Energy transition during a crisis

The US inflation rate is expected to continue falling in January when the US Consumer Price Index CPI is presented on February 14 and the consensus is between 6.2 - 5.5 percent annualized. As Powell continues his struggle to convince investors that the war on inflation is far from over, the market has already priced in rate cuts in the second half of 2023.

With strong gains behind us, it is difficult to evaluate the asset side in the short term. The problem with rising asset prices is that sooner or later they can be a contributing factor to inflation gaining momentum on the upside again and thus continued rising interest rates for a longer period, which Powell also warned against.

However, there is a sector and, above all, individual assets within it that are particularly interesting in both the shorter (6-12 months) and longer (5-10 years) term.

There is a lot of talk about an energy transition from fossil fuels to renewable alternatives or from sources without emissions. Despite that, oil, coal and natural gas accounted for 77 percent of the global energy mix in 2021.

The transition to fossil-free alternatives is inevitable if we are to continue living on our planet, but that does not mean that it is possible to completely stop investing in infrastructure for the energy sources that make up more than three-quarters of the total energy mix. The last two winters, and above all after Russia's invasion of Ukraine, have shown two things:

- the importance of not being dependent on one country for access to energy as well as,

- that nuclear power is a solution, not a problem.

Natural gas

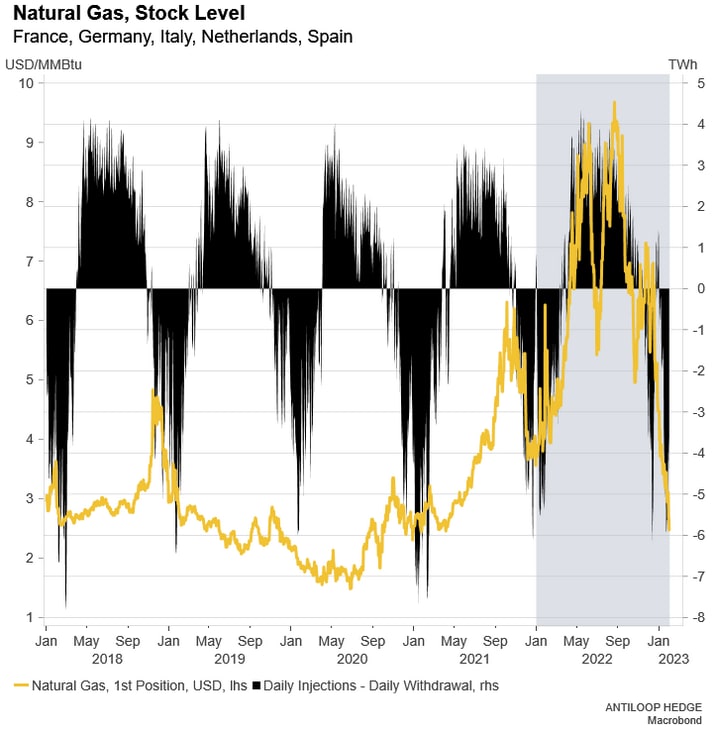

Russia's invasion of Ukraine and decades of poor energy policy in Europe have led to households across Europe seeing their electricity bills multiply compared to previous years. Natural gas prices, which are normally volatile during the year due to problems with long-term storage, have been even more so, but are now trading at levels not seen since a year before Russia invaded Ukraine, despite the fact that next winter is predicted to be more difficult and, above all, more expensive than ever for households and companies in Europe.

The reason for the sharp drop in prices has to do with a warmer than expected winter and the fact that stocks, at least now, are relatively full. Although it eased this year's winter, a solution for the future is still not in place and the International Energy Agency wrote in a report at the beginning of the year that it expects about 30 billion cubic meters of gas to be missing as Europe starts to stockpile ahead of winter 2023 during spring and summer.

The already known shortage of gas combined with the fact that the price has fallen back 75 percent since the peak in August means that the outlook for the next six months looks positive, but that, as always with natural gas, is not an asset suitable for buy and hold for longer term than a few months.

Capacity increase and solution

Russia's invasion of Ukraine and decades of poor energy policy in Europe have led to households across Europe seeing their electricity bills multiply compared to previous years. Natural gas prices, which are normally volatile during the year due to problems with long-term storage, have been even more so, but are now trading at levels not seen since a year before Russia invaded Ukraine, despite the fact that next winter is predicted to be more difficult and, above all, more expensive than ever for households and companies in Europe.

The reason for the sharp drop in prices has to do with a warmer than expected winter and the fact that stocks, at least now, are relatively full. Although it eased this year's winter, a solution for the future is still not in place and the International Energy Agency wrote in a report at the beginning of the year that it expects about 30 billion cubic meters of gas to be missing as Europe starts to stockpile ahead of winter 2023 during spring and summer.

The already known shortage of gas combined with the fact that the price has fallen back 75 percent since the peak in August means that the outlook for the next six months looks positive, but that, as always with natural gas, is not an asset suitable for buy and hold for longer term than a few months.

Risks

External author:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.

© Bank Vontobel Europe AG and/or its affiliates. All rights reserved.