Europe's prospects

Promises of eternal growth forecasts have been replaced by headlines describing how an era of low inflation is over for good, how Britain's growth has shrunk the most since 1709 and how the winter will be cold due to the energy crisis. By contrast, Germany may be going to keep shutting down their nuclear reactors.

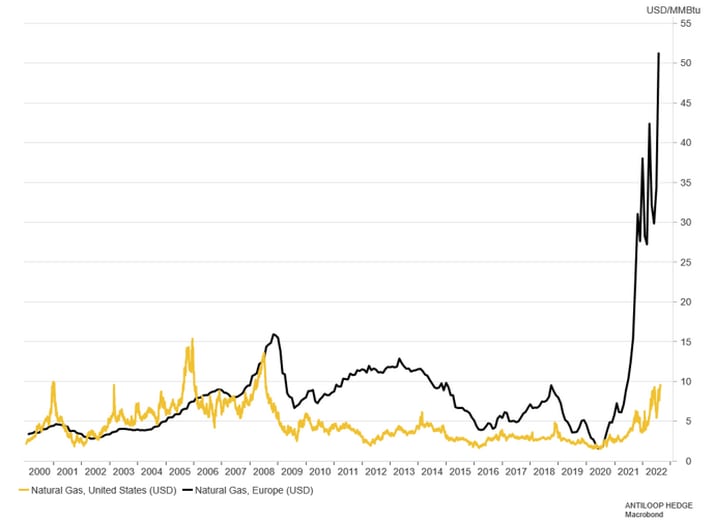

As can be seen in the

chart above, gas prices in Europe have risen sharply in the shadow of the

energy crisis we were already facing before Russia's invasion of Ukraine. Since

then, things have got much worse and residents across Europe are worried about

how they can afford further rises in energy and food costs.

It is clear that the

idea of a 2% inflation target world is long gone, and that prices will continue

to rise. The fact that price rises are now due more to imbalances in supply and

demand than 14 years of loose monetary policy also means that the power of

central banks is limited. Certainly, a recession can be expected to eventually

depress demand and thus prices, but the idea that it would lead to a

deflationary state seems remote. Moreover, extremely high energy prices may

instead lead to further, albeit short-term, stimulus if the only way to afford

rising electricity prices is financial support.

The outlook in Europe

is bleak, and the light in the tunnel is almost non-existent. High inflation is

here to stay and sooner or later the ECB will have to normalise interest rates

which will be another setback for Europe.

Risks

Legal notice:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.