Uranium - Have the Fundamentals Shifted?

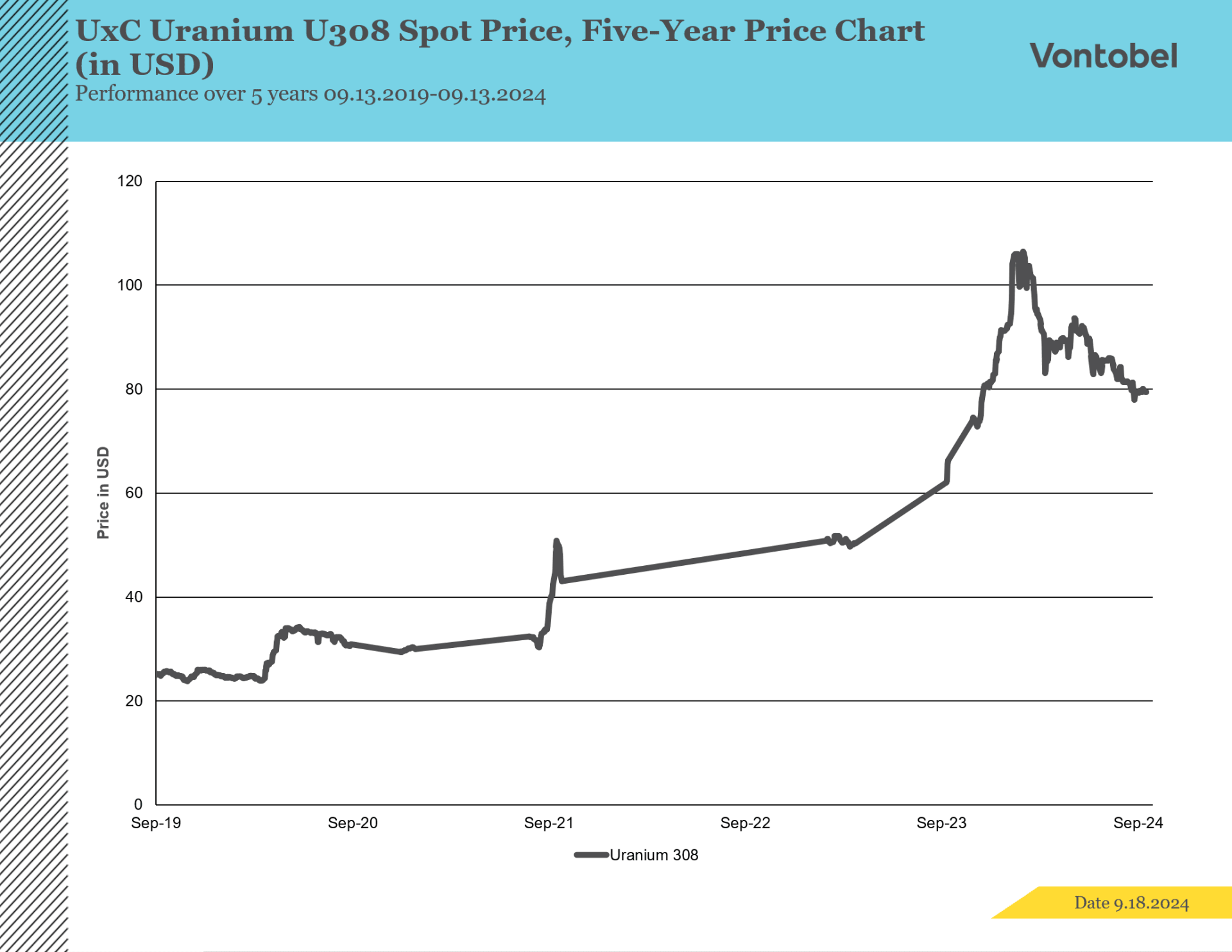

It’s been some time since our last update on the uranium market. Since our last report, the market has seen a significant surge, with spot prices reaching a 17-year high at the beginning of the year before stabilizing at current levels. This raises an important question: have the fundamentals shifted, or is there still potential for further growth in the uranium sector?

How did we get here?

Most people know that the uranium market has been a controversial topic, largely stemming from the catastrophic incident in Fukushima, Japan in 2011 and the concerns regarding the disposal of nuclear waste. Thus, the market has been cooled for a long time with a focus on greener alternatives to supply the world’s demand for energy. In that spirit, many countries decided to close their nuclear reactors to double down on what felt, at the time, to be the way forward. However, without blaming or debating past-time policymakers’ decisions, one can, with recent years rising energy prices and geopolitical tensions, conclude that neither wind, solar, nor natural gas is a complete solution that can meet today’s energy demand. Consequently, countries like Italy, who has long been opposed to nuclear power, have had to change their stance in response to growing concerns about their reliance on imported natural gas and rising energy prices. Although uranium was once considered a niche market for good reasons, it has since evolved into something entirely different.

We have seen a significant increase in the uranium spot price, from 24,63 USD/lbs in January 2020 to 78,5 USD/lbs as of August 2024, while reaching above 100 USD/lbs at the height of the market. These movements can partially be explained by announcements made by the U.S., along with other nations, to triple the production of uranium by the year 2050, thus setting a spike in demand. Moreover, nations like Italy, who have a long history of being anti-nuclear, has decided to restart their nuclear powerplants to respond to future demand.

Who are the major players?

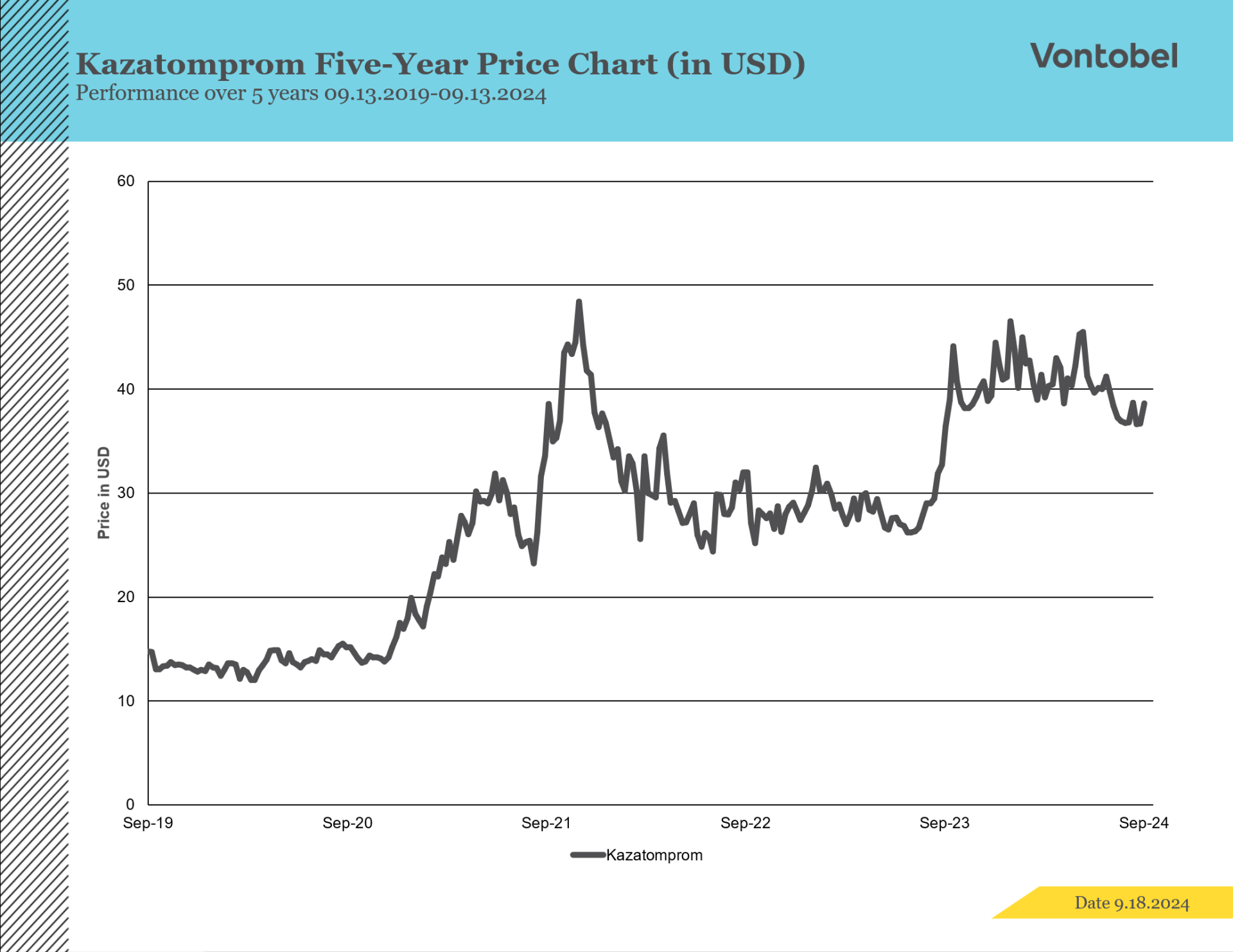

Although rising demand is important, it alone doesn't fully explain the increase in spot prices. To get a clearer picture, we also need to consider how supply factors into the equation. Around two thirds of the world’s production of uranium comes from mines in Kazakhstan, Canada, and Australia, with Kazakhstan being by far the biggest supplier. In the annual report of Kazakhstan’s largest uranium producer, Kazatomprom, it is mentioned that about one-third of the world’s nuclear reactors run on their uranium. However, recently Kazatomprom has been under a supply chain risk, setting off a spike in the spot price as demand remains high. This incentivizes other players to either enter or increase their share in the market, as it becomes more profitable to restart the old mines. Kazatomprom is a key component of the Vontobel Nuclear Energy Index, which provides diversified exposure to the nuclear sector.

General Energy Demand

Apart from a few exceptions, the world’s energy consumption has steadily increased year after year for decades and will probably continue to do so. The introduction of new technologies like Artificial Intelligence (AI) has already become a necessity for both individuals and companies and is coupled with significant energy usage. Hence, AI’s energy consumption is projected to rise by around 26% to 36% year over year. Zooming out to the general energy demand, it is forecast to rise in 2024 by around 4%, which is an increase from 2,5% in 2023, which underlines the importance of finding a dependable solution that can meet the rising demand.

But why is the price not moving higher?

The uranium prices have increased in the last years; however, year-to-date it is down around 13,20%. In general, the uranium market is positively reactive to the economic conditions of the market, meaning that during economic uncertainty and geopolitical tensions, some commodities tend to struggle, like we have seen in oil prices lately. In 2008’s financial crash the spot price of uranium came tumbling down with the general market. Current market conditions with emphasis on economic, political, and geopolitical tensions like the Russian invasion of Ukraine and fear of a recession all contribute to the uncertainty of future spot prices.

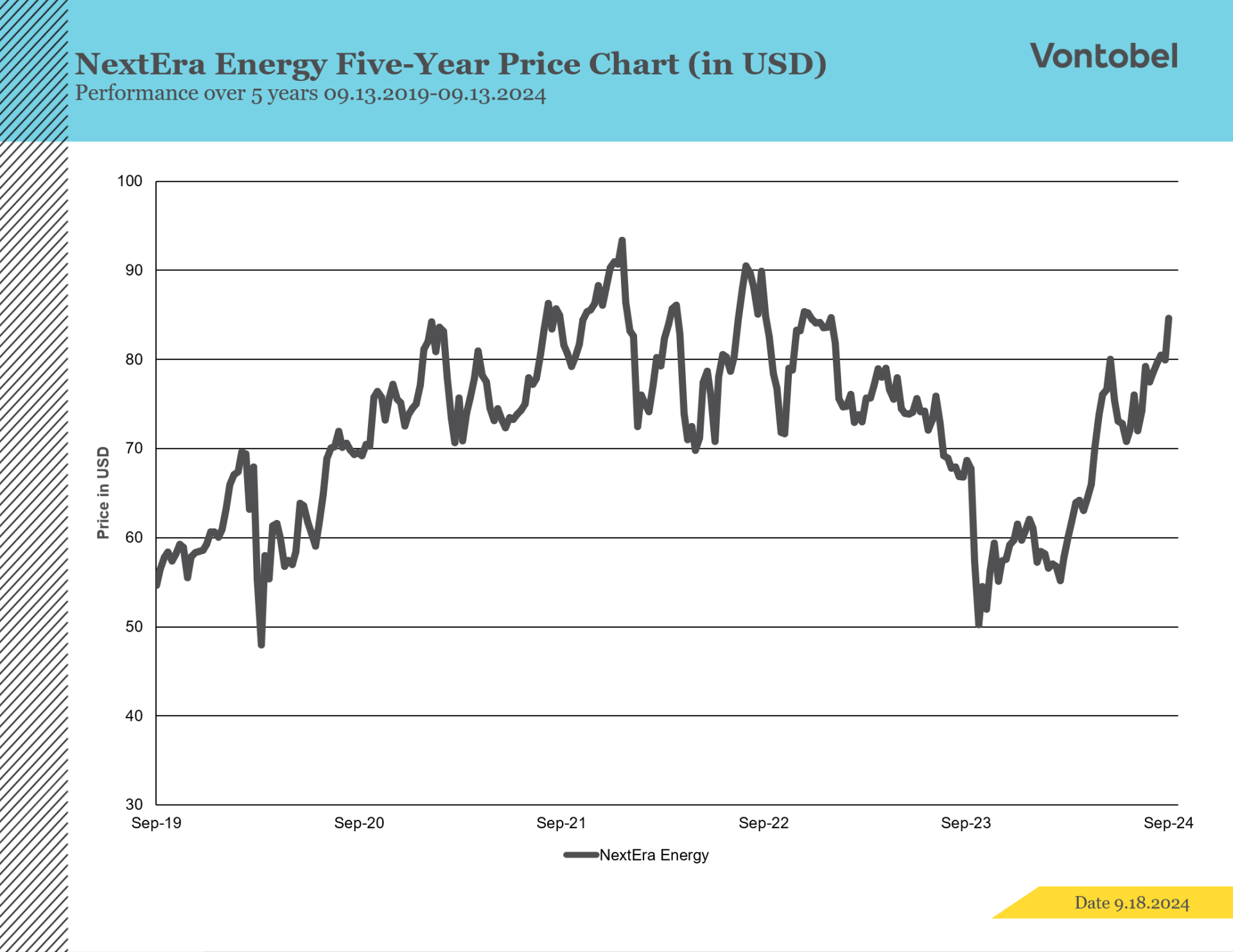

NextEra Energy

NextEra Energy operates in the energy market, providing a variety of energy solutions across the U.S. The company runs two power plants that supply electricity to various cities. While NextEra Energy does not directly benefit from increases in uranium spot prices, it stands to gain from a broader rise in energy demand. Although uranium is not a major focus of NextEra’s operations, its diversified portfolio offers investors exposure to multiple energy sectors, balancing the impacts of different market trends.

Ultimately, uranium is an interesting investment idea that while currently is experiencing unfavorable market conditions, could benefit both the long-and short-term investor.

Risks

Credit risk of the issuer:

Investors in the products are exposed to the risk that the Issuer or the Guarantor may not be able to meet its obligations under the products. A total loss of the invested capital is possible. The products are not subject to any deposit protection.

Currency risk:

If the product currency differs from the currency of the underlying asset, the value of a product will also depend on the exchange rate between the respective currencies. As a result, the value of a product can fluctuate significantly.

Market risk:

The value of the products can fall significantly below the purchase price due to changes in market factors, especially if the value of the underlying asset falls. The products are not capital-protected

Product costs:

Product and possible financing costs reduce the value of the products.

Risk with leverage products:

Due to the leverage effect, there is an increased risk of loss (risk of total loss) with leverage products, e.g. Bull & Bear Certificates, Warrants and Mini Futures.