Investors’ Outlook: falling into place

Early last month, investors faced a series of market-mov ing events: weak US employment data, a surprise inter est-rate hike by the Bank of Japan, underwhelming earn ings from some of the technology sector’s heavyweights that had long buoyed the stock market, and rising tensions in the Middle East. These developments reignited fears of a recession, triggering a sell-off. It served as a sobering reminder that perhaps some investors had been too optimistic, believing the US economy could glide through without facing a downturn.

The economic shadows are lengthening

The global macroeconomic picture has grown increasingly worrying in recent months. The Eurozone’s economic outlook remains sluggish (ING, 24.07.2024), while data out of China has deteriorated (Bloomberg, 15.07.2024), with little indication that the People’s Bank of China (PBoC) is ready to introduce significant stimulus measures—though policymakers will likely eventually need to act to meet the official 5 percent growth target set for this year. However, the primary focus has been on the world’s largest economy.

There was plenty to sort through. The closely monitored US labor market didn’t turn out to be as strong as previously believed (CNN, 21.08.2024), stoking fears that the Fed may have missed the window to cut interest rates in time and could now struggle to stave off a recession (Financial Times, 02.08.2024). Although the US job market has remained robust by historical standards, it has begun to show signs of softening.

With higher interest rates increasingly weighing on businesses and consumers, signs of weakness are surfacing across the economy. Leading indicators in the services sector have weakened considerably, and there is a notice able rise in credit card and auto loan delinquencies (Axios, 06.08.2024).

Of course, there are positive developments as well. With fewer employees leaving their current positions (Bloomberg, 02.08.2024), wage pressure has eased. Additionally, inflation has also been trending downwards: consumer price growth slowed to 2.9 percent year-on-year in July, the lowest level in more than three years. Taking all these factors into account, the Fed will likely be compelled to cut rates three to four times before the end of the year.

Winter is coming

The US labor market and summer this year share a common trait: both were “hot” for a long time. While other areas of the economy weakened under the pressure of restrictive monetary policy, the labor market remained resilient and tight. But even the best summers eventually come to an end.

Various surveys were already forecasting cooler conditions ahead. According to the Conference Board, US consumers are increasingly pessimistic about the labor market (Bloomberg, 02.08.2024), while demand for temporary staff has been declining for some time (USA Today, 08.07.2024), a trend often seen as a precursor to layoffs of permanent employees.

However, the real chill set in with the release of the July monthly labor market report. According to the Bureau of Labor Statistics, some 114,000 new jobs were created, significantly below the expected 175,000. Data for June and May were also revised downward. At the same time, the unemployment rate in the US rose from 4.1 percent to 4.3 percent, according to the report. The core unemployment rate (The core unemployment rate excludes temporary or cyclical factors, such as economic recessions or expansions.), which tracks individuals not just temporarily unemployed, also edged up slightly from 1.40 percent to 1.44 percent.

The pressing question now is: when will “winter” (i.e., a US recession) arrive? The official verdict is still pending. The National Bureau of Economic Research (NBER) uses a range of criteria to assess whether the US economy is in recession, and this process typically takes time: on average, between four and 21 months for the NBER to announce the start of a recession.

If the “Sahm Rule” (an indicator named after the economist Claudia Sahm), is to be believed, a recession is already on the horizon. This indicator is triggered when the three-month moving average of the US unemployment rate increases by 50 basis points (bps) compared to its 12-month low. It was designed to alert monetary authorities to the early stages of a recession, signaling when action, such as interest-rate cuts, might be necessary. Given that the indicator has been historically accurate, even going back to the 1970’s (JPMorgan, 08.08.2024), it became a major talking point following the release of the July jobs report.

While the weak labor market data at the beginning of August led to a temporary sell-off in the stock markets, many market participants still seem confident that the Fed will succeed in achieving the much-cited “soft landing” for the economy—that is, bringing inflation down to the Fed’s 2 percent target without triggering a recession. This optimism is reflected, for example, in Bank of America’s Global Fund Manager Survey. In July, 68 percent of respondents still expected a “soft landing”. In August, this figure had risen to 76 percent, as hopes for interest- rate cuts increased following the weak labor market data.

Claudia Sahm herself seems hesitant to declare a recession just yet, emphasizing last month that the US economy was still in a strong position and that it was unlikely that the country was currently in recession (Fortune, 02.08.2024). She noted that “this time really could be different. The Sahm Rule may not tell us what it’s told us in the past, because of these swings from labor shortages, with people dropping out of the labor force, to now having immigrants coming lately. That all can show up in changes in the unemployment rate, which is the core of the Sahm Rule.”

Regardless of when, or if, a recession is officially declared, the latest data is poised to increase the pressure on the Fed to cut interest rates. At the Kansas City Fed’s annual Jackson Hole Economic Symposium, it was evident that Fed members are now also concerned about the deceleration.

According to Fed Chair Jerome Powell, the slowdown in the labor market is “unmistakable” and a further slowdown is neither sought nor welcomed. The time has therefore come for interest-rate cuts.

Signals of misaligned Fed rates?

The so-called Taylor Rule* —a formula that helps central banks balance their goals of controlling inflation and promoting economic growth by providing a guideline for setting interest rates—suggests the Fed’s is currently 1.7 percentage points too high, amid rising unemployment and slowing inflation.

*The core unemployment rate excludes temporary or cyclical factors, such as economic recessions or expansions.

According to the classic Taylor Rule, the current benchmark interest rate set by the Fed is approximately 1.7 percentage points—or equivalent to seven quarter-point cuts—above the appropriate level. This assessment follows an increase in the unemployment rate to 4.3 percent in July and a slowdown in inflation, with the Personal Consumption Expenditures Price Index excluding food and energy rising just 2.6 percent year-over-year in June (Bloomberg, 26.07.2024). Incorporating the Fed officials’ estimate of a 0.7 percent “neutral real rate” and a long-run unemployment rate of 4.4 percent, the Taylor rule suggests an appropriate interest rate of about 3.7 percent.

Market-implied rate expectations currently indicate strong confidence in substantial monetary easing over the next year, forecasting a decrease in the overnight rate by at least two percentage points. The fed funds futures market expects this easing cycle will likely conclude with rates stabilizing above 3 percent. This represents a notable shift from the pattern since Paul Volcker’s retirement as Fed chairman in 1987, where the trough of the fed funds rate during each easing cycle consistently fell below 3 percent. While there is widespread expectation for imminent rate cuts by the Fed, the market increasingly views the exceptionally low rates of the past three decades as an anomaly. As a result, the consensus is moving towards a future characterized by generally tighter monetary policy.

Fed inertia and global unrest fuel credit spread volatility

August saw market turbulence driven by several factors: concerns that the Fed is behind the curve in cutting interest rates, the unwinding of the yen carry trade, a closely contested US presidential race, and ongoing unrest in the Middle East. This resulted in spread widening early in the month. While markets were largely priced to perfection, the current volatility has pushed spreads higher, though only to levels seen late last year—and not to levels that would suggest panic selling due to renewed recession fears.

Equities’ whirlwind ride

This summer took investors on a whirlwind ride. While Europe faced stormy weather and Hurricane Beryl ravaged the Caribbean and the US Gulf Coast, similarly, after reaching an all-time high by mid-July, stock markets encountered a perfect storm in an already weak seasonal period, leading to a spectacular global sell-off. Equities nearly entered correction territory by early August but quickly rebounded. Where might markets go from here?

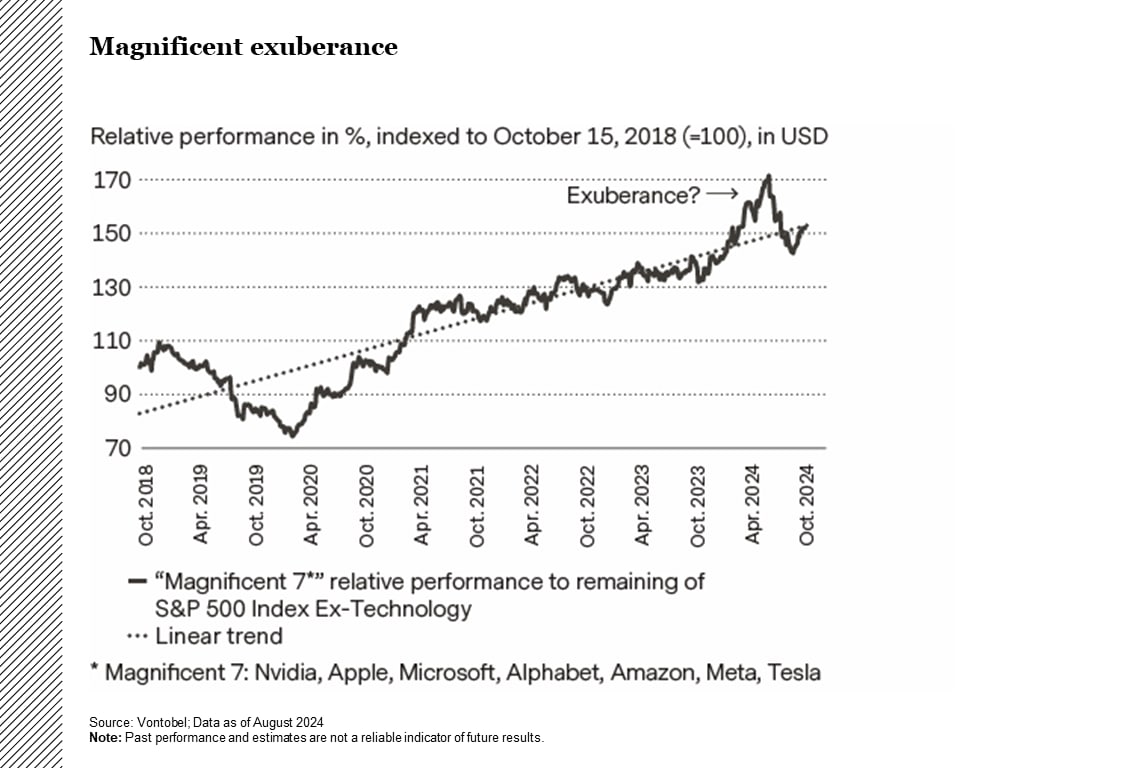

July saw plenty of headlines on the US presidential election and escalations in the Middle East and Eastern Europe conflicts. By mid-July, investor sentiment was dampened by a softer-than-expected second-quarter reporting season, high expectations from a strong first half-year and stretched valuations. Uninspiring comments from large US tech companies about the longer-than- expected time to monetize AI investments and sustained capital expenditures ignited a rotation out of tech leaders into small caps and value stocks.

By end-July, disappointing US job figures raised fears that the Fed was again behind the curve in cutting rates, reviving recession concerns. This, combined with a surprise rate hike from the Bank of Japan, triggered a massive unwinding of leveraged yen positions, creating perfect storm conditions. The resulting global sell-off affected all risky assets, particularly equities, with “fear gauges” like the Chicago Board Options Exchange’s Volatility Index (VIX) reaching levels only surpassed by the 2008 Lehman Brothers collapse and the 2020 Covid-19 outbreak.

Equity markets were probably ripe for a short-term correction this summer, given the record-breaking performance in the first half of 2024, extreme bullish positioning, rich valuations, and ambitious earnings expectations for US tech stocks. The market shake-up last month has been beneficial for market breadth, with the exuberance of mid-July now under control. In fact, this recent correction was likely a healthy consolidation within a longer-term uptrend.

Historically, a 10 percent correction is not unusual, even more so given the traditionally weak seasonal period. Additionally, S&P 500 Index companies have emerged from their buyback blackout period, which should support the market. With technical concerns now addressed, the focus shifts to fundamentals. Growth and earnings momentum remain strong, as evidenced by the latest reporting season and corporate outlooks.

From “Cruel Summers” to enduring “Love Stories”

Some readers may have found themselves at Zurich’s Letzigrund stadium (or elsewhere) this summer, swept up in the pop culture phenomenon that is Taylor Swift, perhaps dragged there by their children. Swift’s catchy songs, however, offer more than just entertainment; they also provide an apt metaphor for the current state of the commodities markets.

Commodities’ year-to-date performance can best be summed up as “Back to December”. After an initial rally, the Bloomberg Commodity Index has returned to where it was in December.

For several commodities, it has indeed been a “Cruel Summer”. Agricultural commodities, which make up almost 27 percent of the index, have struggled with bumper harvests (oversupply). Base metals, accounting for just under 16 percent of the index, have been weighed down by subdued industrial demand and economic uncertainty in China, a major metals consumer.

While oil prices were initially buoyed by geopolitical fac tors and seasonal demand, the outlook appears less rosy. China, the world’s largest oil importer, is reducing imports. With the driving season coming to a close and inventory draws tapering off, even the Organization of the Petroleum Exporting Countries and its allies (OPEC+)— typically bullish—has cut its global oil demand forecasts. Much now hinges on the group’s future pro duction policies. OPEC+ is currently withholding around 5.7 percent of global supply but plans to gradually return 2.2 million barrels per day to the market in the fourth quarter (Reuters, 12.08.2024). How ever, given the uncertain demand outlook, it remains to be seen if these cuts will be reversed. Yet, the pressing question on many minds is: “Is it (really) over now?”. In the absence of major shocks, Brent crude oil prices are likely to stay between USD 70 to USD 80 per barrel. With OPEC’s recent forecast cuts, driven partly by China’s economic situation, further production cuts may be on the horizon to support prices.

Meanwhile, investors continued their “Love Story” with gold, which makes up 17 percent of the index. After an already impressive rally, the precious metal reached a new all-time high of over USD 2,500 per ounce in August. Interestingly, the factors that have driven gold demand in the recent past—such as central bank and emerging market demand—seem to be losing their importance. Markets shrugged off news that the People’s Bank of China had halted its gold reserve buying and remained unfazed by reports of a decline in Chinese gold imports for non-monetary purposes in July (“Shake it off”). Instead, traditional macroeconomic drivers like US real yields and the US dollar have returned to center stage. An expectation for lower US real yields and a weaker US dollar argues for maintaining a slight overweight.

Euro-dollar prospects brighten as franc stability faces tests

Weak US economic data has lifted expectations of faster Fed easing, potentially pushing the euro-dollar exchange rate sustainably above USD 1.10 depending on global risk sentiment and improvements in the Euro zone. In Switzerland, a strong franc challenges exports, which may lead the Swiss National Bank (SNB) to consider further rate cuts to curb the currency’s rise amid limited interventions.

Euro-dollar bulls have been bolstered by recent disappointing US economic data, including the weak July 2 employment report, which fueled expectations of faster easing by the Fed. This has pushed the euro-dollar above USD 1.10. However, the strength and duration of any rally will also depend on a resurgence in global risk appetite and positive developments in the Eurozone. Continued improvement in the Eurozone’s economic environment could narrow the current and expected euro-US growth differential, supporting a sustainable break of the USD 1.10 mark.

Continued equity market jitters could spoil euro-dollar upside if persistent and if it eventually translates into a broad risk-off market sentiment with associated safe-haven flows.

Swiss economy at the mercy of the mighty franc

The Swiss economy, which is heavily reliant on exports, is highly sensitive to currency fluctuations. With inflation concerns easing, the strong franc could pose challenges for exporters, particularly small and medium-sized businesses. Swissmen, the leading advocacy group for manufacturers in the country, has recently urged the SNB to intervene, cautioning that the strong franc is detrimental to the economy.

The deflationary environment, coupled with the tightening effects of a stronger currency, has reignited expectations for rate reductions by the SNB in September. The SNB began its easing cycle with a 25-bps reduction in March, followed by another 25-bps cut in June. Bloomberg Economics anticipates further cuts of 25 to 50 bps by year’s end. While these measures might limit further appreciation of the franc, they are unlikely to significantly alter the course of its rally, which is driven by global market uncertainties.

Although foreign exchange (FX) intervention remains a possibility, the SNB has been relatively inactive in this area this year, having acquired only CHF 281 million in foreign reserves in the first quarter.

Note: Past performance and estimates are not a reliable indicator of future results.

Authors

Frank Häusler, Chief Investment Strategist

Stefan Eppenberger, Head Multi Asset Strategy

Christopher Koslowski, Senior Fixed Income & FX Strategist

Mario Montagnani, Senior Investment Strategist

Michaela Huber, Senior Cross-Asset Strategist