem to support a rate cut, as Gross Domestic Product (GDP) growth rates, for example, came in below consensus estimates. Specifically, the flash Quarter-over-Quarter (QoQ) GDP growth rate for Q3 came in at minus 0.1% compared to consensus estimates of 0.4%. The same was true for the year-on-year figure, which came in at minus 0.1% versus 0.7%. On the mortgage lending front, an independent committee recommended that the Swedish government raise the mortgage ceiling from 85% to 90%. It has also been suggested that the current repayment requirements of 2% per year down to 50% Loan-to-Value (LTV) should be scrapped in favour of a straightforward 1% for all home buyers and owners with a LTV ratio above 50%. As might be expected, the construction and housing sectors praised these proposals, pointing out that developer-driven construction in Sweden has been more or less dead since the stricter rules were adopted.

Others see risks in making it easier for consumers to take on debt. Sweden already has the second highest private debt-to-GDP ratio in Europe. The measures could have the unintended side-effect of fueling a house price bubble as consumers, who have already priced in cheaper credit in anticipation of a rate cut, suddenly have an incentive to borrow even more. Coupled with a 50 basis point rate cut by Riksbanken, property prices in growth regions such as the Stockholm area could soar. With more money in their wallets as a result of lower borrowing costs, consumer spending could increase, fuelling inflationary pressures once again. Nevertheless, it is likely that both the proposed measure and the expected rate cut will become reality. The former is associated with an increase in the money supply, which is inversely correlated with the interest rate and the value of the local currency.

Given that, at the time of writing, polls and betting markets are at odds with each other on who will win the US presidential election, the currency play for SEK is a risky one. The simple strategy is; if one thinks Trump will win, go short SEK/USD. If the opposite is true, go long SEK/USD.

Exchange Rate SEK/USD, one-year daily chart

Exchange Rate SEK/USD, five-year weekly chart

Macro comments

For Q3 2024 (with around 350 S&P500 companies reporting), 75% of companies have reported a positive earnings surprise, while 60% have reported a positive revenue surprise.

For Q4 2024, 37 S&P500 companies have issued negative Earnings-per-Share (EPS) guidance, while 18 S&P500 companies have issued positive EPS guidance. However, Wall Street analysts are forecasting earnings growth of 12.7% and revenue growth of 4.8% for Q4 2024.

Communication Services is the best performing sector so far, beating Q3 earnings expectations in 92% of reports to date. Consumer Staples is second, with 87% of Q3 earnings beating estimates. Health Care is third best, since the sector with 85% positive earnings surprises. Consumer Discretionary, Real Estate and Materials have performed worst with only 64%, 63% and 57% of their Q3 earnings exceeding consensus estimates.

We have also received Q3 2024 results from 80 Swedish OMX companies as of Thursday 31 October 2024. Of these, only 46% beat consensus estimates, while 51% missed expectations. For sales, 38% beat and 62% missed expectations. For orders, with twelve observations, 50% have beaten and 50% have missed consensus estimates.

Today, Wednesday, 6th November, we’ll receive the October Services Purchasing Managers' Index (PMI) from Japan, Spain, Italy, France, Germany, and the Eurozone. We also get German industrial orders and eurozone Producer Price Index (PPI), both for September. Finally, we get weekly oil inventories from the Department of Energy’s (DOE) statistics as well as the minutes of the Bank of Japan's meeting on the 20th of September. In addition, Toyota, Qualcomm, CVS Health, McKesson, GEA, Gilead, Klöckner, Skanska, Securitas, Sampo, Lundin Gold, Lundin Mining, XXL, GN Store Nord and Novo Nordisk will publish their interim results.

On Thursday 7th November we start with China's October Trade Balance. Later in the morning, Germany's trade balance and industrial production, as well as eurozone retail sales, all three for September, will be released. The US will contribute with Q3 productivity, initial jobless claims and September wholesale inventories. Several central banks will be releasing interest rate announcements, such as the Fed, the Bank of England and the Riksbank in Sweden. We also await interim reports from CRH, Daimler Truck, Next (operational update), Münchener Rückversicherung, Duke Energy, Airbnb, Nippon, Hufvudstaden, Millicom, DNO, Veidekke, Alm Brand, Kojamo and Zealand Pharma.

Friday 8th November starts with Japanese household consumption for September. In the morning in Europe, Statistics Sweden will publish household consumption and industrial orders for September. From North America, we get Canada's employment for October and the Michigan index for November from the United States. Friday will also see interim reports from Baxter, CNH Industrial, Sony and Bure.

Risks have shifted to the downside ahead of the US election results

The short term bullish trend on the S&P 500 has been broken and the index is trading below its MA20. This is under positive but waning momentum as indicated by the MACD. The first level of support is at MA100, followed by MA100, currently at 5,600.

S&P 500 (in USD), one-year daily chart

S&P 500 (in USD), weekly five-year chart

The Nasdaq 100 is currently trading just above support with falling but positive momentum. On the downside, the first level of support is the MA50, currently at 19,810, followed by the MA100, currently at 19,655. This is followed by the MA200. In terms of the election, a Trump victory could lead to higher yields, which would weigh on the Nasdaq 100 more than, say, the broader S&P 500.

Nasdaq-100 (in USD), one-year daily chart

Nasdaq-100 (in USD), weekly five-year chart

The short term trend for the German DAX has turned negative since the breach of MA20. The first level of support is currently the MA50. This is followed by levels around 18,940 and MA100, currently at 18,650.

DAX (in EUR), one-year daily chart

DAX (in EUR), weekly five-year chart

The risk for the OMXS30 is skewed to the downside. This is because the momentum is falling and the MACD has given a sell signal. Note also the negative divergence between the index and the MACD. A break below the MA200, currently at 2,533, and 2,490 could be next.

OMXS30 (in SEK), one-year daily chart

OMXS30 (in SEK), weekly five-year chart

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risks

Credit risk of the issuer:

Investors in the products are exposed to the risk that the Issuer or the Guarantor may not be able to meet its obligations under the products. A total loss of the invested capital is possible. The products are not subject to any deposit protection.

Currency risk:

If the product currency differs from the currency of the underlying asset, the value of a product will also depend on the exchange rate between the respective currencies. As a result, the value of a product can fluctuate significantly.

External author:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.

Market risk:

The value of the products can fall significantly below the purchase price due to changes in market factors, especially if the value of the underlying asset falls. The products are not capital-protected

Product costs:

Product and possible financing costs reduce the value of the products.

Risk with leverage products:

Due to the leverage effect, there is an increased risk of loss (risk of total loss) with leverage products, e.g. Bull & Bear Certificates, Warrants and Mini Futures.

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.

© Bank Vontobel Europe AG and/or its affiliates. All rights reserved.