Ethereum continues to rise?

With the current Non-Fungible Token (NFT) boom, Ethereum has made the headlines. Ethereum as a platform currently offers the most versatile option to build the internet of the future, where value can be exchanged better than before.

In my earlier article, I went through the basics of Ethereum, but let's take a brief summary to refresh our memories.

Ethereum, like Bitcoin, is a cryptocurrency. However, the term is confusing, as Bitcoin and Ethereum, despite their communities pickering with each other, are not direct competitors. Where Bitcoin is “hard money” that is created only in a limited amount, Ethereum is the platform on which Web 3.0, or the internet of the future, can be built.

Ethereum's direct competitors are other smart contracts platforms such as Solana, Cardano, Polkadot and Binance Smart Chain.

Bitcoin is rigid and its protocol hardly changes. Ethereum is constantly changing as developers make the operation of the protocol even better, smoother and cheaper. Ether, ETH, is the cryptocurrency used by the Ethereum network to execute transactions.

Ethereum is a block chain, i.e. a database designed to be unhackable. In the blockchain, the information is stored in a chronological chain consisting of blocks of data. Each transaction performed with an ETH coin must be verified and saved as a block in a unique block in the blockchain. Due to this process, the blockchain is often compared to a ledger.

The Ethereum blockchain stores more data than just the transactions with ETH coins. The blockchain smart contracts allow developers to build dApps, i.e. decentralized applications such as games or business applications. NFT can also be minted into the Ethereum network and DeFi applications can be built.

As of this writing, Ethereum has a market capitalization of $413 billion. It is the second largest cryptocurrency in terms of market value after Bitcoin. A year ago, it was priced at about $ 330 and is currently trading at about $ 3,300 despite the sharp (and unexpected) drop it has seen last week. The increase during the year has still been a staggering 1,000 percent.

Source: CoinMarketCap.com

Note: Historical returns are not a reliable indicator of future returns.

Metcalfe's law as a driver of Ethereum's price increase

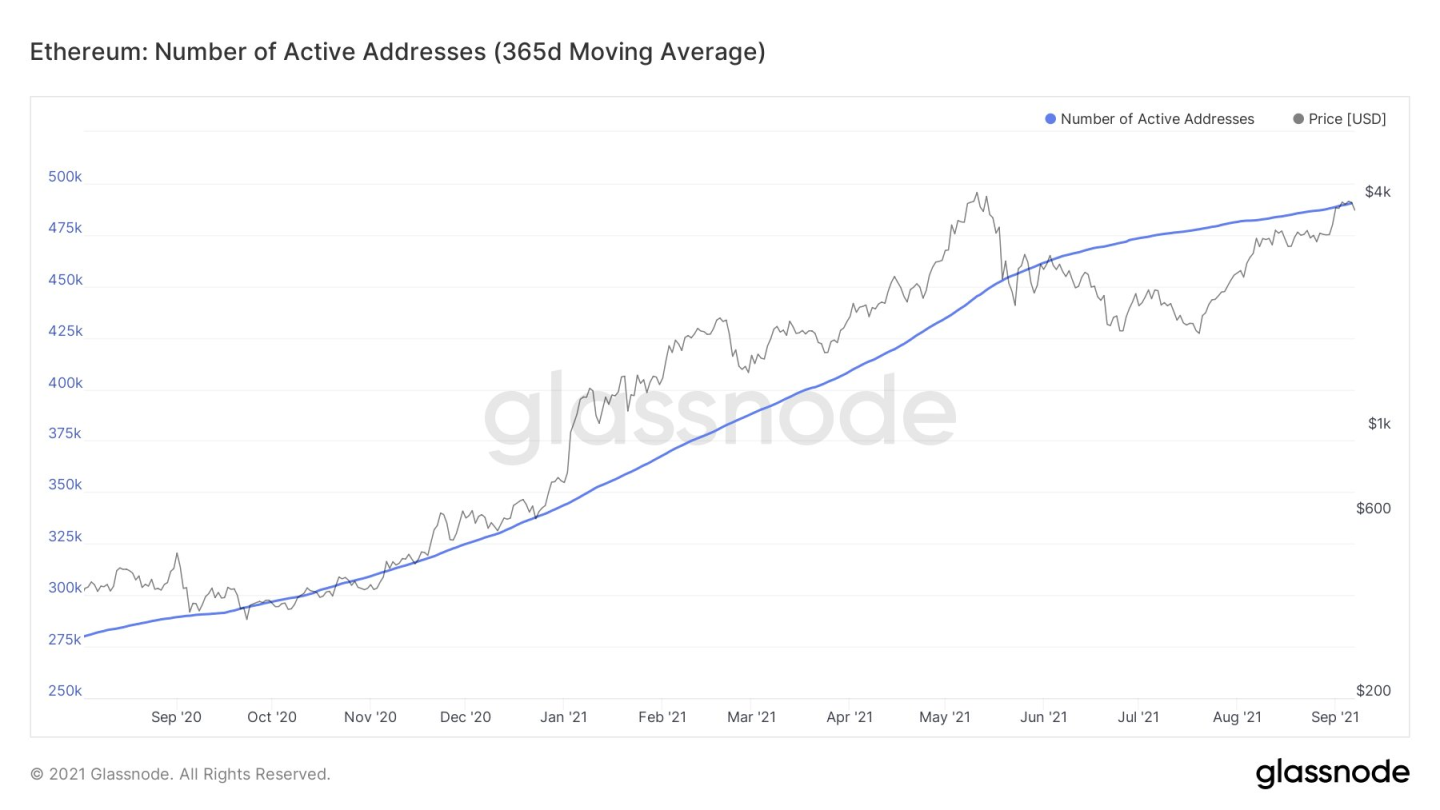

According to Metcalfe's law, the value of a network is proportional to the square of the number of network users. Simply put: the more users a network has, and the more network users interact with each other, the more valuable the network is. A great example of network effects is Facebook.

Macro investor Raoul Pal has studied the significance of the network effects on the price of Ethereum and Bitcoin.

Bitcoin’s growth rate over the past ten years has been wild. At the current growth rate of it will reach one billion users in the year 2025. Its growth has been faster than the spread of the Internet.

The growth of Ethereum's network effects is even faster than Bitcoin, according to Raoul Pal's research. Its market value grows faster than that of Bitcoin when active addresses are compared to the market value.

Source: @raoulGMI Twitter

Note: Historical returns are not a reliable indicator of future returns.

Ethereum's price development has also strongly correlated with Bitcoin's earlier price path. Picture from February, currently Ethereum's price is rising faster than Bitcoin's previous development.

Source: @raoulGMI Twitter

Note: Historical returns are not a reliable indicator of future returns.

Network effects have a significant impact on the price of both Bitcoin and Ethereum, although they are not fully comparable in their uses.

EIP-1559 update, or “London hard fork”

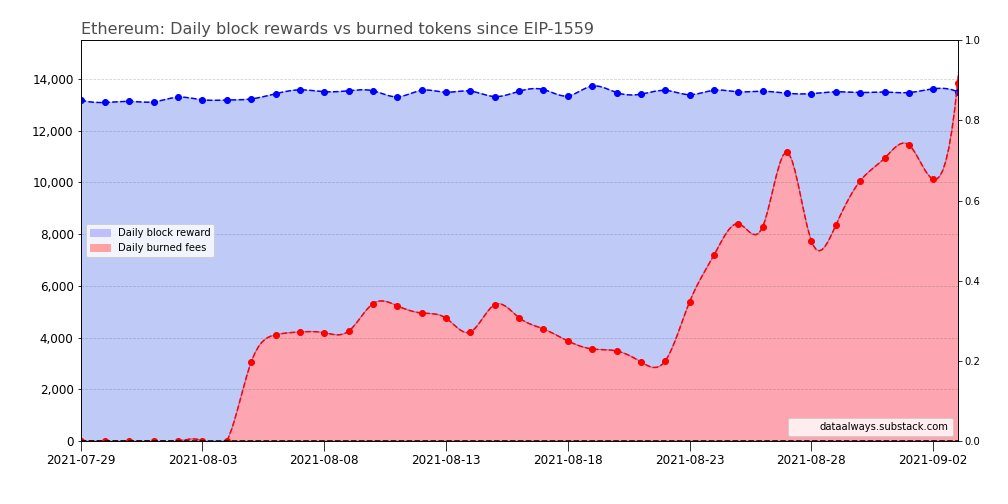

In early August, the Ethereum network was upgraded with the EIB-1559 update, which aims to make Ethereum’s transactions more efficient. The upgrade shifted the cost structure of the Ethereum network to a hybrid model that encourages miners to mine both during active and quiet moments on the network. In the upgrade, the base fee is calculated by an algorithm for each transaction in the Ethereum network. Tips are optional payments that can be used to speed up transactions. The aim of the EIP-1559 update is to make the transaction costs more predictable and to improve the user experience of the Ethereum network.

Source: https://inews.co.uk/inews-lifestyle/money/investing/ethereum-london-hard-fork-when-date-upgrade-meaning-crypto-price-prediction-bitcoin-1134665

The base transaction fee does not go to any party, it is burned. That is, in each transaction, ETH coins are removed from circulation. Miners are allowed to keep the tip to themselves as an incentive to mine ETH. The burning of the base fee makes Ethereum inflation lower and the network has even become deflationary recently: in the NFT boom, the Ethereum network has been very active and more ETH coins have been burned than mined.

Source: @DocumentEther Twitter, dataalways.substack.com

Note: Historical returns are not a reliable indicator of future returns.

When Ethereum is deflationary, ETH coins disappear into the ether and that puts pressure on the price of ETH if demand is assumed to remain constant.

The ratio of mining and burning ETH coins changes according to the operating activity of the Ethereum network.

So far, in addition to coin transfers, DeFi and NFT minting and trading have been responsible for most of the transactions in the network.

The forecasts and hopes of many experts also included cheaper transaction costs with the update, but so far the plans have not materialized.

The Ethereum network generates enough value for its users that the increased costs over time have not discouraged the network users.

Source: Glassnode

Note: Historical returns are not a reliable indicator of future returns.

The number of active users should also continue to grow, strengthening the value of the Ethereum network.

Source: Glassnode

Note: Historical returns are not a reliable indicator of future returns.

The Ethereum 2.0 upgrade, scheduled for later this year, brings along many benefits, including lower transaction costs.

Ethereum 2.0

Ethereum, like Bitcoin, has so far used PoW, or Proof-of-Work, as its consensus mechanism. PoW has been criticized in the media for its use of energy.

In the future, the Ethereum network will move to the PoS consensus mechanism, i.e. Proof-of-Stake. In the PoS mechanism, ETH coins are mined instead of energy use by placing ETH coins as collateral. The more ETH coins a user puts as collateral, the more power the user has to confirm network's transactions and mint new coins. This allows for limited minting of new coins without having to use huge amounts of energy to solve mathematical equations.

According to the latest PoS proposal, a user must have at least 32 ETH coins staked to participate in mining. The previous proposal was 1,500 ETH coins, so the new proposal lowers network users to participate in staking.

There are currently nearly 7.5 million ETH coins staked, with a total value of almost $30 billion. It represents 6.37% of the total number of ETH coins in circulation.

Source: https://news.bitcoin.com/eth-2-0-contract-exceeds-7-4-million-ether-close-to-30-billion-locked-liquid-staking-pools-grow/

Since December last year, the Ethereum community has been testing the PoS consensus model in the Beacon chain. The transition to the PoS mechanism has been the community¨s intention from the outset, but has been delayed due to errorenous versions. The Beacon chain fixes the earlier problems. The ecosystem transition as a whole to the Beacon chain is called Ethereum 2.0, or Eth2.

Ethereum improves its network update by update. Eth2 brings with it:

- Scalability: The Ethereum network must be able to support thousands of transactions per second so that applications built on the network can run faster and at a lower cost.

- Security: Ethereum must be as secure as possible against hacker attacks. Security ensures peace of mind for users and institutions to participate in the network. The Beacon chain is designed to help secure the network.

- Sustainability: A smaller carbon footprint has become a big theme in the crypto world. Eth2’s PoS consensus mechanism will be a significantly more environmentally friendly solution than PoW.

Potential investors should remember that cryptocurrencies such as Ethereum and Bitcoin can be expected to remain extreme volatile so the risk of losses is very high especially when trading leveraged products such as mini-futures (long and short).

Risks

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the securities, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. Past performance is not a reliable indicator of future performance.