Coinbase or Bitcoin - choosing a crypto investment

Coinbase's shareholders have not had any reason to cheer since the company's listing in April, as a third of the share price has disappeared into the winds in a couple of months. Reading the forums, many investors seem to wonder which one to buy: Coinbase or bitcoin.

Coinbase's shareholders have not had any reason to cheer since the company's listing in April, as a third of the share price has disappeared into the winds in a couple of months.

Source: Investing.com

Note: Historical returns are not a reliable indicator of future returns.

Reading the forums, many investors seem to wonder which one to buy: Coinbase or bitcoin. The differences between the two investments are examined in more detail below.

Coinbase

Coinbase’s listing a couple of months ago was one of the most anticipated listings in recent years. Coincidentally, Coinbase’s listing hit the hottest moment in the cryptocurrency market. Since then, the prices of cryptos led by bitcoin have plummeted to less than half of their peaks and Coinbase’s stock has fallen with them.

Part of the pressure on Coinbase's share price has also been brought about by strong insider sales. Coinbase did not arrange a share issue at the time of the listing, but Coinbase’s shareholders may sell their old shares to new investors when Coinbase is listed on the Nasdaq.

Coinbase’s EBITDA margin has been a whopping 60.2 percent, but the company can’t count on its continuation forever. The margin is almost entirely made up of trading fees that the company collects from investors trading in cryptocurrencies.

As competition intensifies in the cryptocurrency market, Coinbase is expanding its business to cover various aspects of cryptographic investment. It has launched a credit card in partnership with Visa and the Coinbase Prime service, through which it provides institutions and businesses with storage services, better trading tools and data analysis. Coinbase also develops cyber security solutions tailored for cryptocurrencies and blockchains.

In May, Coinbase released its Q1 results. The company generated $1.8 billion in revenue. Compared to a turnover of 191 million a year ago, the growth has been explosive. In Q4 last year, sales were $585 million.

Coinbase posted a profit of $771 million in Q1, 24 times more than a year ago. EPS, or earnings per share, was $3.05.

In Q1, 94 percent of the company's profit consisted of trading fees.

Coinbase did not provide guidance for Q2 but reminded investors that the company’s industry is inherently unpredictable.

And that’s exactly what the last couple of months in the cryptocurrency market have been.

Bitcoin

Bitcoin has always been the largest of the cryptocurrencies in terms of market value. Ethereum has gained ground to bitcoin this year, but like other cryptos, it has collapsed as well.

The price of bitcoin has fallen by about half since its spring peaks. In my previous article, I explored how collapses have so far been part of bitcoin’s four-year cycle.

As of this writing, bitcoin traders and holders are horrified as its price knocks on the bear market door at about $ 30,000. With China banning bitcoin mining, the market has reacted negatively to the news, although mining will move to other countries over time.

Source: Investing.com

Note: Historical returns are not a reliable indicator of future returns.

In the midst of the panic, long-line Bitcoin investors on Twitter have reminded newer Bitcoin traders and holders of the bitcoin’s longer-term view.

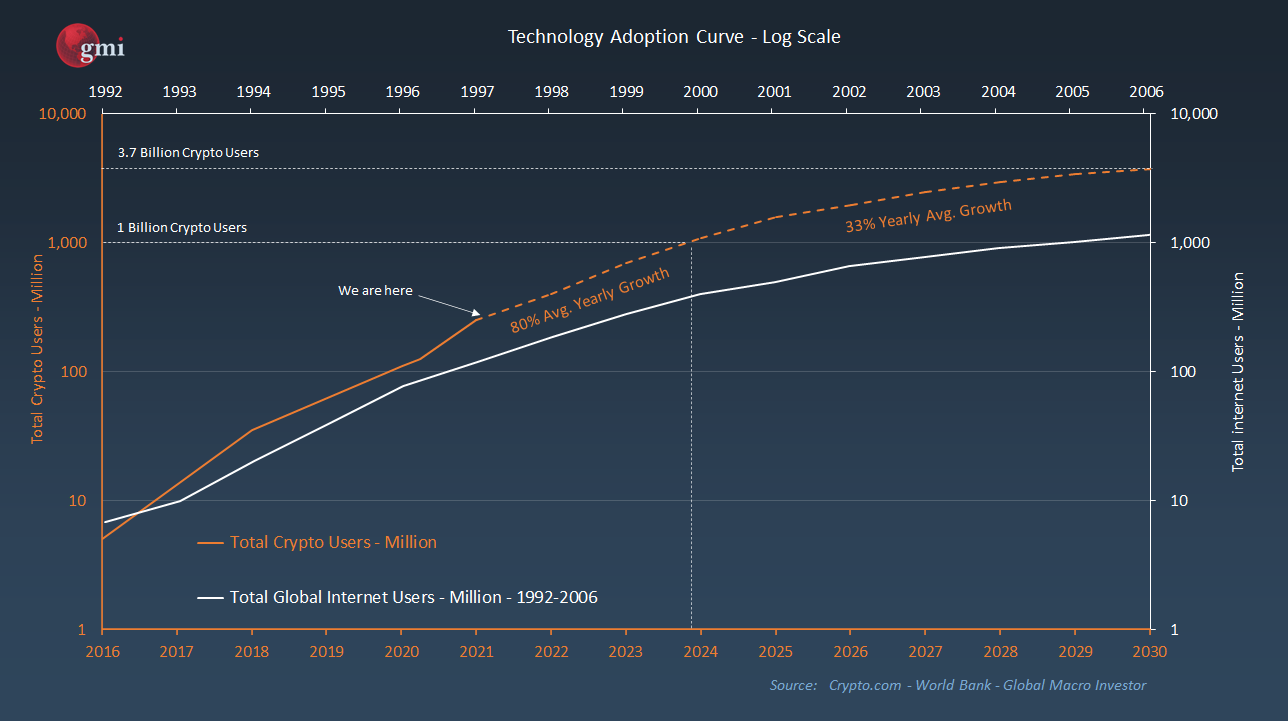

One of Bitcoin’s veterans is Raoul Pal, who recalled on Twitter with his graph (below) that bitcoin adoption is still stronger than the adoption of Internet users about 25 years ago. The model predicts bitcoin to reach the one billion user limit in 2024.

From a technical point of view, Bitcoin can be analyzed in many ways. Technical analysts study the outputs of the graphs, on-chain analysts analyze Bitcoin network events from the grassroots level.

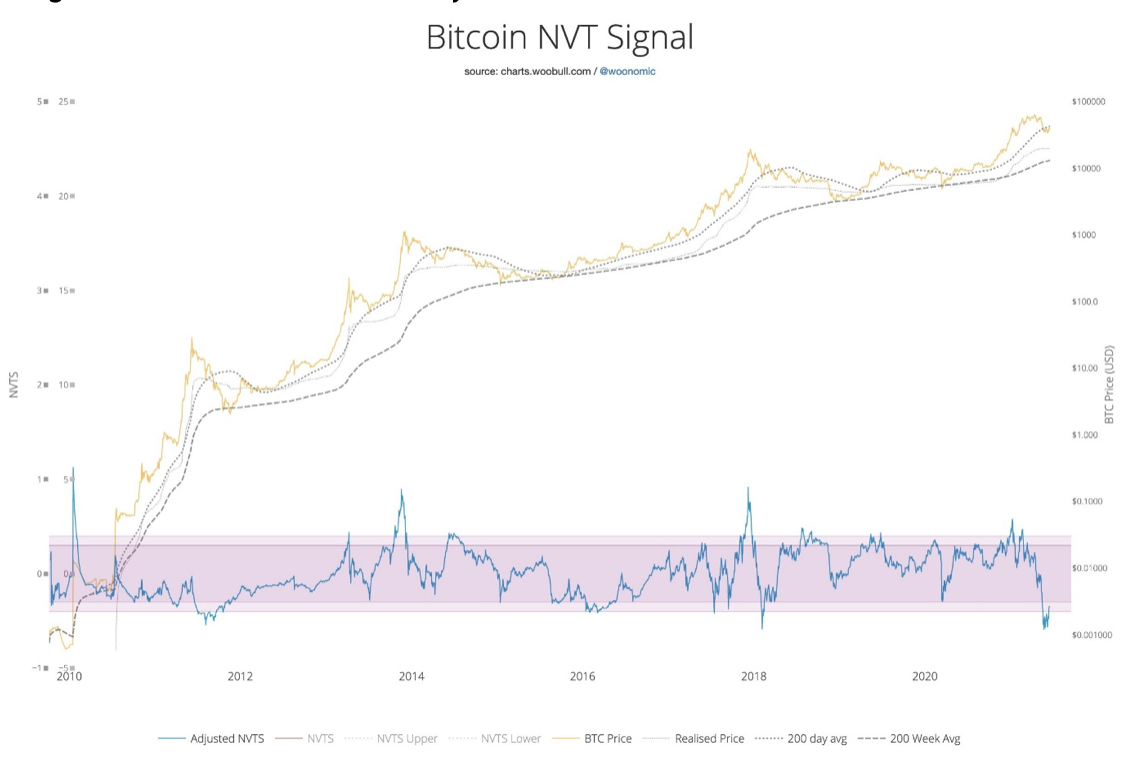

According to the NVT signal from respected on-chain analyst Willy Woon, bitcoin is currently oversold. The NVT (Network Value to Transaction) ratio is often compared to the P / E ratio of stocks.

From the Glassnode graph, it can be seen how long investors who have held bitcoins have taken advantage of the spring collapse and bought more bitcoin into their portfolios.

Coinbase’s co-founder Fred Ehrsam warned of bitcoin’s “Death Cross,” meaning the 50-day moving average would fall below the 200-day. The indicator, known by its wild name, has been considered a bad omen for any asset from the point of view of technical analysis.

On the other hand, it is a delayed indicator. The last time bitcoin experienced Death Cross in March 2020, it marked the beginning of a strong bull market.

Death Cross, which received a lot of media attention, fell into the teeth of Coinshare’s analysis. Studies show that the indicator is not a valid bear market predictor for periods of one month, three months, half a year or a year.

Nor should it be forgotten about the historic event of El Salvador being the first state to adopt bitcoin as a means of payment in its country. Other Latin American countries have expressed interest in following in El Salvador's footsteps with regard to bitcoin.

If you believe bitcoin will continue to collapse, you can aim for a return with Vontobel’s MFS BTC1 V93 Minifuture. It offers a 1.5-fold leverage, so as Bitcoin futures decline by one percent, the value of the Mini rises by 1.5 percent. Similarly, the product reinforces the rise in Bitcoin futures, causing a leveraged loss to the Mini. The product matures if the price of the Bitcoin futures reaches the $ 42,926 Stop-Loss level. It is then calculated a settlement price in accordance with the minimum funding level of 50,325.

Vontobel's MFL BTC1 V62-Minifutuuri offers the opportunity to seek a return on the price increase of the Bitcoin futures. Thanks to its 2.77-fold dynamic leverage, as the price of the Bitcoin futures rises by one percent, the value of the Mini rises by 2.77 percent. Similarly, Bitcoin futures losses are leveraged into a loss in the Mini investment. The Mini will mature prematurely if the price of the Bitcoin futures falls to the Mini’s Stop-Loss level of $ 27,094.

Coinbase or Bitcoin?

High Yield Investor listed (HYI) five reasons to invest in Coinbase instead of a direct Bitcoin investment. As an introduction, HYI says it will invest in assets with the best risk-return profile instead of just staring at the potential for a rocket-like rise.

- Coinbase is a growing business. Coinbase generates cash flow, which leads to an increase in its intrinsic value over time. Bitcoin, on the other hand, does not generate cash flow or dividends. Bitcoin's revenue is based on a potential increase in its price. HYI therefore sees the purchase of bitcoin as speculation, and not as an investment like a Coinbase share. HYI compares bitcoin to gold; if HYI wants to take a look at gold, the company will do so through gold mining companies rather than by direct investment in gold.

- Coinbase is diversified into over one hundred cryptocurrencies. Bitcoin is one of hundreds of cryptocurrencies and is facing ever-intensifying competition from other cryptos. Coinbase is spread across hundreds of different crypts, to some extent reducing its risk to any particular cryptocurrency.

- Coinbase may benefit even when crypts collapse. Most of Coinbase's income consists of trading fees. The more you trade, the more Coinbase earns. And when markets collapse, volumes are often at their highest. Coinbase offers trading in hundreds of cryptos, so it is not entirely dependent on the volume of one particular cryptocurrency but may benefit from the development of the entire cryptocurrency market.

- Coinbase invests in other businesses. Coinbase aggressively invests its returns in areas that support the company’s long-term strategy. Most of its revenue comes from the exchange business and, under competitive pressure, margins are expected to decline. Within five years, the company expects more than half of its revenue to come from outside trading fees. Coinbase sees itself as a cryptographic infrastructure business that offers many different services and tools to help its customers optimize cryptographic trading and storage. If that will be successful mid- to long-term remains to be seen.

- Coinbase is easier to appreciate than cryptocurrencies. Coinbase’s ability to generate cash flow gives it a core value. The real value of Bitcoin is in the hands of the market, but Coinbase brings productivity and innovation to the table.

Nevertheless, you have to be aware of the risks of investing in stock, with significant dependency on numerous factors, such as customer satisfaction, service quality (for example, ability to manage periods of extreme trading activity), strategic management decisions, governance, etc, which are not applicable to bitcoin investments.

If you want to benefit from an increase in Coinbase's share price, you can aim for a return with Vontobel's BULL COIN X4 V3 certificate. As a BULL certificate, its value will increase by 4% as the Coinbase share rises by 1% during the day. The value of the certificate will decrease by 4% as the price of Coinbase's share decreases by 1%.

Motley Fool wrote about selling Coinbase’s stock for two reasons when cryptos collapsed:

- As cryptocurrency prices come down sharply, their prices fall. Coinbase collects a relative fee and low crypto asset prices from transactions, and the number of commissions collected by Coinbase also decreases. At the same time, Motley Fool states that 81 percent of Coinbase’s historical income came from trading fees, which puts Coinbase at risk of falling interest in speculation in crypto assets.

- Coinbase is facing significant competition. The company is one of the first major cryptocurrencies and enjoys the network effects it brings. Competitors are developing their services and products at a rapid pace and are putting pressure on Coinbase margins and the service package.

If you want to short Coinbase, Vontobel’s BEAR COIN X3 V3 certificate provides a tool for that purpose. Its value will increase by 3% as Coinbase's share price falls by one percent during the day. The certificate yields a three percent loss as Coinbase’s share price rises by one percent.

According to a Marketwatch article , the correlation of Coinbase price to bitcoin is relatively small, 0.32. The correlation between Nasdaq and bitcoin, in turn, is 0.20.

By trading Coinbase, your perspective is the entire cryptocurrency market and your idea is Coinbase’s ability to make a profit from its business. By trading Bitcoin, in turn, you take a look at the price fluctuations of the largest cryptocurrency.

Do you trade Coinbase, bitcoin or both? Share your opinion on the cryptocurrency market in Sijoitustieto forums.

Risks

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the securities, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. Past performance is not a reliable indicator of future performance.