A week dominated by Central Banks

This week will be dominated by central bank interest rate announcements (Fed, ECB and Bank of England). The fight against inflation is the worst for the ECB, as is the future path of interest rates in the Eurozone. The Q4 reporting season has not been convincing overall, but earnings outcomes have been relatively good for the US technology sector. We also see that the USD may have bottomed out against the SEK.

Focus this week on central banks

The announcements from three of the world's major central banks (the Fed on Wednesday, 1 February and the Bank of England and ECB on Thursday, 2 February), combined with US employment data on Friday, 3 February, will likely dominate this week’s agenda for the stock markets. Chinese stock markets also opened this week after a week-long New Year celebration.

The Fed is expected to raise its policy rate by 25 basis points to 4.75 per cent, which is anticipated to be the last hike in this economic cycle. Meanwhile, there is more uncertainty around the ECB’s rate announcement. This is because ECB president Lagarde has adopted an unusually hawkish tone lately. One rationale behind this is that inflation is substantially higher in the Eurozone (around 9 per cent per year) compared to only 6 ½ per cent in the US. This explains why the market expects ECB to raise the policy rate by 50 basis points each this week and on the next occasion. There are, however, some concerns that the weaker European economy may limit the ECB to just one 50-point hike. Several Swedish industrial companies have seen slowing European demand in Q4 2022 and early Q1 2023.

Measured by two-year government bond yields, the US currently has a negative real interest rate of 2.25 per cent, while the negative real interest rate in Germany exceeds 6 per cent. The ECB currently has a policy rate of 2.0 per cent, compared to 2.5 per cent in Sweden and 3.5 per cent in the UK.

US 2-Year Treasury Yield (in %) in a weekly five-year chart

Regarding US Non-Farm Payrolls on Friday, 3 February, expectations are that 200K new jobs were created in January, compared to 223K in December. The market is also anticipated to keep an eye on the wage growth rate, with estimates representing an increase of 4.3 per cent per year.

US companies lose more profits outside North America

After 29 per cent of S&P500 companies reported their Q4 2022 numbers as of Friday, 27 January, 69 per cent of those reports were better than expected on earnings, while 60 per cent were better than expected on revenue. Since last week, the average earnings growth rate for S&P500 companies in Q4 2022 has deteriorated from minus 4.6 to 5.0 per cent. For S&P500 companies with less than half of their revenue exposure to the US, the headline earnings decline in Q4 2022 earnings growth has been 7.3 per cent. For S&P500 companies with less than 50 per cent of their sales in the US, the Q4 2022 earnings decline has been minus 3.5 per cent. So the economy is better in North America compared to the rest of the world.

The tech companies in the S & P500 index need to surprise positively for the S & P500 index to continue to rise. Until Friday, 27 January, 85 per cent of the Information Technology sector's Q4 reports have been better than expected. This week, the rest of the major companies in this sector will release their Q4 reports in the form of Meta, Alphabet, Amazon and Apple. 107 S&P 500 companies are scheduled to launch their Q4 2022 reports this week.

We have also compiled the Q4 2022 reports until 27 January, delivered by 29 Swedish and two Finnish OMX companies. When we summarise the Q4 2022 results of these OMX companies, only 52 per cent have exceeded market expectations regarding profits. In contrast, revenues have been higher than expected overall, with 69 per cent of companies exceeding expectations. Six companies have reported order intake, with Consensus figures also being available. Fifty per cent of the order intake figures has outperformed analysts’ expectations.

VIX down to low levels

Surprisingly, the VIX, which measures stock market volatility, is now down to historically low levels. That is true even though the Q4 2022 reporting season could have been more convincing. Declining interest rates might have lulled investors into believing that central banks will only tighten liquidity for a bit longer. Otherwise, low levels in the VIX usually offer an excellent opportunity to buy downside protection in the stock market. There is no shortage of triggers for a new market turmoil. More debt financing to refinance maturing debt is one hot topic. The Ukraine war has been relatively stagnant over the winter, but an offensive from either side in the spring is likely. Last but not least, the slowdown in global economic activity might take a turn for the worse in 2023.

VIX Index (in USD) in a weekly five-year chart

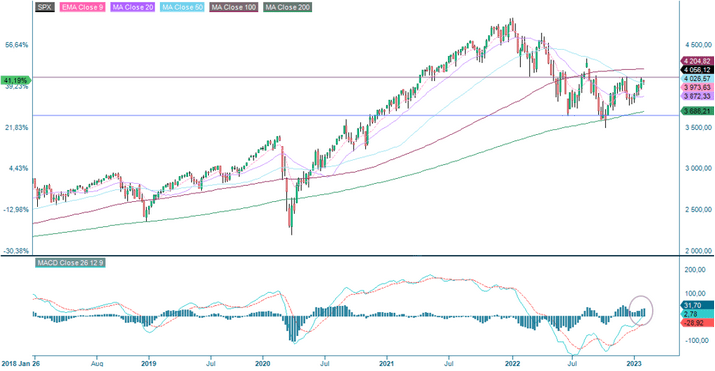

S&P 500 trying to break up through resistance

From a technical perspective, S&P 500 is trying to break up above resistance around 4,100. In case of a break to the upside, the next level is around 4,300. However, momentum is positive but falling, as illustrated by the MACD histogram. Perhaps the index needs to gather some energy.

S&P 500 (in USD), one-year daily chart

In the weekly chart, MACD has generated a buy signal. That makes the long trade look a little more interesting. But note that the index needs to break the resistance around 4,100 in the daily chart before the weekly chart even comes into play.

S&P 500 (in USD), weekly five-year chart

Nasdaq 100 is also at interesting levels

Tech-heavy Nasdaq 100 is testing resistance in the shape of MA200 and an upper line of a long falling wedge-formation.

Nasdaq 100 (in USD), one-year daily chart

The weekly chart shows that Nasdaq 100 is trading in a falling wedge. Momentum is negative but increasing. If the index breaks out on the upside, the formation indicates that levels around 15,000 may be next.

Nasdaq 100 (in USD), weekly five-year chart

OMX and DAX, are perhaps not as exciting

Swedish OMXS30 has been trading sideways for some time under falling momentum. That is illustrated by EMA9 and MACD, which have generated a weak sell signal. The negative divergence between MACD and the index does not favour the further upside.

OMXS30 (in SEK), one-year daily chart

The weekly chart shows that OMXS30 is currently stuck at Fibonacci 61.8%. Momentum is positive but decreasing illustrated by the MACD histogram.

OMXS30 (in SEK), weekly five-year chart

The development for the German DAX looks similar to the development in OMXS30. Again, the negative divergence between the index and MACD can be found in the daily chart.

DAX (in EUR), one-year daily chart

DAX (in EUR), weekly five-year chart

The US dollar is a strong indicator of risk appetite

As discussed above, the upcoming central bank announcements in the current week will likely determine short-term development in the financial markets. In recent months, the US dollar has retreated markedly from the multi-year peak in the autumn as appetite for risk assets and commodities has returned.

However, this week the US dollar has strengthened once again. Is this a sign that we have seen the bottom in the US dollar? The pattern is like the moves around recent FOMC meetings, e.g., September, November, and December 2022.

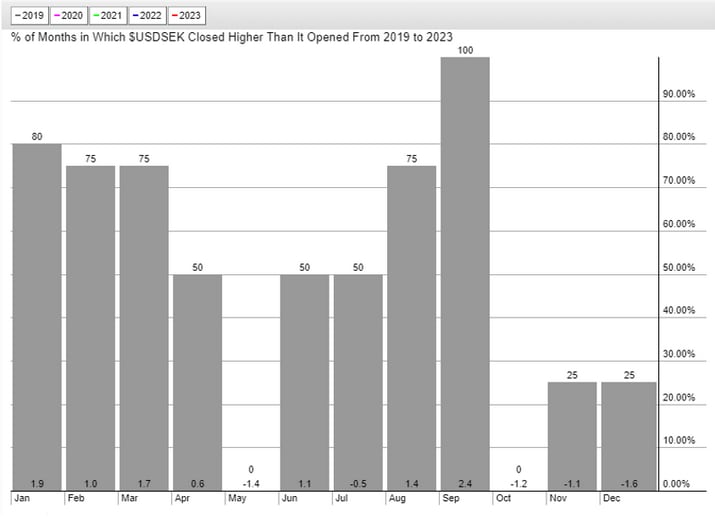

Also, the US dollar is traditionally seasonally strong in the first quarter; see below. In contrast, in 2023, the USD depreciated against the EUR and the SEK. Will it resume the historical pattern, or is the abnormal performance a forebearer of more weakness?

USDSEK monthly seasonality

From a technical perspective, we trace a double bottom in the daily chart, which suggests a further upside in USDSEK. However, heavy resistance could be in the 10.40 to 10.45 area, swarming with multiple moving average levels. Below, there is possible technical support around 10.2.

USDSEK, one-year daily chart

USDSEK, weekly five-year chart

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence of numbers in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risks

External author:

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.

Disclaimer:

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.