Børshandlede produkter

Skræddersyet af eksperter

Børsnoterede produkter tilbyder investeringsmuligheder for alle markedsforventninger og giver adgang til nye markeder.

Skræddersyet af eksperter

Børshandlede produkter er en bred kategori, der giver mulighed for gearede investeringer i aktiver, som ellers ville være utilgængelige for private investorer.

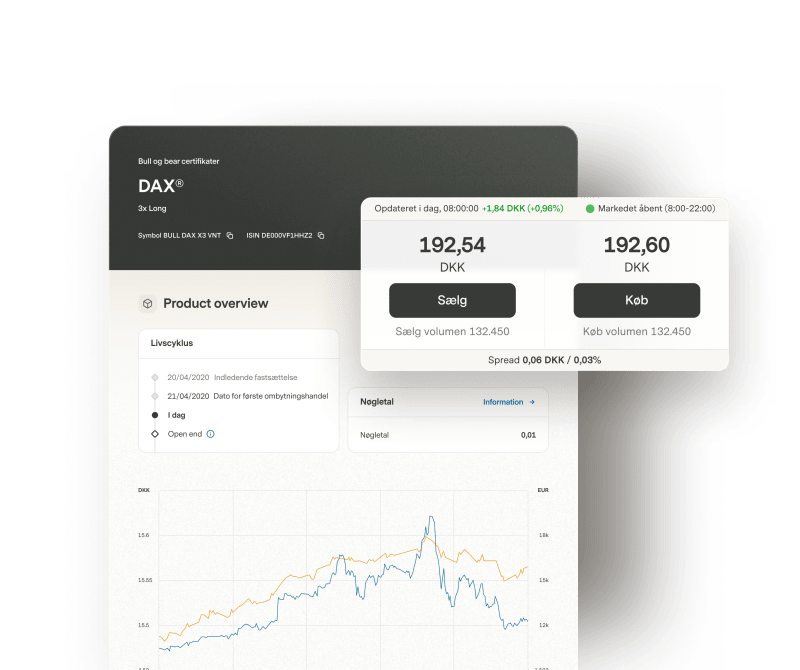

Se alle artikler om uddannelseAlle relevante produktoplysninger på et øjeblik!

Søg efter produkter ved at filtrere produktoversigtssiden med produkttypespecifikke filtre.

Find produkter hurtigt og nemt!

Effektiv søgning på alle produkter, artikler, uddannelsesinformation og ofte stillede spørgsmål.

Inspiration og knowhow

Spændende investeringsideer, indsigt og fakta om strukturerede produkter.

400k+

100+ år

25+ år

A3 rating