A bottom in the oil price – or another leg down?

The oil price has pulled back considerably from the highs at the beginning of the summer. Despite a tight supply situation and the ongoing energy crisis in Europe, fears of an economic slowdown in the US, as well as China, is now a prevailing theme in metal and energy markets.

The relation between interest rates (in the chart below: 10 year US yield) and the oil price is surprisingly strong. However, the recent pick-up in rates has only had a limited impact on oil. Possible explanations are a recent build in inventory and some short-term headwinds from increasing real yields and a stronger US dollar.

Interest rates vs. oil price

Source: Stockcharts and Carlsquare. Note: Past performance is not a reliable indicator of future results. Left: CBOE 10 Year Treasury Note Yield Index. Right: WTI Light Crude Oil CME contract in USD.

However, the tight supply means that prices are sensitive to sudden shocks (e.g., lower Russian exports, Hurricane season) which risk could be driving prices higher in the coming months. Also, in Europe, oil might serve (albeit only partly) as a substitute for expensive natural gas. Since the Biden administration is trying to push down oil prices in the US ahead of the mid-term elections in November, through the release of strategic petroleum reserves, we would focus on Brent oil.

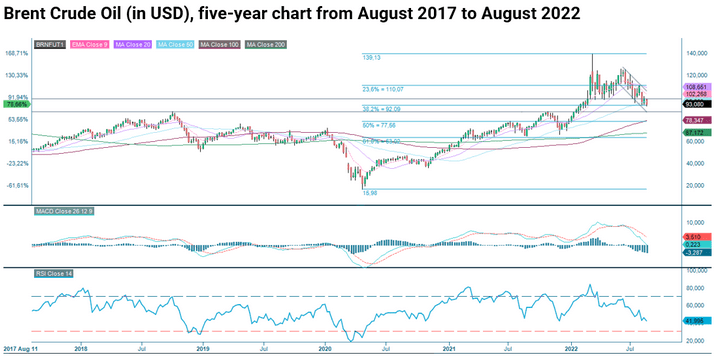

From a technical perspective, the oil price is in a negative trend below MA 200 which likely means continued volatility in the near term. Nevertheless, there might be a bounce from the USD 92-93 per barrel level if these recent bottoms should hold. The five-year chart also suggests Brent could find support around these levels. The USD 100 level is a natural first target.

Source: Infront and Carlsquare. Note: Past performance is not a reliable indicator of future results.

However, the price action has been decidedly negative in recent days and bulls would need to see prices rebound soon. In a negative scenario where the price breaks down further, the charts suggest a downside to USD 85 per barrel.

Source: Infront and Carlsquare. Note: Past performance is not a reliable indicator of future results.

Risici

External author:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.

© Bank Vontobel Europe AG and/or its affiliates. All rights reserved.