Tech reports important for sentiment

This week's case is cocoa, where the main question is when the rally will end. Several of the Magnificent Seven are due to report their first quarter results this week, including Alphabet, Intel, Meta Platforms and Microsoft. This follows a sharp drop in semiconductor stocks, including Nvidia in the US, at the end of last week. But from a technical point of view, the S&P500 seems to be on its way up again.

Case of the week: Cocoa, when will the music stop?

Cocoa has enjoyed a historic rally, with futures prices up more than 150% YTD. A perfect storm of heavy rains and high temperatures has created favorable conditions for black pod disease and swollen shoot virus. Hedge funds have also piled into the market, pushing futures prices even higher. Although extremely difficult to predict, one possible path forward is discretionary profit taking until a turning point towards the end of the summer.

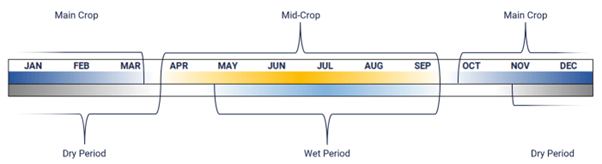

Cocoa is grown mainly in Côte d'Ivoire or the Ivory Coast and neighboring Ghana, which together account for ~60% of global production. Cocoa trees prefer temperatures of 20-30 degrees Celsius and, essentially, as much sunshine as possible. Rainfall is optimal at 1,500-2,500 millimeters, with too much rain affecting yields and encouraging fungal growth. The concentration of production in both countries, as well as their geographical proximity and shared climate, all combine to make the cocoa supply vulnerable to shocks. Both countries have two harvest cycles, with the main crop harvested from October to March and the mid-crop from May to August. Bad weather or, as was the case two years ago, strikes by port workers can have a relatively large impact on supply and, consequently, on prices. On the demand side, cocoa is mainly used for chocolate and chocolate flavorings. Demand is relatively stable as chocolate and chocolate flavorings are used in many different foods and drinks.

Cocoa crop cycle in western Africa

The mid-crop, which began in April, is expected to be lower than last year. With an expected yield of 400-500 thousand tons, it represents a significant decline from the previous mid-crop of ~610,000 tons. This is due to a perfect storm of variables negatively impacting yields. Looking ahead to the 2023/2024 season, the weather has been extreme. Dry spells have been significantly longer and drier than previous dry seasons. Meanwhile, wet periods have seen significantly more rainfall over longer periods. The relatively more extreme weather has affected yields, as cocoa trees prefer a gentle mix within the above parameters. During periods of significant rainfall, black pod disease and swollen shoot virus have devastated cocoa pods and trees. Add El Niño to the mix and the news for cocoa yields is even worse. After all, cocoa trees generally take 3-5 years to become fruitful and are then economically viable for ~25 years. A large proportion of the trees in Côte d'Ivoire are nearing the end of this 25-year period. Putting all this together, the rally in futures prices and the pessimistic outlook seem reasonable.

Cocoa future Jul’24 (USD/MT), one-year daily chart

In the short term, there is no clear trigger to pop the rising balloon that is cocoa futures prices. Hedge funds around the world have been piling into the commodity, a particularly attractive hedge as geopolitical uncertainty and market fears rise. Of course, there will be some who will cash out now and again. If there is enough profit taking in a short period of time, it is theoretically possible that the bubble could burst. However, we think it is more likely that profit-taking will lead to smaller blips. This has been the case so far, with selloffs in early March, mid-March, early April, and mid-April. If this pattern continues, we can expect the overall trend to hold, with selloffs occurring at 2.5-week intervals. Meteorological anomalies, demand shocks or increased production from countries other than the top two could break this pattern, but the likelihood of these events is difficult to assess. Therefore, a trader looking to make money on cocoa could try to time a sell-off and go long, waiting for a clearer trigger to close the position and/or go short. One such trigger is the grindings data to be released in July. Another is the pod count to be released sequentially in August. These statistics are expected to be negative, with little expectation of the opposite. The overwhelmingly negative sentiment opens the door for opportunistic traders to do the opposite of catching the knife.

Cocoa future Jul’24 (USD/MT), one-year daily char

Cocoa future Jul’24 (USD/MT), five-year weekly chart

Macro comments

AI-focused tech stocks, which had been rallying for much of the past 18 months, were hit hard on Friday 19th April. Nvidia and Super Micro Computer fell 10% and 23% respectively. Nvidia's chips have driven much of the generative AI hype, while Super Micro makes the Nvidia-powered servers that often-power data centres. The AI opportunity hasn't necessarily changed, but higher yields and a new risk aversion have left both high-flying stocks vulnerable to profit-taking. Another former darling in which investors seem to have lost faith is Netflix, which fell 9% on Friday 19th April.

Nvidia (in USD), weekly five-year chart

As of Friday 19 April 2024, around 70 S&P 500 companies (14% of all companies) have reported their Q1 2024 results. 74% have reported positive earnings surprises and 58% have reported positive revenue surprises.

Overall, S&P 500 companies are reporting Q1 2024 earnings that are 7.8% ahead of expectations. The Consumer Discretionary sector is reporting Q1 2024 earnings that are 17.6% above expectations. Communication Services is the second-best sector with an earnings surprise of 15.6%, followed by Information Technology with an earnings surprise of 12.8%. The stock market punishes companies that report negative earnings surprises. On average, the share price of these companies has fallen by 6.1% measured from two days before the earnings release to two days after the release of the report.

This week, around a third of all S&P500 companies will release their Q1 2024 reports (or for another quarterly period). Today, Wednesday 24 April, Meta Platforms will release its interim report. On Thursday 25 April, Alphabet, Caterpillar, Intel, and Microsoft are due to report. This is being followed by Exxon Mobil on Friday 26th April.

On Friday the 26th, US Personal Consumption Expenditures (PCE) inflation figures for March will be published. Expectations are for a monthly increase of 0.3% and a year-on-year increase of 2.6%, down from 2.5% last month. The factors that have driven up the Consumer Price Index (CPI), such as housing, are weighing less on the PCE, suggesting a more modest acceleration in the recovery.

Has risk shifted to the upside?

The S&P 500 appears to have bounced nicely off the MA100 and is currently approaching the EMA9 at 5,050. A break to the upside could create an attractive opportunity for long positions. The next level is around 5,125 where the MA50 and MA20 converge.

S&P 500 (in USD), one-year daily chart

S&P 500 (in USD), weekly five-year chart

The Nasdaq 100 is currently trading at resistance formed by the MA100 at 17,385. A break and levels around 17,900 could be next.

Nasdaq 100 (in USD), one-year daily chart

Nasdaq 100 (in USD), weekly five-year chart

The Swedish OMXS30 is consolidating. Resistance to the upside is at 2,550. Support is around 2,500. With support from the US, the risk is currently to the upside.

OMXS30 (in SEK), one-year daily chart

OMXS30 (in SEK), weekly five-year chart

A break above the German DAX's MA20, currently at 18,115, could create an attractive long opportunity with a target around 18,400.

DAX (in EUR), one-year daily chart

DAX (in EUR), weekly five-year chart

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risks

External author:

Credit risk of the issuer:

Investors in the products are exposed to the risk that the Issuer or the Guarantor may not be able to meet its obligations under the products. A total loss of the invested capital is possible. The products are not subject to any deposit protection.

Credit risk of the issuer:

Investors in the products are exposed to the risk that the Issuer or the Guarantor may not be able to meet its obligations under the products. A total loss of the invested capital is possible. The products are not subject to any deposit protection.

Market risk:

The value of the products can fall significantly below the purchase price due to changes in market factors, especially if the value of the underlying asset falls. The products are not capital-protected

Risk with leverage products:

Due to the leverage effect, there is an increased risk of loss (risk of total loss) with leverage products, e.g. Bull & Bear Certificates, Warrants and Mini Futures.

Product costs:

Product and possible financing costs reduce the value of the products.

Currency risk:

If the product currency differs from the currency of the underlying asset, the value of a product will also depend on the exchange rate between the respective currencies. As a result, the value of a product can fluctuate significantly.