No long-term turnaround

So far this year, the S&P 500 has fallen over 20 percent and is nosediving at the same lows we saw in June of this year. The outlook for the global economy looks shaky, central banks need to keep raising interest rates to fight inflation and most recently the British pound imploded against the US dollar. It's starting to look more and more like the situation Brent Johnson, founder of Santiago Capital, has been warning about for so long.

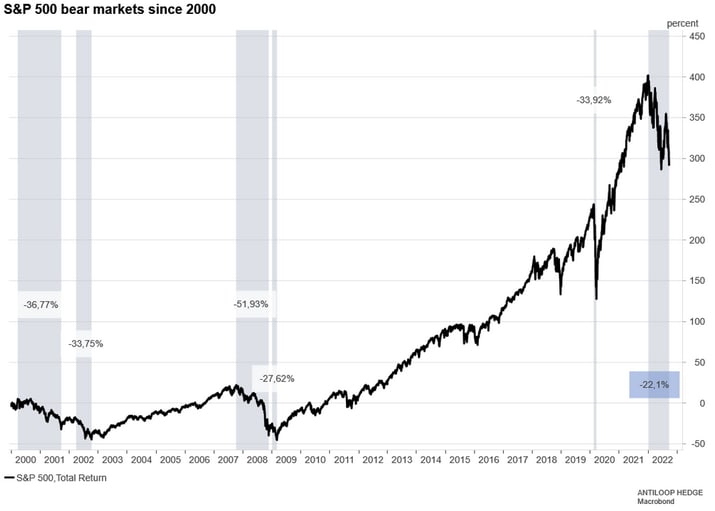

Since 2000, the broad stock index S&P 500 has had five bear markets that lasted an average of 266 days in which the market fell an average of 36.80 percent. However, the sixth, which began just as the market first recorded a new all-time high during the first trading day of the year, looks to be worse than what we have seen before.

After the market rose over 17 percent following

a local bottom in June this year, we quickly fell back down to levels close to

the same bottom again. Now it remains to be seen if the support around 3600

holds, or if the S&P 500 will continue down towards 3400 before another

bear market rally. Despite the fact that valuations have come down recently, we

are still at a high level, and that is due to last year's profits. As interest

rates rise and inflation rises, margins will shrink and so will profits.

After over a decade of low interest rates and quantitative

easing, investors have become accustomed to limited downside risk. That reality

is unfortunately over now, at least until the Federal Reserve or other central

banks change their foot again.

The question now is where the bottom really

is. If we were to only compare with the average of the five bear markets we

have seen since the year 2000, it would mean that the S&P 500 bottoms

around 3000. This means a further downside of over 15 percent. However, doing

that type of analysis is not possible, but we have to look at and understand

the macro data to be able to come to some kind of conclusion as to when and

perhaps above all why it would turn.

What we know right now is that inflation

remains high, and that it is the absolute main focus of the central banks.

Jerome Powell doesn't care if your portfolio loses value, if the price of your

house goes down, and neither does Stefan Ingves of Swedish Riksbank. The fact

that the latest inflation figure in both Sweden and the US came in above

estimates also shows that we will need even more tightening monetary policy,

and probably for a longer period.

Another important factor is the labor market.

Unemployment remains low in the US, which means there is still room for the

Federal Reserve to raise interest rates aggressively. It is only when we see

greater unemployment that a pause in interest rate increases may be in sight.

Mini Futures

Important legal information

Risks

Legal notice:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.