Investors' Outlook: Continental breakfast

The political constellation on the Old Continent was put to the test in June following the European elections. From Germany to the Netherlands and Italy to Spain, the election results showed a marked shift to the right. In France, President Macron announced early elections after the far-right Rassemblement National made significant gains. This led to uncertainty about the country's political course and fueled fears of a “Frexit”. This was followed by a sell-off in French equities, which also weighed on other European markets. From an investor perspective, Paris (and Europe as a whole) could be an interesting idea at the moment. Political developments have put pressure on asset prices within the eurozone.

Hustle and bustle

The month of June may not have offered many changes to the macroeconomic menu, with leading global economic indicators moving sideways. However, many major central banks were anything but idle, forging ahead with interest-rate cuts while the Fed stuck to its cautious wait-and-see strategy. Investors, meanwhile, found themselves being served a dish of uncertainty, as European politics cast a shadow over equity markets.

Among those that reduced rates was the European Central Bank (ECB), a move that had been widely telegraphed in the run-up to its June meeting. The Bank of Canada surprised markets by lowering its overnight rate ahead of the expected July cut, and the Swiss National Bank (SNB) delivered its second reduction while lowering its inflation forecasts.

The Fed seems to be in a bit of a dilemma and is sitting on the fence. It reduced the expected rate cuts for 2024 from 0.75 percent to 0.25 percent—signaling just one cut. However, a second cut is quite possible, as the US economy, and especially its labor market, could be nearing a turning point. Despite remaining strong by historical standards, the first cracks are starting to show. The Bureau of Labor Statistics reported 8.06 million job vacancies in April, the lowest since February 2021, and revised the previous month’s figure down to 8.36 million. Initial jobless claims, a proxy for layoffs, are also on the rise. A survey by the National Federation of Independent Business revealed in April that small US businesses are dialing back their hiring plans.

Over in Europe, the recent political tremors and accompanying market jitters may present a window of opportunity. The cyclical nature of European equities might just get a boost from the current “late-stage mini-cycle”. Additionally, the region’s earnings per share (EPS) dynamics are looking relatively solid, especially when stacked against other regions.

Examining the financial Buffet

At the end of last year, the Vontobel Multi Asset team laid out its economic baseline scenario for 2024. At that time, it anticipated a postponed recession, subdued inflationary pressures, and interest-rate cuts by central banks. These predictions have largely materialized.

The aggressive interest-rate hikes by global central banks have left their mark on many economies, particularly those sensitive to changes to interest rates (see chart 1). Sweden, one of Europe’s wealthiest countries, serves as a prime example. The country has been grappling with falling house prices and sluggish construction activity due to its preference for variable-rate mortgages, leading to a technical recession in the third quarter of 2023. The outlook for 2024 remains challenging: Swedish bankruptcies surged by 72 percent year-on-year in April 2024, and the unemployment rate hovered just below 9 percent in May. Similarly, Europe and the UK slipped into recession towards the end of the year.

Other countries may have dodged meeting the technical definition of a recession, but there is still little cause for celebration. In Canada, for example, insolvencies in the first quarter of 2024 jumped by 32 percent compared to the previous quarter and 87 percent compared to the same quarter of the previous year. According to a survey by leadership development organization The Executive Committee (TEC), 46 percent of Canadian CEOs believe that Canada is either already in a recession or that a recession is coming. Similarly, the Swiss economy, which remains relatively robust compared to its international counterparts, has been feeling the strain due to its export-oriented economy and the weakness of key trading partners, such as the Eurozone.

It is, therefore, unsurprising that these regions in particular have experienced significant declines in inflation in recent months. In Sweden, the consumer price index with a fixed interest rate rose by “only” 2.3 percent year-on-year in May, while in the Eurozone, consumer prices increased 2.6 percent, and in Canada, 2.9 percent. In the UK, inflation fell to the Bank of England’s 2 percent target in May, while in Switzerland, it has remained within the SNB’s target range since last year.

Consequently, several central banks have initiated monetary easing measures. The SNB set the precedent by cutting interest rates for the first time in March, followed by a subsequent reduction in June. Shortly after, the Swedish Riksbank (May), the Bank of Canada and the ECB (June) followed suit.

And what about the US?

However, the situation differs in the world’s largest economy and the most crucial region for global financial markets—the US. The US economy has coped well with high interest rates, contrary to earlier assumptions, and a recession has not (yet) materialized. This resilience can be attributed to many companies and consumers securing favorable financing conditions, shielding them from the adverse effects of higher interest rates thus far.

Another factor bolstering the resilient US economy is its robust labor market, where high demand for labor outstrips the available supply. This environment has enabled consumers to maintain steady spending habits, providing crucial support to the economy.

The absence of a recession in the US has also resulted in another outcome: Inflation has yet to subside. In May, US consumer prices stood at 3.3 percent, well above the Fed’s 2 percent target. This persistent inflation is not only due to housing market shortages, which are driving up service inflation, but also unexpected factors such as significant increases in car insurance prices, soaring by a substantial 20.3 percent year-on-year in May (see chart 2).

As a result, the Fed has taken a notably relaxed stance on interest-rate cuts. During its June meeting, it released updated forecasts that initially appeared somewhat restrictive. On the one hand, the Fed raised its projections for core inflation (2024: from 2.6 percent to 2.8 percent, 2025: from 2.2 percent to 2.3 percent). On the other hand, it scaled back its expectations for interest-rate cuts in 2024, reducing the forecast from 0.75 percent to 0.25 percent, which corresponds to only one interest-rate cut.

According to a Bank of America survey, almost none of the investors polled anticipate a “hard landing”, i.e., a recession (5 percent). A “soft” (64 percent) or “no landing” (26 percent) seems much more likely.

What might the second half of 2024 have in store?

The economy is poised to be able to continue its trajectory for a while longer. However, even the largest economy is bound to encounter limitations eventually. While the US labor market remains historically robust, signs of a slowdown have emerged in recent months. According to the Bureau of Labor Statistics, job vacancies dipped to 8.06 million in April, marking the lowest level since February 2021. Moreover, the previous month’s figure was revised downward from 8.36 million. Initial jobless claims, considered a near-real-time indicator of labor market health, have been on the rise. A survey by the National Federation of Independent Business indicates that small US companies are scaling back their hiring plans, a factor that has historically dampened economic growth (see chart 3).

There are signs that consumer strength is waning. According to the US Census Bureau, retail sales edged up by just 0.1 percent in May, following a 0.2 percent decline in April. Data from the New York Federal Reserve paints a similar picture: the proportion of credit card debt overdue by more than 90 days, considered “seriously” overdue, rose to 10.7 percent in the first quarter of 2024, up from 8.2 percent a year ago.

Looking ahead to the second half of the year, there seems to be little reason to be overly concerned about US inflation. Firstly, real (inflation-adjusted) interest rates are restrictive, currently standing 7 percent higher than two years ago. Secondly, despite global tensions such as those in the Red Sea, global supply chains appear largely intact, as indicated by the New York Federal Reserve’s Global Supply Chain Pressure Index. Thirdly, goods inflation has cooled, with some sectors like automotive even experiencing deflation due to high inventory levels. Fourthly, China, the world’s second-largest economy, is exporting lower price pressures globally. Fifthly, US inflation expectations are also well anchored, which should help alleviate the Fed’s inflation concerns somewhat (see chart 4).

Regarding monetary policy, it might make sense not to overinterpret the updated Fed forecasts. Fed Chairman Jerome Powell has emphasized that the Fed’s expected future interest-rate path was “a very close call”. He characterized the upward revisions in inflation forecasts as being on the conservative side. Other Fed officials share a similarly cautious but optimistic outlook. Governor Adriana Kugler said that the economy is “moving in the right direction” and if this continues, it will be time to start easing monetary policy “later in the year”. It appears likely that the Fed will make more than one interest-rate adjustment this year.

Evolving monetary policy expectations as 2024 unfolds

As 2024 began, market expectations leaned heavily towards significant monetary policy easing and numerous rate cuts. The assumption was that inflation would swiftly return to target, paving the way for the Fed to reduce interest rates. However, inflation has proven more stubborn than anticipated, leading to a rapid erosion of those expectations. The Fed confirmed as much in its June meeting with the release of the dot plot.

The most notable change is the adjustment from a median forecast of three rate cuts this year to just one. Looking further ahead, projections now point to an annual easing of 100 basis points in both 2025 and 2026, up from the previous 75 basis points, while maintaining a final target of 3.125 percent for 2026. Traders are now pricing in only one or possibly two rate cuts happening this year (see chart 1).

The statement took a slightly more dovish tone, acknowledging “modest further progress” towards the inflation target, a shift from previous concerns over “a lack of further progress”. It’s also worth noting that the dot plot is fairly balanced: four members foresee no change, seven anticipate one cut, and eight project two cuts. In comparison the March dot plot had two members favoring no changes, two supporting one cut, five advocating for a 50 basis-point reduction, nine for a 75 basis-point cut, and one for a 100 basis-point cut.

The Fed believes monetary policy is currently restrictive, especially when compared to their assessment of the neutral interest rate, which they consider to be significantly lower. With economic variables trending in the right direction over the past two months, it seems increasingly likely that the Fed will seize the opportunity to ease monetary policy.

Three years ago, investors considering buying Treasuries had very little yield cushion. By mid-2021, a rise of just under 20 basis points in the 10-year yield would have caused losses on a total-return basis. Today, potential buyers of the 10-year note enjoy nearly 60 basis points of protection at current yields. Yields would need to exceed 4.8 percent on the 10-year Treasury for a negative total return over one year (see chart 2).

The case for vigilance in credit markets.

Spreads have tightened in recent months, with both investment grade and high-yield nearing lows not seen since the Global Financial Crisis. High-yield option-adjusted spreads suggest robust risk appetite, showing resilience without evident signs of distress. However, amid ongoing economic uncertainty, high-yield bonds face significant potential challenges. Anticipated increases in default rates, coupled with the effects of one of the most aggressive monetary policies, are expected to exert pressure on this market segment.

Weighing two plates

US equities reached a new milestone in June, with the S&P 500 Index hitting its 31st all-time high so far this year, again driven predominantly by technology stocks. In contrast, Eurozone indexes, which had kept pace with tech-heavy US markets through the end of May, were hit by a perfect storm at the beginning of June. Could this turbulence present buying opportunities?

The US market is going from strength to strength this year. Historically, election years are associated with strong market performance, and 2024 has marked the strongest start to any election year on record. Nvidia alone has contributed very significantly to the year-to-date performance of the index, with the US technology sector overall accounting for more than 50 percent. In June, Nvidia also became the 12th company since 1926 to hold the largest index weighting in the S&P 500 Index, surpassing USD 3 trillion in market capitalization for the first time. This dethroned both Microsoft and Apple.

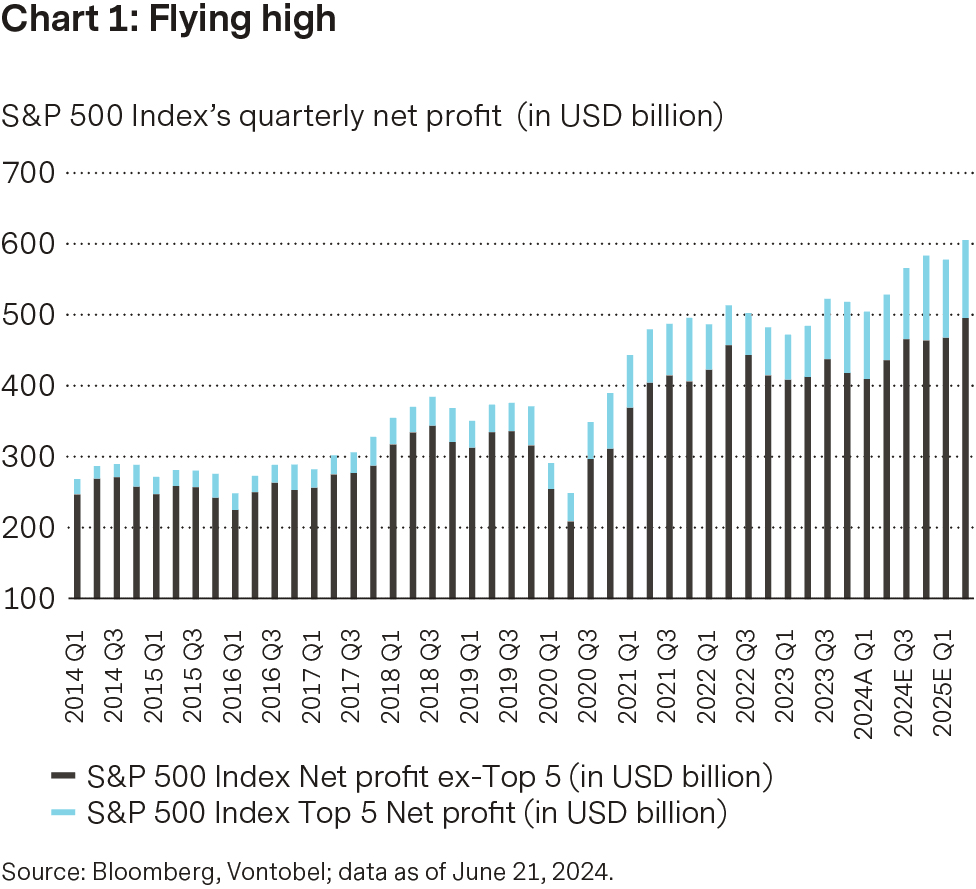

The concentration of market gains among a handful of US stocks, namely Nvidia, Microsoft, Amazon, Meta Platforms, Alphabet and, more recently, Apple, has understandably heightened investor anxiety. However, these stocks have demonstrated exceptional earnings per share (EPS) growth, averaging nearly 40 percent over the last 12 months (see chart 1). This has contributed significantly to the S&P 500 Index’s overall gain this year. Moreover, these companies have continued aggressive share repurchasing programs, now accounting for 30 percent of nearly USD 240 billion repurchased for the entire S&P 500 Index in the first quarter of 2024, one of the largest quarterly amounts on record.

S&P 500 Index – net profit since 2014 and estimates for 2024 and 2025

Regarding Eurozone equities, several issues are at play, ranging from the outcome of French elections, which indicate a strengthening of emerging right-wing sentiments reminiscent of the euro crisis of 2012, to the imposition of tariffs on Chinese electric vehicles that could prompt retaliatory measures. This resulted in market jitters, leading to sizeable capital outflows from the region. This situation could be seen as an opportunity for several reasons.

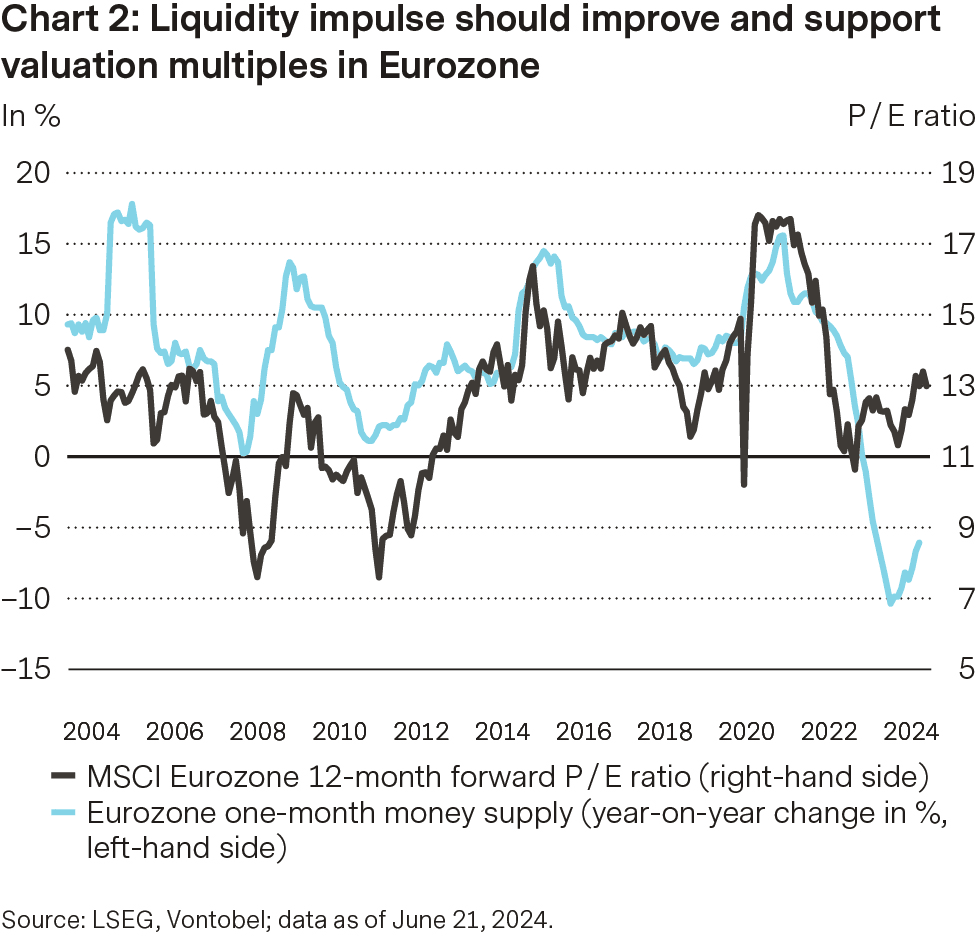

Firstly, political developments reflected in stock markets have historically been short-lived. Secondly, a positive liquidity impulse for the region could come as the ECB continues to ease monetary policy further (see chart 2). This should play in favor of Eurozone equities that are traditionally exposed to cyclical sectors. Thirdly, Eurozone stocks are displaying solid EPS dynamics compared to other regions, coupled with attractive valuations.

Gold — awaiting “King Dollar’s” Abdication

Gold remains one of the best-performing asset classes in 2024. After briefly hitting an all-time high of 2,412 US dollars per ounce in mid-April and approaching that level again in mid-May, prices have taken a breather. Several factors contributed to this pause.

Positive economic news often negatively impacts gold. The combination of resilient economic growth in the US, persistent inflation, and increasingly hawkish rhetoric from the Fed led some investors to anticipate later-than-expected interest-rate cuts. As a non-yielding asset, gold does not generate dividends or coupons like equities or bonds, making it less attractive when interest-rate cuts are delayed.

Is central bank demand slowing down?

Another headwind comes from central banks themselves. Over the past two years, their demand for gold has been strong: in 2022 and 2023, central banks accounted for almost a quarter of annual gold demand. In the first quarter of 2024, they added a further 290 tons (net). However, recent data suggests that central bank demand may be slowing. For example, China, the largest official sector buyer, stopped adding gold to its reserves in May.

Why a small gold overweight may still be a good idea

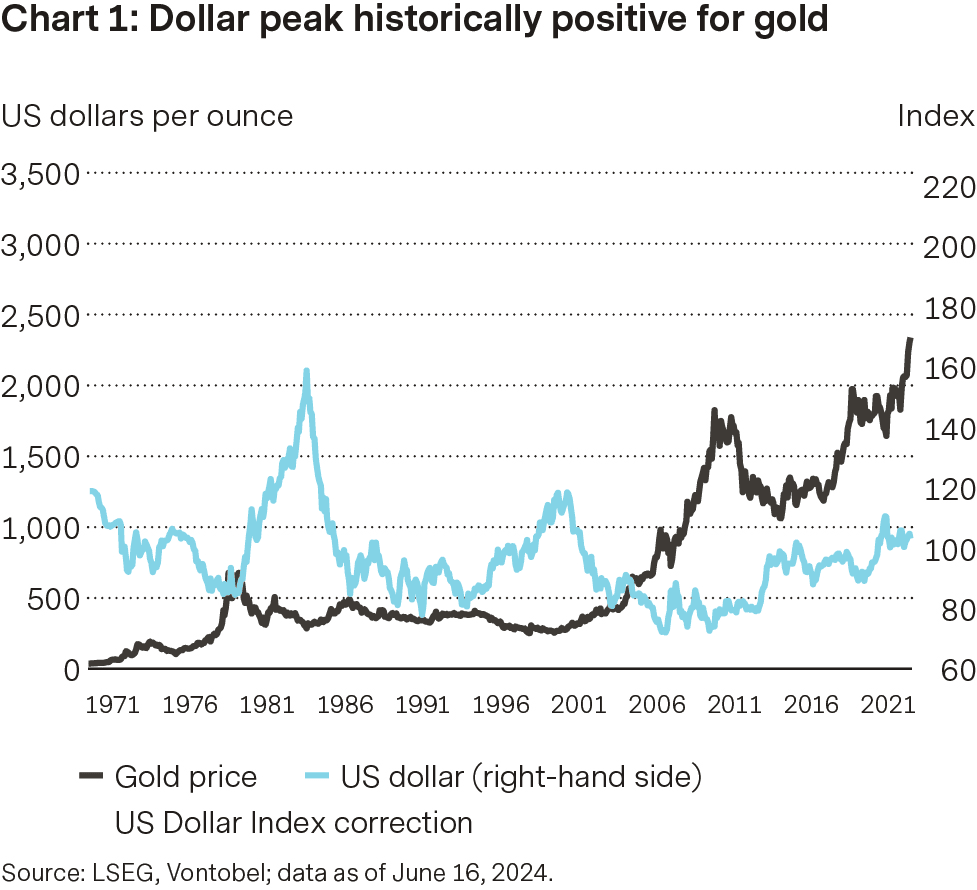

Gold’s future performance hinges on several factors, including, among others, the Fed’s inflation fighting credentials, future Fed policy and everything that comes with it (e.g., a weaker US dollar), future central bank demand, as well as “safe haven” considerations. As for the Fed, hopes for US interest-rate cuts are alive and kicking—markets still expect two cuts by the end of

2024. This should eventually lead to a peak in the US dollar. Historically, a peak in the dollar has been positive for gold (see chart 1).

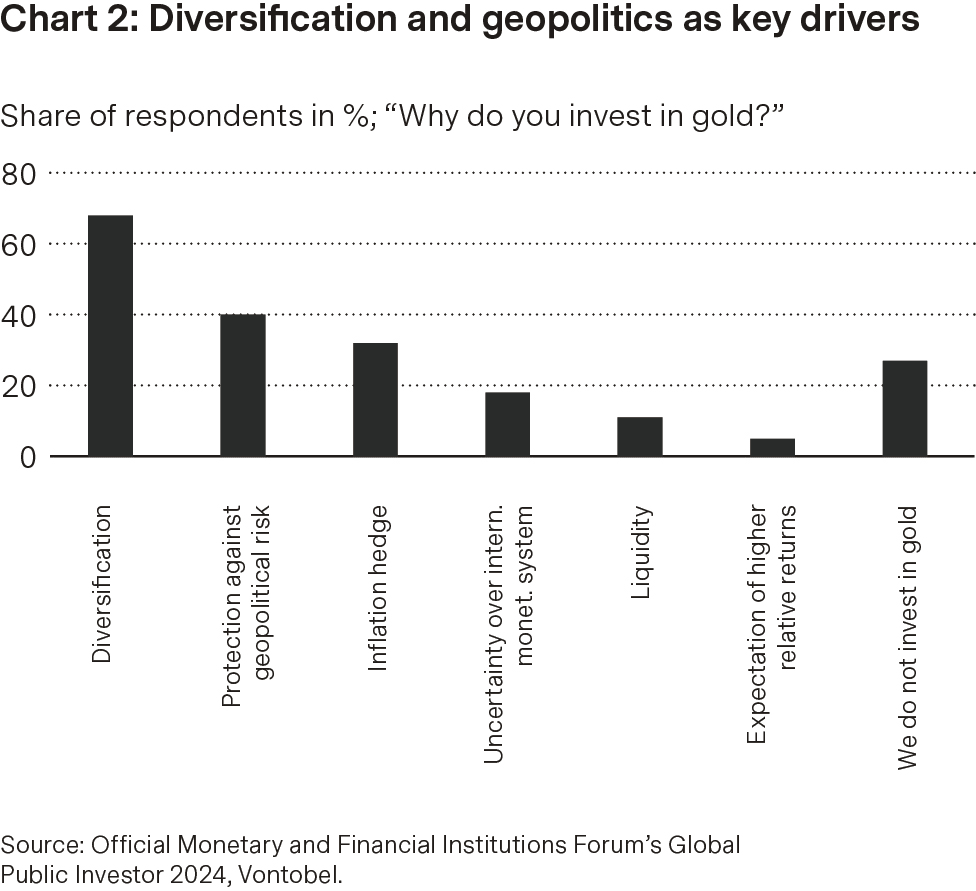

Regarding future central bank demand, the longer-term structural story looks intact. The Official Monetary and Financial Institutions Forum’s (OMFIF) Global Public Investor 2024 survey suggests that diversification and geopolitical considerations are top of mind for many policymakers (see chart 2). Additionally, central bank holdings in emerging markets are still lower than those in developed markets, suggesting potential for increased central bank demand (especially in emerging markets).

Dollar bears’ stomach ache: political turmoil vs. easing inflation

In the coming months, currency markets are poised to be influenced by two critical factors: firstly, encouraging signs of disinflation in the US may embolden the Fed to initiate long-awaited rate cuts; secondly, the potential rise to power of Marine Le Pen’s far-right Rassemblement National party in France could spark a clash with Brussels over the trajectory of France’s debt.

In the short term, dollar bears are likely to encounter persistent challenges amid political uncertainties that complicate the financial landscape. This added complexity comes at a particularly inconvenient moment, as expectations of easing inflation in the US might otherwise have offered some much-needed relief. The current phase of policy-driven dollar-buying is poised to subside when economic data out of the US shifts and the Fed starts cutting interest rates. There seems to be considerable potential for US short-term yields to decline, which would negatively impact the dollar (see chart 1).

Ripple effects of French elections on global markets

Although events in Paris are usually confined to Paris or, at most, Europe, the current situation has raised concerns for global financial markets more significantly than usual. Chatter about the election possibly steering France away from the European Union (EU) can’t be dismissed as mere conjecture, especially in light of the precedent set by Brexit. The euro is confronted with a rapidly deteriorating political situation that would normally prompt investors to abandon the currency. The prospect of France leaving the EU, known as “Frexit”, has unexpectedly become a real worry, unsettling financial markets sensitive to this kind of political uncertainty. In terms of performance, the euro has rebounded from its lows in mid-April but is now relinquishing some of its gains this month (see chart 2).

Political instability in France has intensified scrutiny of its financial health. Although traditionally seen as part of Europe’s economic core, France’s debt and deficit dynamics are now, in many ways, more concerning than those of peripheral nations. Until the results of the final round of voting on July 7, the euro could remain under pressure.

Note: Past performance and estimates are not a reliable indicator of future results.

Authors

Frank Häusler, Chief Investment Strategist

Stefan Eppenberger, Head Multi Asset Strategy

Christopher Koslowski, Senior Fixed Income & FX Strategist

Mario Montagnani, Senior Investment Strategist

Michaela Huber, Cross-Asset Strategist

Risks

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.

© Bank Vontobel Europe AG and/or its affiliates. All rights reserved.