US election pushes S&P500 to new highs

In August, Alphabet lost an antitrust case filed by the US Department of Justice (DOJ), which ruled that Google has maintained an illegal monopoly in search and search text advertising. Following the verdict, the DOJ has issued a framework of proposed remedies. This could possibly trigger a forced split-up of the different parts of the Alphabet Group. The question is how that would affect the share price for Alphabet. On another note, the S&P500 has risen for four consecutive days since Donald Trump won the US presidential election. As a result, US equity indices are now in overbought territory.

Case of the week: Big Tech under legal scrutiny

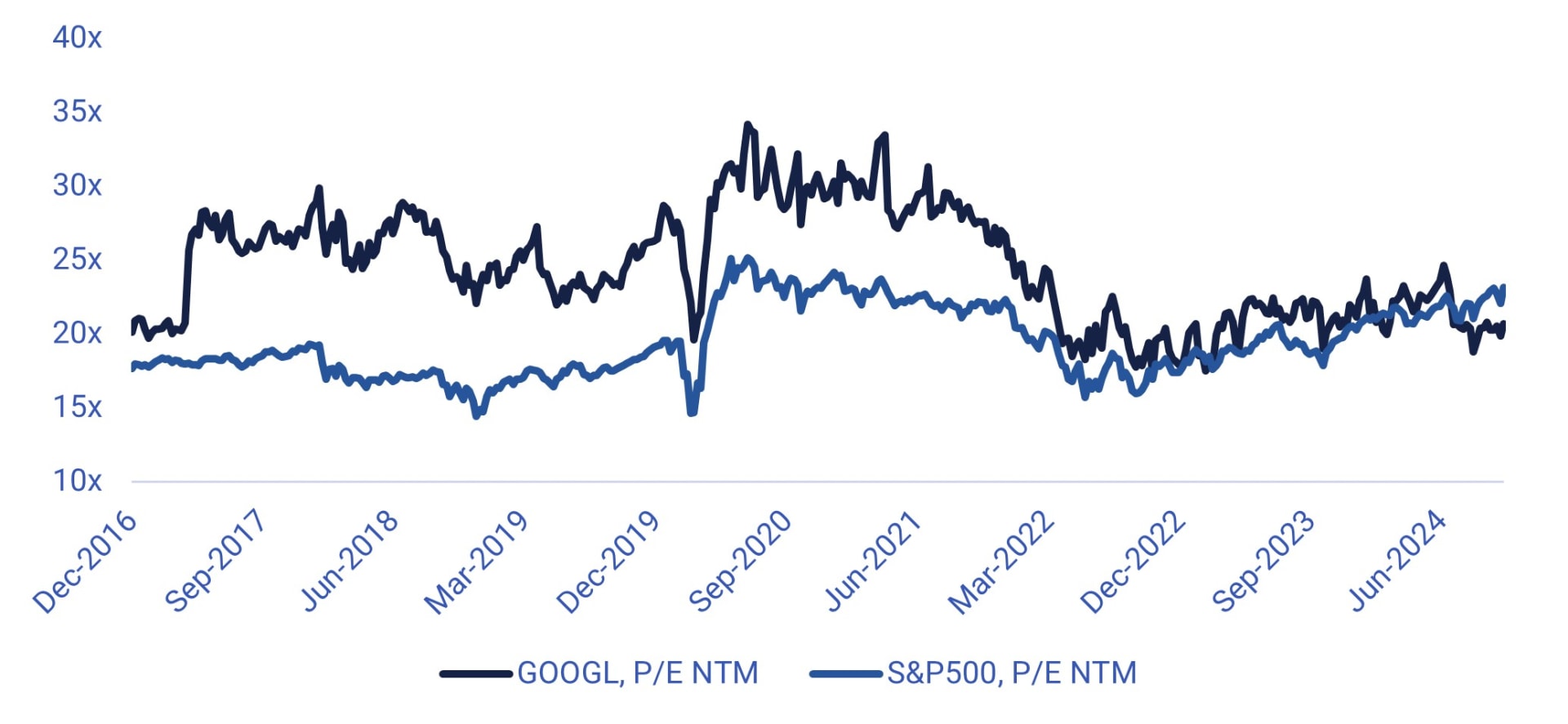

Following gains on the better-than-expected Q3 report and the rally in the US stock market after the presidential elections, shares in the search and cloud giant Alphabet have performed slightly ahead of the S&P 500 year-to-date. However, as illustrated below, Alphabet is currently valued at a discount to S&P500 (based on the forward-looking price-to-earnings ratio (rolling over the next twelve months, or NTM) according to S&P Capital IQ). The valuation is currently at 20-21x earnings compared to 23x for the S&P500. In contrast, Alphabet has historically typically enjoyed a higher valuation than the index, based on the same metric.

Alphabet C and S&P500 forward P/E -ratio multiple from 2016/17

One of the main concerns among investors is likely regulatory risk. In August, Alphabet lost an antitrust case filed by the US DOJ. The U.S. District Judge ruled that Google has maintained an illegal monopoly in search and search text advertising. Following the verdict, the DOJ has issued a framework of proposed remedies. According to media reports, this could include a possible divestiture of parts of Alphabet's business, such as the Chrome browser and Android operating system. The DOJ is expected to file a more detailed proposal with the court by 20 November this year. Google will then have until 20 December this year to propose its own remedies.

In contrast, last week, media reports suggested that President-elect Donald Trump has commented against splitting up Alphabet. This news likely helped push up Alphabet shares. However, we note that the anti-trust investigation was initiated already during the previous Trump administration, and it is unusual for presidents to meddle with cases already filed.

Some commentators have argued that a break-up could ultimately be positive for shareholders, suggesting that the sum of Alphabet's parts is greater than its current market valuation. However, if the DOJ does indeed propose a break-up or other significant restrictive measures, there is likely to be increased uncertainty about the future growth prospects of the various businesses. Therefore, even if a final decision is not expected until August 2025 at the earliest, we believe there is a clear risk that Alphabet's valuation discount to other big tech companies will widen in the near term.

From a technical point of view, the stock is in a bullish trend, with a possible return to previous all-time highs at around 190 USD per share. However, there is a possible double top forming at around 180 USD per share. This could be an early sign of a reversal pattern. Like the US market in general, the stock looks a little overbought. In the event of an adverse price reaction, the MA200 level below 164 USD looks like a natural first checkpoint. Further down, the rising trend line at around 150 USD per share could provide support.

Alphabet C (in USD), one-year daily chart

Alphabet C (in USD), five-year weekly chart

Macro comments

Trump's victory in the US presidential election, combined with the Republicans most likely gaining a majority in Congress, sent US equity markets and the US dollar higher on Wednesday morning 6 November, but also US 2-year and 10-year Treasury yields by 10-11 basis points. Meanwhile, Chinese stock market indices were slightly weaker. By the time the US market closed on Friday 8 November, the S&P500 had risen almost 5% since 5 November.

The market believes that Trump will be able to implement many of the economic policies he proposed during the election campaign, such as cutting corporate taxes and imposing tariffs mainly on China but also on Europe. However, it is also likely that the tariff levels will probably end up being lower than what Trump initially proposed. This is because there is an element of negotiation with, for example, the EU and China. These market expectations have pushed the US 2-year Treasury yield higher, as shown in the chart below.

US 2 Year Treasury Yield (in Percent), weekly five year chart

Today, Wednesday 13 November, the Euro-Zone Industrial Production for September is on the agenda. We also get the US Consumer Price Index (CPI) for October and the weekly oil inventories statistics from the Department of Energy (DOE). Allianz, RWE, Cisco, Lundbeck, Suncore Energy and Tencent are out with interim reports. Loomis hosts a Capital Markets Day.

On Thursday 14th November Sweden and Spain will publish CPI for October. The UK will release Q3 Gross Domestic Product (GDP) and September industrial production. The Eurozone will publish Q3 GDP and Q2 employment. The US will contribute October Producer Price Index (PPI) as well as initial jobless claims. Volvo is holding a capital markets day in Virginia, USA. Applied Materials, Deutsche Telekom, Siemens, Walt Disney and Foxconn are due to release their interim reports on Thursday.

On Friday we start with Japan's Q3 GDP and September industrial production. From China we get October house prices, industrial production, retail sales, investment and unemployment. In Europe, a little later in the morning, we get France and Italy's CPI and Germany's wholesale prices, all for October. From the US we have retail sales and industrial production in October and the Empire manufacturing index in November. Alibaba, Nibe and Bavarian Nordic also release quarterly results on Friday.

New opportunities to get in for those who missed the US rally

Buy the rumour, sell the fact was not the case after Trump won the US presidential election. The chart below shows that the S&P 500 has rallied for four consecutive days since the announcement. Meanwhile, the Relative Strength Index (RSI) is approaching overbought levels and a profit-taking sell-off is definitely an alternative scenario. An attractive level for those who missed the rally could be between 5,850 and 5,875 where the first level of support is found.

S&P 500 (in USD), one-year daily chart

S&P 500 (in USD), weekly five-year chart

Possible levels to go long on the Nasdaq are between 20,600 and 20,675.

Nasdaq 100 (in USD), one-year daily chart

Nasdaq 100 (in USD), weekly five-year chart

The German DAX is consolidating above the MA50 but below the MA20. Meanwhile, the MACD is still in positive territory, but a sell signal could be in the cards. Nevertheless, the index seems to be waiting for a trigger to decide which direction to go.

DAX (in EUR), one-year daily chart

DAX (in EUR), weekly five-year chart

The OMXS30 is holding at the support formed by the MA200. MACD has given a sell signal and the risk is to the downside. The next level of support is at 2,500.

OMXS30 (in SEK), one-year daily chart

OMXS30 (in SEK), weekly five-year chart

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risks

Credit risk of the issuer:

Investors in the products are exposed to the risk that the Issuer or the Guarantor may not be able to meet its obligations under the products. A total loss of the invested capital is possible. The products are not subject to any deposit protection.

Currency risk:

If the product currency differs from the currency of the underlying asset, the value of a product will also depend on the exchange rate between the respective currencies. As a result, the value of a product can fluctuate significantly.

External author:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.

Market risk:

The value of the products can fall significantly below the purchase price due to changes in market factors, especially if the value of the underlying asset falls. The products are not capital-protected

Product costs:

Product and possible financing costs reduce the value of the products.

Risk with leverage products:

Due to the leverage effect, there is an increased risk of loss (risk of total loss) with leverage products, e.g. Bull & Bear Certificates, Warrants and Mini Futures.

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.

© Bank Vontobel Europe AG and/or its affiliates. All rights reserved.