Winter is coming... with a final sell-off for shares

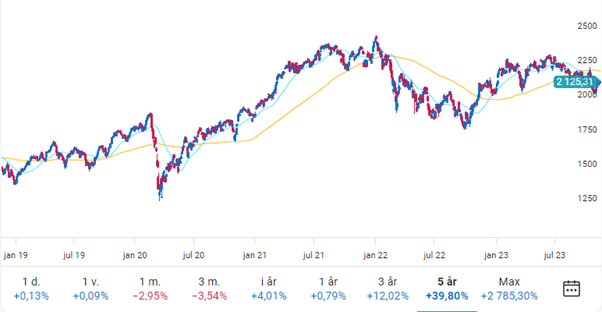

The Swedish stock market has trended negatively for over five months. Since the OMX peak at the 2326 level on June 16, the stock index has first broken below its 50-day moving average and then fallen below the 200-day.

All the way down since July, the less important 50-day average has been an invisible ceiling for the OMX, with only a brief exception in mid-October. Right now (November 14) it looks like the index (2124) is going to push up through the 50-day (2140). It may very well be like this for a few positive weeks and is perhaps worth trading on if you are quick-footed.

The 200-day curve is typically more important to track. It is at 2206 now, which closely coincides with the resistance confirmed many times last fall at the even number 2200, which on those occasions was also at the same level as the 200-day moving average. Now that we have the reporting period behind us, hopes for inflation under control and lower interest rates in 2024 as well as thoughts of Christmas bonuses and real estate rallies, my best guess is that the market will break through the 50-day, continue upwards for a few weeks, maybe even briefly go up through the 200-day in a false breakout upwards of a few percent. The October peak at 2236 constitutes a kind of benchmark that is quite logical in the context. That's how I would think if I tried to take into account the market's group psychology and herd behavior.

OMX index, as well as 50-day and 200-day moving averages

Personally, I wouldn't try to make money on the way up there at 5-6% but focus on selling shares that I don't want to keep in the portfolio and take a short position on the stock index if we get all the way to around 2240 in the OMX. The last two times the OMX fell below the 200-day was in February 2020 and in January 2022. Both times the market literally crashed soon after. This time it has been calmer so far, but the trend looks undeniably negative, so the fear and downward acceleration could come at any moment.

OMX index, as well as 50-day and 200-day moving averages

Furthermore, it looks like an ominous double top for OMX. One peak is made up of the second half of 2021 when indices were lifted to their highest levels ever in connection with huge pandemic-related stimulus. The second one we have just left behind along with the summer heat of 2023. It is fascinating how high and rising interest rates could coincide with another index peak this summer, almost as high as the turn of the year 2021/2022. It demonstrates how out of sync the stock market often is with the underlying economy itself. It is of course possible to analyze based on, for example, beginning signs of falling inflation and hope for lower interest rates, or relief that the US labor market and economy proved so resistant to higher interest rates. Or, for Sweden, positive profit effects of the weak krona.

On the other hand, we still have a few years to go before increased policy rates have had time to affect most loan agreements, not least mortgages and secondary effects from falling house prices. The consumer recession is simply not here yet because there were larger than expected reserves left over from the record stimulus during Covid.

In the previous declines after the stock market valuation records in 2000 and 2007, the market only started to fall seriously when the Fed began its interest rate cuts. It simply confirmed how vulnerable the economy really was. The stock market fell all the way down during the interest rate cut period, and both times the result was approximately a halving for the entire stock market. About halfway down, the 50-month average was first broken and then the cycle bottom was found at the 200-month average. The latter is today at 1442, or about -33% from today. Given that the S&P 500 is at least twice as expensive as normally calculated on cyclically adjusted profits or sales kroner, and that Sweden tends to move roughly like the US, a drop of -33% from today would not even be something to raise eyebrows about.

However, I find it hard to believe that the stock markets would be allowed to fall so much without massive action from the central banks. Rather than trying to short stocks all the way down, I would focus on averaging into real assets and a list of quality favorite stocks, to take advantage of the upcoming stimulus effects. I think assets such as precious metals (gold, silver), energy commodities (uranium, oil), cryptocurrencies (Bitcoin, Ether) as well as cheap infrastructure and energy-related companies could be attractive investments relative to broad stock market indices. The last category is naturally quite broad, but you can think in terms of partly oil companies and mines, partly in terms of IT infrastructure (including selected semiconductor companies and social media, but you have to think carefully about their valuation, risk and market position).

I have already taken positions in gold, uranium and oil. However, I am holding off on buying more traditional stocks and indeed also, longer-term crypto positions, but I expect to be able to make some real quality finds among the big companies in the coming year.

Nothing is certain, of course, because the central banks may not actually panic this time around (cough, cough, laugh, laugh), and markets may not even fall until the recession hits hard. But regardless of the rise or fall, I dare to count on both companies and commodities in precious metals and energy to develop very strongly for the rest of the 2020s. The cryptocurrencies too. If it gets even better than for, e.g., the OMX or S&P500 depends mostly on whether the stock valuation levels will stay at the same historical (“unjustified”) record levels or begin to normalize. I think it will be, but it is not critical for my portfolio to do absolutely well, especially relative to society's overall cost level. But first we have to get through the winter, which I think will first be characterized by a few strong weeks which in that case may constitute a "last" selling opportunity for the stock market.

Risks

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.

© Bank Vontobel Europe AG and/or its affiliates. All rights reserved.

External author:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.