Investments that can protect you from inflation

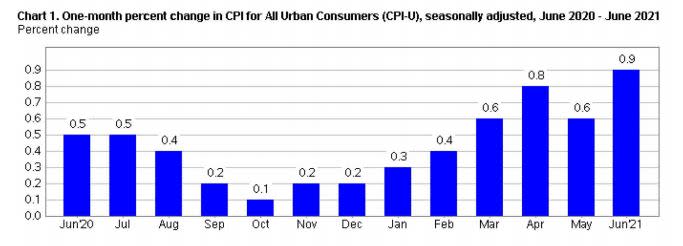

Consumer price inflation has risen sharply over the past six months, according to the latest statistics from the US Bureau of Statistics. One important reason is that the economy is starting to pick up again after the pandemic.

Consumer price inflation has risen sharply over the past six months, according to the latest statistics from the US Bureau of Statistics. One important reason is that the economy is starting to pick up again after the pandemic. This has led to an unexpectedly high demand for workers in several areas, which has led to bottlenecks and increased prices. In addition, most American households have received several large extra payments from the state as compensation for loss of income during the pandemic. This "citizen's salary" was, moreover, just one of all the stimulus measures taken to counteract the negative effects of the shutdowns that would slow down the spread of the coronavirus.

The effect of more money in circulation, but fewer people working with reduced production as a result, as well as low comparative figures relative to the initially almost total economic downturn last spring and summer, was thus not entirely unexpectedly a high measured inflation rate.

Now the US Federal Reserve, the Fed, says both that inflation is temporary and transient (transitory), and that they can start talking about considering gradually reducing (losing) monetary support measures. It would be very welcome if the economy could start to stand on its own two feet soon, so it is possible to make a reliable estimate of its inherent stability.

However, it really remains to be seen if any of the Fed's statements come true. I rather believe that the transitory properties of inflation turn out to be transitory, and that it will be the taper that will be tapered and reversed. Of course, in the next six months the economy will probably look quite ok relatively earlier, and the official inflation rate is likely to fall back somewhat from today's high levels, ie appear to be "transient". But in just over a year, we may be back on square one with a weaker economy again, more stimuli and at the same time higher inflation rates. At the very least, actual inflation measured by shadowstats methodology is likely to remain high.

According to shadowstats, the consumer price inflation rate in the US is about 13 percent rather than the just over 5 percent that the official statistics show. The figure of 13 percent is calculated by using exactly the same methods as the authorities used in 1980. Since then, the authorities' measurement method has been changed to take into account that, for example, consumer electronics are undergoing rapid quality development.

This means that even if the latest iPhone model costs SEK 10,000 instead of SEK 4,000, the price per 'unit' is actually considered to have fallen, because the new phone can do so much more than the old one. The same goes for TVs. They have become both bigger and better, so even if consumers pay more for a standard TV and change it more often, so that the expenses per year for "one TV" are much larger now than 25 years ago, the authorities can count it as that the price has halved in the meantime.

Source: www.shadowstats.com, Courtesy of ShadowStats.com

Are equities or gold the best protection against inflation?

What should you really own when inflation takes hold? Yes, the authorities do what they can to keep price increases within a controlled and optimal range that provides minimal unemployment and maximum production in society. However, I would not expect them to succeed in their endeavors. So, if the “transient” inflationary impulse is followed by more sustained inflation, caused by decades of increasing monetary stimulus, increasing financial financing, with declining productivity and generally rising unit prices as the ultimate result, what could a strategic invested investor do? Equities were an extremely poor form of investment during the 70's era of high inflation, but phenomenal during the 2010's zero interest rate policy. The death of the shares in the 70's came after an era of extreme faith in a group of unbeatable companies, "Nifty Fifty" which was considered to be able to be bought at any price because growth and future profitability would compensate for everything. Now the FANG (Facebook, Apple, Netflix, Alphabet – formerly Google) companies have the same immortality status. Is there a risk that we will see a kind of repeat of the 70s if inflation rises? Just ten years after "Nifty Fifty" death of equities was proclaimed. What about FANGs and all the hundreds of loss unicorns in about 10 years?

Bull & Bear-Certificates

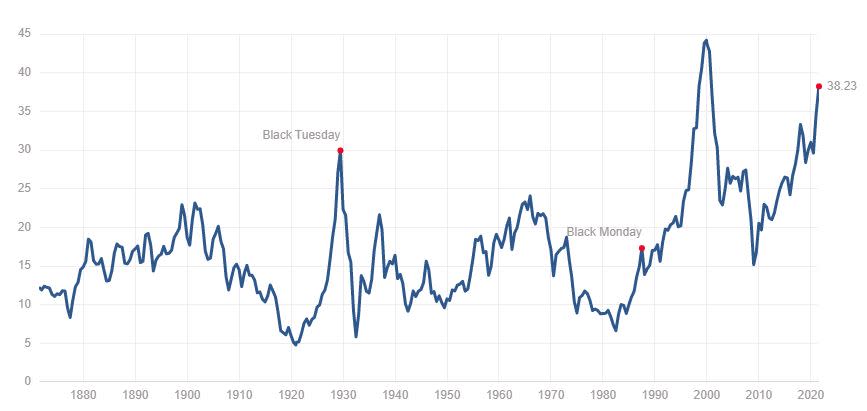

In any case, US corporate profits are unusually highly valued now. Shiller's P / E (Profit / Earnings) ratio is at a high 38, which can be compared with a low of 7 in the early 80s when the inflation rate was at a record high, and the P / E ratio was constantly below 20 before the IT bubble gained momentum in 1995. Low inflation and high growth contributed then to price increases and valuations for the technology sector that have never been seen before. Until now again. In the last ten years, low inflation and zero interest rates have once again caused stock markets and, not least, technology companies to fly.

The situation is really reminiscent of those that prevailed in the early 70s and 00s, respectively. "Unbeatable" companies with record high values are once again facing an inflationary impulse, transient or not. It sounds like a good opportunity to look for alternative or complementary investments that can better protect against the effects of inflation than equities usually do.

Historical Development of Shiller's P/E ratio

For example, is gold or a gold company a smart place to invest, if one thinks that high inflation can have a negative effect on stock prices - especially the largest and most highly valued stocks in the US technology sector?

It is not obvious how to read the historical movements of gold. As I talked about in another podcast this week, inflation was relatively high during the 20-year period 1980-2000, but the gold price still fell sharply from 800 to 200 dollars per ounce in the meantime. Then shares were a much better investment. But if you measure from 1971 instead, which was not when inflation was high, but when it started to rise from a low level, the gold price also went very well, at least until the browser Netscape's listing in 1995 and the IT bubble attracted all interest from investors .

The corresponding apparent paradox is found in the 20-year period in 2000-2020 when the gold price 8-folded despite an average very low inflation during the period, especially the last ten years when gold set its all-time high in August 2020.

US Consumer Price Index (CPI) inflation 1980-2021: a high inflation era and a low inflation era

The gold price in US-dollars / ounce: one down cycle and one up cycle; what will be the next direction?

The price of gold fell in the period around 1980-2020 despite high inflation but rose very sharply during the low-inflation era in the 20 years after that. It hardly gives a signal that one should own gold when inflation is high. But if you shift the graph a little and note when inflation increased or decreased, and adjust further for how central banks and real interest rates developed, a different, albeit rather complex picture emerges:

This is how the interplay between inflation, interest rates, gold and equities really works

Falling, especially negative, real interest rates are positive for gold. And equities do not react negatively until interest rates rise above a certain threshold level at the same time as inflation appears to be spiraling out of control. Gold stocks are also stocks. They fall with the stock market but can then rise very quickly when the gold price has risen enough and looks to establish a new higher price floor.

Of course, there are no easy answers, then everyone would trade gold and gold stocks

What can we expect from shares, gold shares and their alternatives in the next 10 years? I think we will see a slowly accelerating CPI inflation and that an escape from expensive shares in a couple of years can partly find its way into alternatives such as precious metals, commodities and digital assets. This could then lead to a positive relative development for e.g. gold, Bitcoin, Ether and agricultural commodities relative to stocks over the next five years. The indexation disease with passive money that has pushed up the prices of shares can then have a corresponding negative effect on the largest technology shares, especially those that do not report gains or positive cash flow. Maybe the same passive money can then also give a buying pressure for gold and gold mines. I think it is not wrong to have a share of gold (10-20%) in the portfolio already now, but that the "dry powder" could be switched to shares again already at the next share correction of 10-20%. Then you could fold back to 10-20% gold again if or when the shares set new all-time highs. This can be done, for example, every six months for a couple of years. When inflation looks more sustainable, one could gradually aim for an ever higher normal share of gold. If the gold has then found a positive trend, the proportion of gold shares is gradually increased and after a while more and more small and junior gold companies are added.

Bull & Bear-Certificates

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.