Can Fed handle the pressure? – A bet on S&P500

With 55 percent of S&P500 companies reporting their Q1 2022 results, 80 percent have beat analysts' forecasts. The corresponding figure for higher-than-expected revenues is 72 percent. But tech companies as a group did not perform very well last week.

With 55 percent of S&P500 companies reporting their Q1 2022 results, 80 percent have beat analysts' forecasts. The corresponding figure for higher-than-expected revenues is 72 percent. But tech companies as a group did not perform very well last week. But tech companies as a group did not perform very well last week. Especially the Amazon result was a big disappointment compared to a challenging comparative period last year.

Aggregate earnings growth for the S&P500 companies is now 7 percent in Q1 2002 but would have been 10 percent without Amazon's numbers (!) For Q2 2022, Wall Street analysts expect 5.5 percent profit growth for the S&P Corporate constituents.

US share indices fell last week, with the Nasdaq leading the way and the Dow Jones the relatively diminutive decliner. The correlation between a high proportion of technology companies in the Nasdaq and more industries in the Dow Jones is evident.

At the same time, the Shanghai stock exchange recorded a positive trend break last week. Japan and China's central banks are now stimulating the economy, unlike the Fed in the US. However, on Saturday, April 30, weak Chinese Factory Purchasing Index figures were released (down from 49.3 in March to 47.4 in April). Covid shutdowns have had an impact.

Tomorrow, May 4, the Fed will publish its interest rate statement. The Fed is under pressure since consumer confidence in the US has already declined. It could fall even further if there are too many rate hikes. The risk of recession increases as US household costs have already risen on items such as petrol, energy, and household products. Over the past week, the 10-year US Treasury yield rose marginally from 2.90 percent to 2.94 percent.

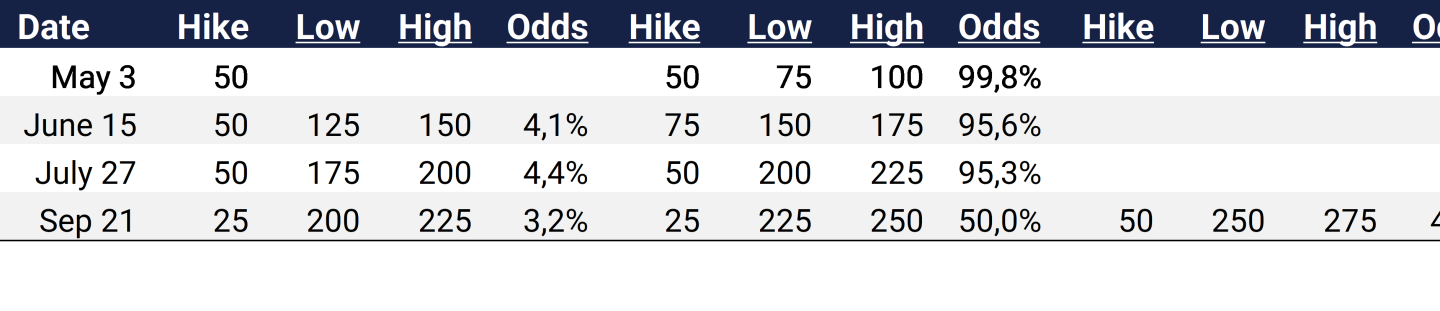

We have compiled investors' expectations of the Fed's rate hike trajectory in the table below and amounts in bps (save where there is %).

What is striking is how steep and rapidly rising the rate hike curve is that investors are anticipating from the Fed. Moreover, the forecasts are well collated and only begin to diverge ahead of the Fed meeting on September 21.

There will be a press conference following the Fed's rate decision, where Fed chief Powell will clarify the central bank's strategy and rate hike path.

In our view, the instrument to play ahead of the Fed's decision tomorrow, Wednesday, May 4, could be the S&P500 index. Should the Fed begin to hesitate about the future path of rate hikes depending on how the US economy develops, this should favor the stock market.

Since May 4 is also Star Wars Day, you might add "May May 4 be with you".

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence of numbers in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risks

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future results.