The Future Path of the USD in a Divided Election

As we approach the presidential election, it is a hot topic to speculate on who will end up as the next president. While it may seem tempting to do the same, everyone can agree on the prevailing uncertainty. Therefore, the focus of this article will be to explore the future path of the USD, regardless of who becomes the 47th president.

What Tariffs can Mean for the USD?

The evidence suggesting that Trump will strengthen the dollar includes a deduction of taxes, potentially increasing economic activity and inflation. However, tariffs have almost become synonymous with Trump in this election. A tariff is a protectionist tax paid by companies that import goods or services from other countries. Even though the goal is to protect one's country from outside competition, it is often linked to making consumers worse by passing the tax to the end consumer. Apart from this, the tariffs, especially those suggested by Trump, risk causing supply chain disruptions due to their aggressive nature. Companies would face challenges getting accustomed to the tariffs and potentially finding new suppliers to stay competitive.

Furthermore, the aggressive nature of the tariffs makes it foolish not to expect retaliation from other countries. For example, on the 5th of October this year, the European Union imposed tariffs on Chinese automakers due to the fierce competition and thus dumped prices. Many prominent EU automakers argued that a tariff would ultimately have an undesired effect since China would respond by increasing tariffs and making other sectors worse off. Hence, when trying to understand the impact of a tariff, it becomes increasingly difficult when not everything else is kept constant.

Perhaps Trump's last term could provide some insight into his effect on the USD since even back then, one of his core points was tariffs. Looking at the numbers, the USD did not appreciate during Trump's term, which aligns with the 40 years of republican presidents, on average, experiencing the same. So why do people still believe it will be the case this time? To an extent, the explanation is based on the current economic condition and the future of the Federal Reserve's interest rate cuts. If it is assumed that tariffs increase inflation due to an increase in the general price level, it would cause the Fed to be more cautious about decreasing interest rates and, thus, create a greater demand for the dollar, causing it to increase. However, this only works if the US economy is stable, as higher interest rates and inflation could damage a weak economy.

Dollar Uncertainty

On the other hand, if Harris were to be elected, it should be expected that she would maintain some tariffs. As a matter of fact, after Trump's last presidency, many of the high tariffs, particularly those imposed on China, were kept in place by the Biden administration. This suggests that tariffs will continue to be used regardless of who becomes the next president. The difference lies in how these tariffs will be implemented. Harris will most likely adopt a more multilateral approach, working with U.S. allies to apply pressure on China and negotiate trade deals that address broader issues such as labor standards and environmental concerns.

The history of U.S. presidents also shows that, under a Democrat's presidency, the USD tends to appreciate more on average compared to a Republican presidency. This pattern may not continue if Harris wins, due to less aggressive fiscal expansion, leading to lower growth expectations and continued uncertainty in fiscal and tax policies from the Biden administration.

Will Europe be the Loser?

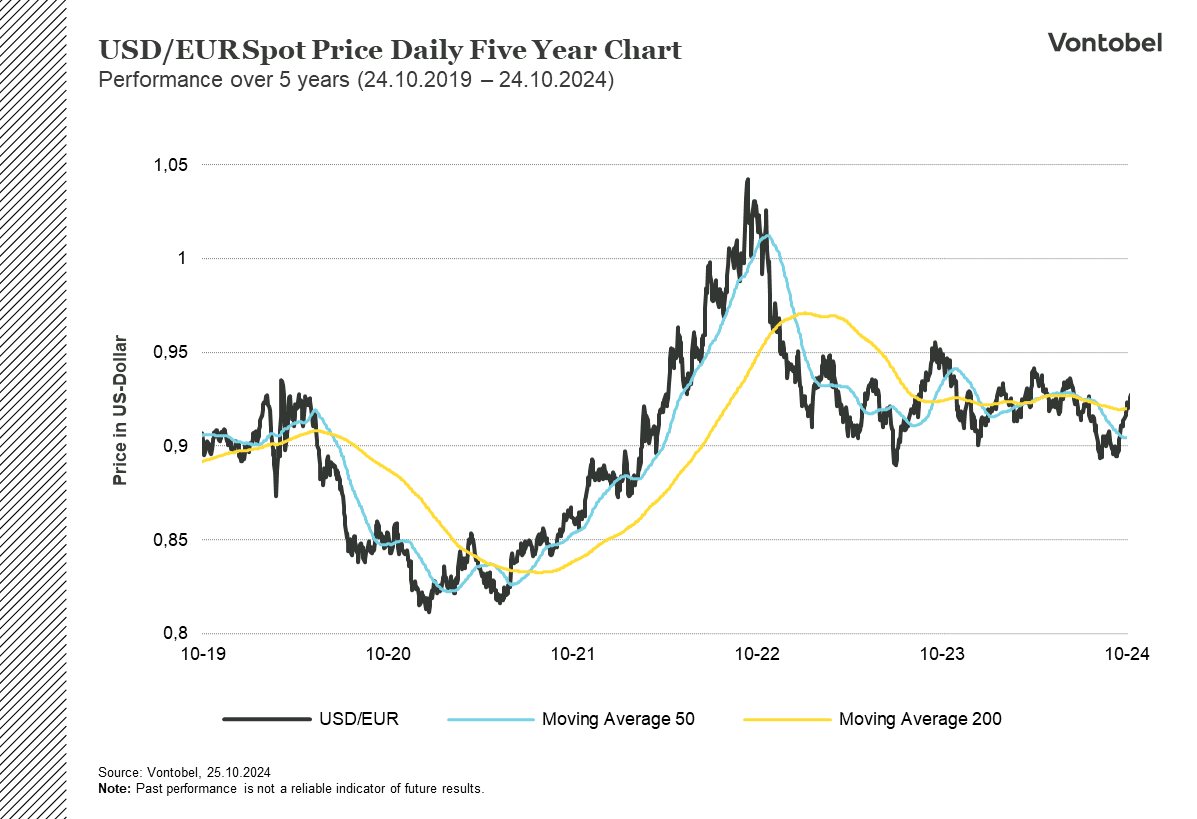

A more protectionist US would not benefit Europe. According to the Governors of the Swedish and German central banks, Erik Thedéen and Joachim Nagel, the tariffs put forward by both candidates are concerning, as interventions in trade are not desirable for most countries, especially not for nations like Sweden and Germany, which rely on exports. However, the ultimate effect of the proposed tariffs can only be judged once the ones that come into effect are known. Therefore, it should not be ruled out that certain tariffs may be adjusted or dismissed as a result of retaliatory measures. Moreover, if the USD appreciates, as experts believe, Europe will experience more expensive imports, while the natural demand for its exports may diminish due to the offsetting effect of the tariffs.

Finally, who ends up as the US’s 47th president will be known after November 5th, but even then, what policies are implemented can only be determined later. The uncertainty regarding the future direction of the U.S. economy will likely present great opportunities for investors who are ready to seize them. Moreover, what we can be certain of is that while tariffs may seem invisible to the average consumer—since they are paid by the importer—their impact will not be. Higher prices will ultimately shift the burden onto consumers, who will feel the hit in their wallets.

Risks

Credit risk of the issuer:

Investors in the products are exposed to the risk that the Issuer or the Guarantor may not be able to meet its obligations under the products. A total loss of the invested capital is possible. The products are not subject to any deposit protection.

Currency risk:

If the product currency differs from the currency of the underlying asset, the value of a product will also depend on the exchange rate between the respective currencies. As a result, the value of a product can fluctuate significantly.

External author:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.

Market risk:

The value of the products can fall significantly below the purchase price due to changes in market factors, especially if the value of the underlying asset falls. The products are not capital-protected

Product costs:

Product and possible financing costs reduce the value of the products.

Risk with leverage products:

Due to the leverage effect, there is an increased risk of loss (risk of total loss) with leverage products, e.g. Bull & Bear Certificates, Warrants and Mini Futures.

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.

© Bank Vontobel Europe AG and/or its affiliates. All rights reserved.